Share and Follow

But some experts warn that while the policy aims to get young buyers into the market sooner, it could drive up prices to the point where it cancels out any benefits of the scheme.

How much time could first-home buyers save?

In Sydney, a household that once faced more than 10 years of disciplined saving will now only need about three — cutting almost seven and a half years.

The analysis used the property price caps set under the scheme in each city, along with the average gross disposable income for a two-person household. It does not include stamp duty or transaction costs.

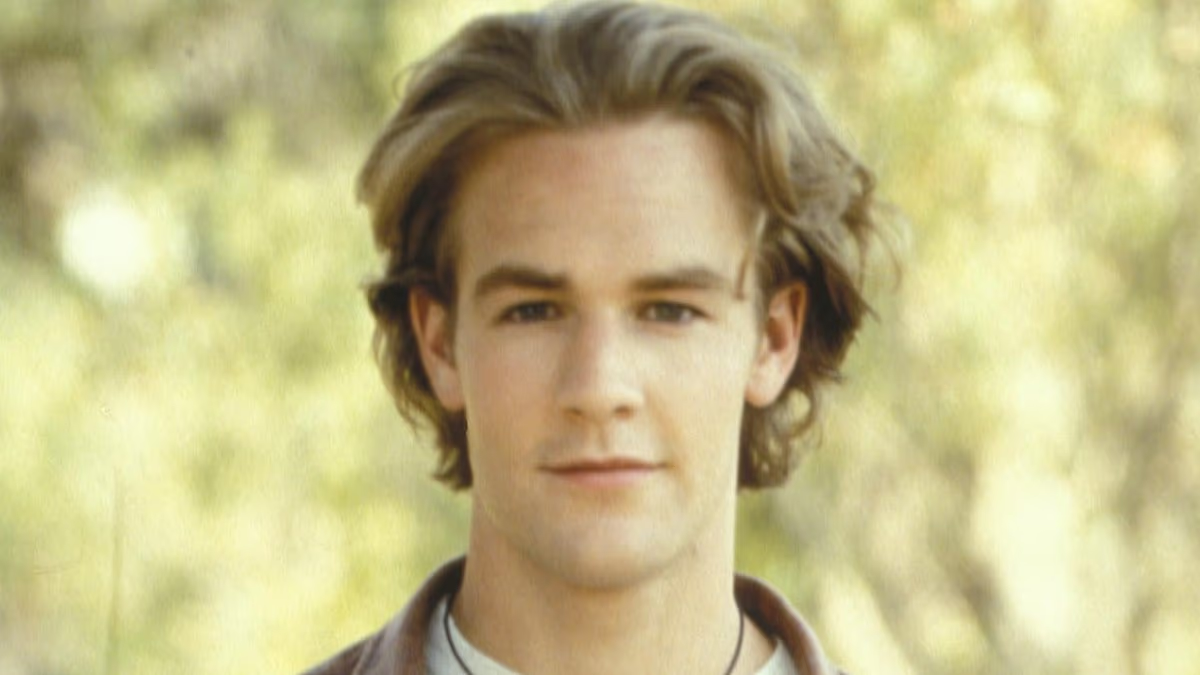

Those in Sydney could shave off seven years of saving with the government’s new First Home Guarantee scheme, according to Domain analysis. Source: SBS News

‘Fast entry’ for buyers

“More Australians will be able to benefit … it opens up choice … [and] higher caps open up more opportunities.”

“That’s life-changing,” she said.

“And if you’ve only got 5 per cent equity in a home, that is quite a bit of risk. There is that risk that you could fall into negative equity, particularly if prices pull back.”

A ‘backwards step’ to solving the housing crisis

“But the problem is that ultimately, if you are just pushing up demand but not increasing the supply of properties, then you’re just pushing up the price of property.”

“The way to address the housing market is to boost supply, not to add to demand.