Share and Follow

UK manufacturing contracts for sixth month in a row

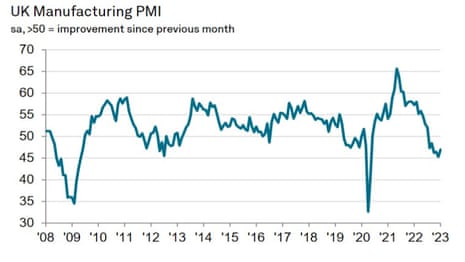

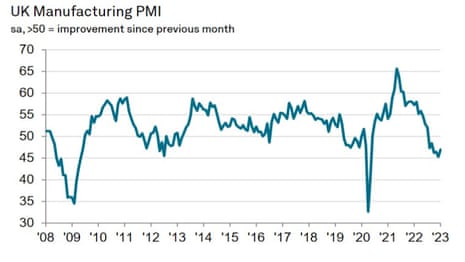

The British manufacturing sector contracted in January for the sixth month in a row as it was hit by inflation, shortages and weak demand, according to the closely followed purchasing managers’ index (PMI).

The index reading for January was 47 points, below the 50 mark that signifies an expansion in output, according to survey compilers S&P Global.

That was higher than the December reading, which was the worst in 31 months. (If we were to exclude the pandemic, when factories big and small felt forced to shut, then it was a level not seen since 2009 in the financial crisis.)

Key events

Filters BETA

It’s a fairly quiet day on financial markets so far. That is probably a result of investors having got into position ahead of the Federal Reserve chair Jerome Powell’s comments later.

The FTSE 100 is up by 0.1% at 7,778 points. Europe’s blue-chip Stoxx 600 index has gained 0.2%, while Germany’s Dax is up 0.1% and France’s Cac 40 is up less than 0.1%.

On the FTSE, it’s the packaging companies leading the way, while Ladbrokes owner Entain is also doing fairly well after raising its profit forecasts after the football World Cup pushed up gamblers’ losses.

It might be slightly too early to celebrate a turning point for UK manufacturers.

Glynn Bellamy, UK head of industrial products at KPMG, an accountancy firm, said:

It will be some months yet until manufacturers feel that the UK economy has turned the corner, but the first small signs that inflation may have peaked increased optimism slightly in January about cost pressures lowering soon and continuing to fall as the year goes on.

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, a consultancy, said:

January’s S&P survey brings some hope that the downturn in the manufacturing sector is slowing down.

He said expectations of future orders might reflect “hope that lower energy prices will both reduce costs and trigger a strengthening in underlying consumer demand later this year.”

The total orders, export orders and output balances, however, all remained weaker in the UK than in the eurozone, suggesting that Brexit damage is continuing to build slowly, as contracts come up for renewal.

Maddie Walker, a managing director at Accenture, another consultancy, said:

It’s a mixed landscape for manufacturers right now. There are signs from across the economy that inflation is easing. However, the impact continues to be felt as energy costs and pricing remain well above the average that businesses have gotten used to.

Certain industries, such as car production, also continue to be hampered by semiconductor shortages and factory closures.

Six months of contraction effectively means that UK manufacturing is in recession. But is the worst over?

Almost 57% of manufacturers reported that output would be higher one year from now, and average input costs rose at the slowest rate for 27 months. So the squeeze may ease.

But the indicators of what is happening now suggest it is tough going. Companies are getting less new work, and they are struggling to get hold of raw materials and staff.

New work has, in fact, fallen for eight consecutive months, with fewer orders from the US, Europe and Asia – “especially China”.

“Ongoing port and Brexit issues also had an impact,” S&P Global said.

Rob Dobson, director at S&P Global Market Intelligence, said:

UK manufacturers faced a tough operating environment at the start of 2023, leading to reducing intakes of new business, declining production volumes and lower staffing levels. Weak demand at home and overseas, supply chain constraints, strikes and the continuing impact of high inflation all stymied the performance of manufacturers. Weak economic growth in the US, EMEA and across Asia is also dragging down new export wins, exacerbating the strain already caused by port delays and lingering Brexit complications.

There were some shoots of positivity developing, however. Rates of contraction are generally lower than before the turn of the year, a possible sign that we may be past the worst of the downturn in industry. Cost inflation also eased further, while supply chain delays were the least pronounced for three years. Manufacturers’ confidence is also reviving from recent lows, hitting a nine-month high, though the mood continued to be darkened by concerns about inflation and the possibility of recession.

UK manufacturing contracts for sixth month in a row

The British manufacturing sector contracted in January for the sixth month in a row as it was hit by inflation, shortages and weak demand, according to the closely followed purchasing managers’ index (PMI).

The index reading for January was 47 points, below the 50 mark that signifies an expansion in output, according to survey compilers S&P Global.

That was higher than the December reading, which was the worst in 31 months. (If we were to exclude the pandemic, when factories big and small felt forced to shut, then it was a level not seen since 2009 in the financial crisis.)

Thomas Rinn, global industrial lead at the consultancy Accenture, has sent us his thoughts on the eurozone PMI.

Today’s PMI results reflect what we are hearing and seeing in the European manufacturing/industrial market. If you look at recent earnings, industrial businesses leading in digitalisation are reporting strong sales, and in some cases even record profits.

The biggest challenges facing the eurozone manufacturing/industrial sector right now include supply chain disruption, given the scarcity of materials, and access to talent, in what is a tough labour market.

Companies looking to build resilience and to be well-equipped to action change in the face of these external pressures should look at investing in new technologies, such as cloud, operations automation, upskilling employees and rebalancing their supply networks – and they must do this in a responsible manner

Eurozone manufacturing downturn eases

The eurozone’s manufacturing downturn eased further in January and cost pressures have faded.

The eurozone manufacturing sector downturn continued into the new year, with production volumes and new factory orders falling further, according to the final reading for the manufacturing PMI from S&P Global. However, slower rates of contraction in both areas tentatively suggested that the worst of the sector’s slump has passed. Indeed, some parts of the euro area even recorded an expansion in output in January.

Cost pressures have waned across the euro area, with input price inflation slowing to a 26-month low. That said, output charges increased at a faster pace.

The S&P Global eurozone manufacturing PMI rose for a third successive month to 48.8 in January, up from 47.8 in December. While still below the 50 mark that divides growth from contraction, it was the highest reading since last August.

GSK beats forecasts, helped by Shingrix

Britain’s second-biggest drugmaker GSK has beaten forecasts with its annual results, helped by sales of its blockbuster shingles vaccine Shingrix.

The company, which spun off its consumer health business Haleon last summer, reported sales of £29.3bn for 2022, up 19%, and a 56% rise in pretax profits to £5.6bn. Shingrix contributed £3bn of sales.

The drugmaker, left with its vaccines and medicines business, has developed a vaccine for respiratory syncytial virus (RSV), a common respiratory virus that usually causes cold-like symptoms, but it can result in severe illness in infants and older people. GSK hopes for regulatory approval for the vaccine this year, one of four anticipated approvals.

Yesterday, US rival Moderna was granted breakthrough therapy designation for its mRNA vaccine for RSV, which means a faster development and review period. Pfizer is also in the late stages of developing an RSV vaccine for adults aged 60 plus. There are no RSV vaccines at present.

Emma Walmsley, the chief executive, hailed a “landmark year”.

2022 was a landmark year for GSK delivering the step change in performance we committed to, driven by strong growth in specialty medicines and vaccines, including record sales for Shingrix. We enter 2023 with good momentum, underpinning confidence in our ambitious sales and profit outlooks for 2026.

At the same time, we continue to build a stronger portfolio and pipeline based on infectious diseases and the science of the immune system, including our potential new RSV vaccine. This momentum, together with further targeted business development, means GSK will also be in a strong position to deliver growth from 2026 onwards.

However, some analysts are concerned about GSK’s long-term prospects, as some of its best-selling HIV drugs come off patent towards the end of the decade, which means generic drugmakers can make much cheaper versions.

Market summary

European stock markets have opened a tad higher with the UK’s FTSE 100 in London up 15 points, or 0.2%, at 7,786 on positive company results. Germany’s Dax is unchanged, France’s CAC has edged 0.1% higher and Italy’s FTSE MiB has gained 0.5%.

The pound is trading slightly lower against the dollar and the euro, at $1.2317 and €1.1320.

Oil prices have gained slightly, with Brent crude, the global benchmark, up 15 cents at $85.64 a barrel.

Here is our full story on UK house prices sliding for five months in a row:

You can read more on our strikes blog here:

Up to half a million workers strike today

Today is also a big strike day in the UK, in what is thought to be the biggest industrial action in a decade.

Up to 500,000 workers will go on strike with thousands of schools shut, rail lines closed down and significant border disruption, as unions said negotiations on ending strikes were “going backwards”.

Ministers have been accused of “hoodwinking the public” and freezing any moves towards a settlement with NHS workers and rail unions. Government sources privately conceded that optimism at the beginning of the month about bringing an end to strike action had faded.

The coordinated series of strikes involves teachers, civil servants, Border Force staff and train drivers, with the government telling people to brace for “significant disruption”.

Jon Stone, policy correspondent at the Independent, has tweeted:

Teachers’ pay has eroded by £6,600 since 2010 (IFS). They now work 46-49 hours a week on average (UCL). Teaching vacancies are up from 64,283 in 2021 to 107,104 last year (TeachVac). Government offer to cut their real pay further is objectively stupid 👍

— Jon Stone (@joncstone) February 1, 2023

Tom Bill, head of UK residential research at Knight Frank, said:

The UK housing market is headed for an annual fall in prices as mortgage rates remain notably higher than 12 months ago. To anticipate how steep, you need to look beyond the short-term distortion of the mini-budget. For example, buyers and sellers switched off early for Christmas but activity bounced back in January.

The resilience of prices and sales volumes will be put to the test in the spring when larger numbers of transactions take place and by which time virtually no five-year fixed-rate mortgages below 4% will remain in circulation. We expect prices to decline 10% over the next two years as budgets get recalculated.

UK housing market analyst Neal Hudson tweeted:

Nationwide report UK house prices rose just 1.1% in the year to January 2023.

Prices are already below February 2022 levels and 5.6% below their August 2022 peak based on their non seasonally adjusted index. https://t.co/ahaJkrl15o— Neal Hudson (@resi_analyst) February 1, 2023

Gabriella Dickens, senior UK economist at Pantheon Macroeconomics, says UK house prices have further to fall.

We still think house prices will not find a floor until they have fallen by about 8% from their peak. Households’ real disposable incomes will fall further over the next couple of quarters, as the government reduces its energy bills support, and as firms push through job cuts in the face of surging borrowing costs.

Meanwhile, mortgage rates are over three times higher than at the start of 2022, despite falling from October’s peaks, and look set to fall only slowly this year, ensuring that mortgage approvals remain near Q4’s rock bottom level. Demand also will be constrained by lenders’ affordability tests, which are based off Bank Rate. Many potential buyers also will wait until prices have fallen substantially.

The MPC [monetary policy committee], however, should have some scope to reduce Bank Rate next year, once slack has emerged in the labour market. In addition, the recent sharp fall in wholesale energy prices suggests that real incomes will recover in the second half of the year. As a result, we revised up last week our forecast for the subsequent recovery in house prices over the course of 2024, to 5.0%, from 3.7%.

Introduction: UK house price growth slows to lowest rate since mid-2020; all eyes on Fed decision

Good morning, and welcome to our rolling coverage of business, the world economy and the financial markets.

The year has begun with a further slowdown in UK house price growth.

Annual house price growth slowed to 1.1% in January from 2.8% in December, the lowest rate since June 2020, said Nationwide building society.

Property values fell 0.6% in January from December, following a 0.3% drop in December, marking the fifth monthly decline in a row, the worst string of falls since the financial crisis in 2008.

The average home is now worth £258,297, down from £262,068 a month ago, and prices are 3.25% lower than their August peak.

Robert Gardner, Nationwide’s chief economist, said:

However, there are some encouraging signs that mortgage rates are normalising, but it is too early to tell whether activity in the housing market has started to recover. The fall in house purchase approvals in December reported by the Bank of England largely reflects the sharp decline in mortgage applications following the mini-budget.

“It will be hard for the market to regain much momentum in the near term as economic headwinds are set to remain strong, with real earnings likely to fall further and the labour market widely projected to weaken as the economy shrinks.

“As we highlighted in our recent affordability report, the biggest change in terms of housing affordability for potential buyers over the last year has been the rise in the cost of servicing the typical mortgage as a result of the increase in mortgage rates.

The main event today is the US Federal Reserve’s meeting. America’s central bank is expected to raise interest rates by 25 basis points to 4.75%, a more modest hike than in previous months, but the question remains whether it will then pause for breath.

Markets assume that the Fed will start cutting rates before the end of the year, as inflation slows. Fed chair Jerome Powell’s press conference following the decision should give some clues as to the Fed’s thinking.

Michael Hewson, chief market analyst at CMC Markets UK, said:

It is this disconnect between the Fed’s rhetoric and what the market is pricing which makes today’s rate decision and Powell press conference very much a “live” meeting.

How does Powell square how the Fed sees the path of future rate rises and the markets’ belief that the central bank will start cutting rates again before the year is out.

While Fed officials have insisted that rates will stay high for some time to come, the markets simply don’t believe them, especially when several key inflation indicators have shown that prices are still coming down on a steady trajectory.

This is what makes today’s Powell press conference such a tricky proposition when it comes to market positioning. The danger for the Fed is in allowing the market to continue to think that rates are likely to come down this year, which in turn could see inflation take off again, especially with the labour market being as tight as it is. Powell simply can’t afford for financial conditions to loosen and for the inflation genie to get out of the bottle again.

The Agenda

-

9am GMT: Eurozone S&P Global Manufacturing PMI final for January (forecast: 48.8)

-

9.30am GMT: UK S&P Global/CIPS Manufacturing PMI final for January (forecast 46.7)

-

10am GMT: Eurozone Inflation flash for January (forecast: 9%, previous: 9.2%)

-

10am GMT: Italy Inflation for January (forecast: 10.1%, previous: 11.6%0

-

1.15pm GMT: US ADP Employment change for January (forecast: 178,000)

-

2.45pm GMT: US S&P lobal Manufacturing PMI final for January (previous: 46.2)

-

3pm GMT: US ISM Manufacturing PMI for January (forecast: 48, previous: 48.4)

-

7pm GMT: US Federal Reserve interest rate decision (forecast: 25bps rise to 4.75%)