Share and Follow

SPRINGFIELD, Ill. (WCIA) — Pawnbrokers across the state are trying to quash a bill they say would put their businesses in jeopardy.

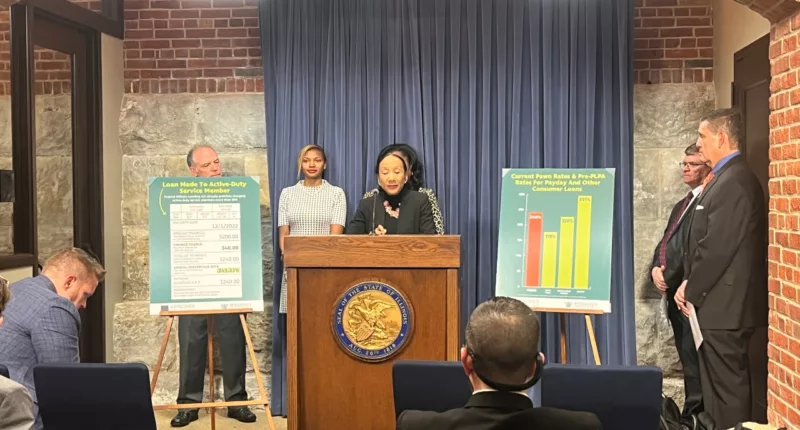

In March 2021, the Predatory Loan Prevention Act was signed into law, capping interest rates for consumer loans at 36% APR. A Sangamon County court issued injunction exempting the state’s 200 pawnshops from the PLPA. Senator Jacqueline Collins (D-Chicago) filed a bill closing that loophole.

“Pawn brokers, like payday lenders, make a living draining money from people who are struggling,” Collins said. “People that reside in my district and many of the other marginalized black and brown communities across the state, and in our rural areas as well.”

Advocates for pawnbrokers say lending is an important part of their business, and such a percentage is impossible to fill.

“These measures would shut down pawnshops throughout the State and shut out Illinois consumers during an increased time of financial insecurity,” Kelly Swisher, president of Illinois Pawnbrokers Association, said.

Pawnbrokers argue they are not like other creditors because they can’t send accounts to a loan collection agency.

“We’re not attached to your credit. We’re not attached to your bank account. All we’re attached to is that item that you brought in, and we’ve already negotiated a price,” Swisher said.

Read Related Also: St. Pete man held family captive for days, arrest records say

Swisher pointed out that the Consumer Financial Protection Bureau, a federal agency protecting consumers from unfair loan and banking practices, also does not list pawn shop loans as ‘predatory’ unlike payday and title loans. He said his customers often have no other alternative.

One financial advocate said consumers should have other options than a pawn shop.

“It’s not a healthy alternative,” Horacio Mendez, President of the Woodstock Institute, a group advocating for economic security and community prosperity. “We’re trying to push regulatory agencies and the financial industry to try to make sure that we fill in those gaps with appropriate and safe and well-regulated products.”

Springfield mayor Jim Langfelder weighed in, siding with the bill.

“What we want, as my own personal self, as a mayor, is to make sure that we do have the individuals that have access to capital so they can survive and thrive,” Langfelder said.

If you are offered a loan with more than a 36% APR, you can file a complaint with the Illinois Department of Financial & Professional Regulation on their website.