Share and Follow

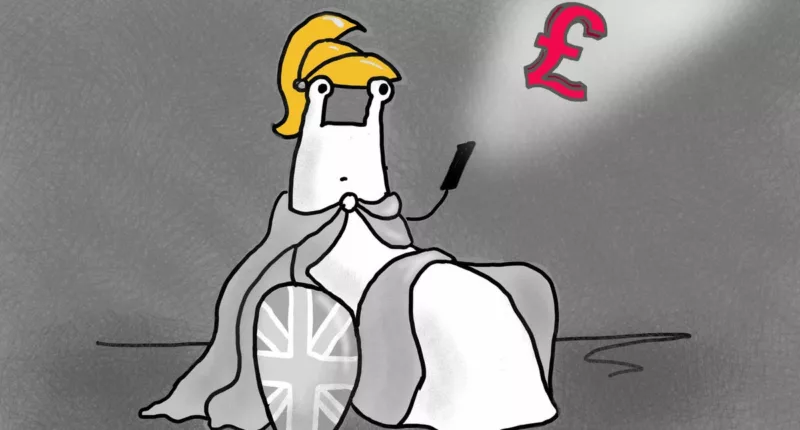

The Bank of England has announced a a four-month public consultation process on a a British central bank digital currency (CBDC) that could launch by the end of the decade. The Bank’s Governor, Andrew Bailey, says that a digital pound of some kind would provide a new way to pay that will “help businesses, maintain trust in money and better protect financial stability.”

Think Platform, Not Product

The Bank today released its consultation document together with an associated technology working paper on CBDC. Sir Jon Cunliffe, the Deputy Governor for Financial Stability, gave an interesting speech on the need for such a digital currency. How exactly such a retail CBDC will work is yet to be determined, naturally, but Sir Jon spoke about a public-private partnership in which the Bank would provide the digital pound and the central infrastructure and the private sector (banks or “approved non-bank firms”) would provide the wallets and associated payment services, the “two tier” approach favoured by central banks worldwide.

There are many, many stakeholders who will need to form a view and provide input to the consultation process. Andrew Griffith, the Economic Secretary to the Treasury (Britain’s Ministry of Finance) says there should be a “national conversation” about it and he is spot on: In addition to the views of the government and financial institutions, it is important to understand what retailers, law enforcement agencies, consumer groups and others want from such a currency.

Nevertheless, while the devil is in the details, generally speaking this is very good news. Why? Well in my view, there are probably three key things to bear in mind about this interesting announcement about a retail central bank digital currency from one of the world’s oldest financial institutions.

First of all, and I think most people understand this crucial distinction now, digital currency is not cryptocurrency. Digital currency is linked to something in the real world (such as, this case, Sterling), while the value of cryptocurrency is determined only by supply and demand. When it comes to supplanting the pounds in our pockets, the stability of a digital currency is the fundamental requirement and stability supports trade, which support prosperity.

Read Related Also: Today’s Wordle #602 Hint, Clues And Answer For Thursday, February 11th

Secondly, and I think most people do not quite understand this important difference yet, digital currency is unlike the electronic money that is currently in bank accounts (which is, by the way, almost all of the money that exists today) because when you send money to a friend for a pizza or something using online banking or Swish in Sweden or Zelle in the USA or PhonePe in India, the money goes from your bank account to their bank account through the banking system. In the future, when you send them a digital ten pounds it will go directly from your laptop to their mobile phone or your car to their laptop or from your smart card to their mobile phone over the Internet, Bluetooth, NFC and who knows what over communications channels, but it will never go anywhere near the banking system. This should mean much cheaper, quicker and more transparent transactions.

Thirdly, I think it is better to think of a digital currency as a platform for innovative new products and services rather than as a product in its own right. I wrote here some time ago that the role of digital currency as a means to bring innovation to the financial world is critical for the UK. Given Britain’s leading role in fintech, and the renewed commitment to the sector following the “Kalifa Review”, the role of digital currency in creating a new generation of products and services will be where the long-term boost to the economy comes from. The point well made in the Bank of England’s 2020 original report on digital currency, where they pointed to the creation of “smart money” (either by some form of smart contract usage or API interface) as where the benefits of a digital currency will come from. People are going to build some amazing new things on top of money that has an API!

Beam me up.

© Helen Holmes (2021).

Once In A Lifetime Change

In essence, the Bank of England and Treasury (who already have job listing for a head of digital currency) are saying a digital pound will be needed but that as it is what the Governor of the Bank of England calls a “profound” decision about the future of money, they want to get it right. I could not agree more with them on both points. As a long-time advocate for digital currency, I look forward to digital Sterling in action, but it has to be the right kind of digital Sterling, a digital currency that responds to the needs of civil society and not simply the dreams of technologies.

The launch of digital currency will be a once in a generation change in the way that money works, so it is very important that the Bank of England, the European Central Bank, the Federal Reserve and everyone else takes the time to work out exactly how it should work and make sure that it is implemented correctly. There is no burning platform, as they say: We do need digital currency but we don’t need it tomorrow and it’s much more important to get it right than to get it quickly.

![Trouble looms as Sina Rambo’s wife, Korth exposes the Adelekes, calls Sina out over alleged domestic violence [Video]](https://newsfinale.com/wp-content/uploads/2022/12/Trouble-looms-as-Sina-Rambos-wife-Korth-exposes-the-Adelekes-200x110.webp)