Introduction: Oil and stocks hit by China protests

Good morning and welcome to our rolling coverage of business, the financial markets and the world economy.

Global stock markets are on edge as the protests intensify at major Chinese cities against the country’s stringent zero-Covid rules.

Stocks have fallen across Asia-Pacific markets, while oil has dropped to a near 11-month low, as public demonstrations in cities including Shanghai, Beijing, Chengdu, Wuhan and Guangzhou pose a growing challenge to president Xi’s zero covid policies.

China’s CSI 300 share index fell sharply in early trading, before closing down over 1%. Hong Kong’s Hang Seng is down 1.3% in late trading.

European markets are set to open lower, as concern grows over China protests and i’s signature zero-Covid policy.

Overnight, hundreds of demonstrators and police have clashed in Shanghai, as frustration mounts nearly three years into the pandemic.

The record rise in Covid-19 cases has added to public anger, explains Victoria Scholar, Head of Investment, at interactive investor:

“Rare protests have broken out across major Chinese cities in a backlash against the ongoing draconian zero-tolerance to Covid approach from the authorities that has inhibited the freedoms of Chinese citizens since the start of 2020 and that has sharply damaged China’s economic growth.

As a result, international investors have become a lot more cautious towards China with the unrest weighing on the Shanghai Composite, the Hang Seng Index and the Chinese yuan in today’s trade.

In mid-November China reduced its quarantine time for international travel by two days, suggesting that Beijing was finally starting to ease its strict lockdown measures and helping to lift travel and casino stocks amid optimism towards the potential economic reopening.

However that optimism has faded fast with China recording another record high level of covid infections on Monday, adding to the sense of frustration after this weekend’s protests.

ASIAN MARKETS BRACE FOR IMPACT AS CHINA UNREST HITS SENTIMENT; ANYTHING EXPOSED TO CHINA IS ‘GOING TO BE VULNERABLE’: SAXO

— FXHedge (@Fxhedgers) November 28, 2022

With optimism about China’s recovery taking a knock, investors are selling out of stocks and oil in favour of safe havens such as dollar, yen and Treasuries.

Stephen Innes, managing partner at SPI Asset Management, explains:

It certainly doesn’t help when many are confined to their apartments watching the World Cup, saw thousands of mask-less fans in Qatar enjoying life that has long been lost in COVID zero haze.

Social discontent could increase in China over the coming months testing policymakers’ resolve to stick to the COVID zero mandates. And since China’s economy is currently in a tug-of-war between weakening macroeconomic fundamentals and increasing reopening hopes.

Mass protests would deeply tilt the scales in favour of an even weaker economy and likely be accompanied by a massive surge in Covid cases, leaving policymakers with a considerable dilemma.

The agenda

-

11am GMT: CBI survey of UK distributive trades (retail industry)

-

2pm GMT: ECB president Christine Lagarde testifies to the European Parliament’s Committee on Economic and Monetary Affairs

-

3.30pm GMT: Dallas Fed Manufacturing Index

Key events

Filters BETA

The drop in the oil price gives G7 nations an opportunity to tighten the financial pressure on Vladimir Putin.

So argues Robin Brooks, chief economist at the Institute of International Finance:

Oil prices are tumbling. The G7 should ignore lobbying from Greece, Malta & Cyprus for a high and ineffectual cap of $60-70. Now is the time to hit Putin where it hurts, as weak demand means Russian production cuts won’t do much. A cap of $30 sends Russia into financial crisis… pic.twitter.com/zG1JUk57BE

— Robin Brooks (@RobinBrooksIIF) November 28, 2022

European stock markets have also opened lower:

#EnDirecto | Apertura bolsas europeas:

🇩🇪 DAX 🔻 -0,49%

🇪🇺 EuroStoxx 🔻 -0,45%

🇬🇧 FTSE 🔻 -0,81%

🇫🇷 CAC 🔻 -0,50%

🇮🇹 FTSE MIB 🔻 -0,69%https://t.co/S6BlqkhebB

— Radio Intereconomía (@rintereconomia) November 28, 2022

FTSE 100 index drops at the open

Britain’s blue-chip share index has fallen half a percent at the start of trading.

The FTSE 100 index has shed 39 points to 7447 points, falling back from last week’s two-month highs.

Oil giants BP (-2%) and Shell (-1.8) are among the top fallers, along with Asia-Pacific focused financial firms HSBC (-1.3%) and Standard Chartered (-1.6%).

Mining giants are also in the red, tracking the drop in iron ore and copper prices.

The economic and market headwinds hitting China are unlikely to abate significantly over the coming months, warns Mark Haefele, chief investment officer at UBS Global Wealth Management.

He predicts Beijing policymakers will focus on stabilizing the economy, rather than spurring growth, adding:

-

Rising COVID-19 infections remain a significant drag on growth.

Read Related Also: High Street giant M&S heads to court to stop rival sweetmakers ‘copying’ Percy Pigs

-

Support for the property sector looks sufficient to limit the damage but may not spur faster growth.

-

A widening of infections could add to supply chain interruptions, with China’s problems spilling into global markets.

Commodities sink as China’s Covid outbreak worsens

Other commodity prices are also sinking this morning, amid fears over China’s worsening virus situation and the series of protests in several cities.

Iron ore futures in Singapore slumped more than 3% at one stage today, while Chinese copper futures declined as much as 1.8%.

Traders are concerned that China’s economic growth could be derailed, as infections rise at a record pace and more lockdowns are imposed. That would sap demand for energy, food and raw materials.

As Bloomberg points out:

A return to stricter lockdowns would further squeeze demand for a number of key commodities.

China is the largest importer of everything from oil to iron ore and soybeans, and purchases have already slowed this year as the economy has stumbled.

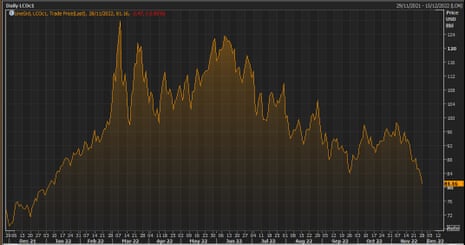

Brent crude oil hits lowest since January

Brent crude, the oil benchmark, has fallen almost 3% to its lowest level since January. as China’s Covid protests fuel demand fears.

Brent is trading at $81.48 per barrel, while US crude is below $75/barrel for the first time in around 11 months.

Politcl uncertainty and the surge in Covid-19 cases in China are both weighing on the oil price, which is a bellwether of growth prospects.

Naeem Alsam, chief market analyst at Avatrade, says:

Basically, it is demand that is creating the main issue for the price, and the fact that we have a potential recession threat and now the covid issues in China, things are becoming difficult for oil traders

The reality is that no one wants to see more lockdowns in China, as a situation like this creates nothing but more headwinds for oil prices.

Full story: Clashes in Shanghai as protests over zero-Covid policy grip China

The wave of civil disobedience –- triggered by a deadly apartment fire in the far west of the country last week –- is unprecedented in mainland China in the past decade.

My colleagues Helen Davidson and Verna Yu report:

In the early hours of Monday in Beijing, two groups of protesters totalling at least 1,000 people were gathered along the Chinese capital’s 3rd Ring Road near the Liangma River, refusing to disperse.

On Sunday in Shanghai, police kept a heavy presence on Wulumuqi Road, which is named after Urumqi, and where a candlelight vigil the day before turned into protests.

“We just want our basic human rights. We can’t leave our homes without getting a test. It was the accident in Xinjiang that pushed people too far,” said a 26-year-old protester in Shanghai who declined to be identified.

Introduction: Oil and stocks hit by China protests

Good morning and welcome to our rolling coverage of business, the financial markets and the world economy.

Global stock markets are on edge as the protests intensify at major Chinese cities against the country’s stringent zero-Covid rules.

Stocks have fallen across Asia-Pacific markets, while oil has dropped to a near 11-month low, as public demonstrations in cities including Shanghai, Beijing, Chengdu, Wuhan and Guangzhou pose a growing challenge to president Xi’s zero covid policies.

China’s CSI 300 share index fell sharply in early trading, before closing down over 1%. Hong Kong’s Hang Seng is down 1.3% in late trading.

European markets are set to open lower, as concern grows over China protests and i’s signature zero-Covid policy.

Overnight, hundreds of demonstrators and police have clashed in Shanghai, as frustration mounts nearly three years into the pandemic.

The record rise in Covid-19 cases has added to public anger, explains Victoria Scholar, Head of Investment, at interactive investor:

“Rare protests have broken out across major Chinese cities in a backlash against the ongoing draconian zero-tolerance to Covid approach from the authorities that has inhibited the freedoms of Chinese citizens since the start of 2020 and that has sharply damaged China’s economic growth.

As a result, international investors have become a lot more cautious towards China with the unrest weighing on the Shanghai Composite, the Hang Seng Index and the Chinese yuan in today’s trade.

In mid-November China reduced its quarantine time for international travel by two days, suggesting that Beijing was finally starting to ease its strict lockdown measures and helping to lift travel and casino stocks amid optimism towards the potential economic reopening.

However that optimism has faded fast with China recording another record high level of covid infections on Monday, adding to the sense of frustration after this weekend’s protests.

ASIAN MARKETS BRACE FOR IMPACT AS CHINA UNREST HITS SENTIMENT; ANYTHING EXPOSED TO CHINA IS ‘GOING TO BE VULNERABLE’: SAXO

— FXHedge (@Fxhedgers) November 28, 2022

With optimism about China’s recovery taking a knock, investors are selling out of stocks and oil in favour of safe havens such as dollar, yen and Treasuries.

Stephen Innes, managing partner at SPI Asset Management, explains:

It certainly doesn’t help when many are confined to their apartments watching the World Cup, saw thousands of mask-less fans in Qatar enjoying life that has long been lost in COVID zero haze.

Social discontent could increase in China over the coming months testing policymakers’ resolve to stick to the COVID zero mandates. And since China’s economy is currently in a tug-of-war between weakening macroeconomic fundamentals and increasing reopening hopes.

Mass protests would deeply tilt the scales in favour of an even weaker economy and likely be accompanied by a massive surge in Covid cases, leaving policymakers with a considerable dilemma.

The agenda

-

11am GMT: CBI survey of UK distributive trades (retail industry)

-

2pm GMT: ECB president Christine Lagarde testifies to the European Parliament’s Committee on Economic and Monetary Affairs

-

3.30pm GMT: Dallas Fed Manufacturing Index