Share and Follow

A St. Petersburg home was severely damaged after a tree fell during Hurricane Milton, leaving a gaping hole in the roof and rain pouring inside. But the damage didn’t stop there, the smell of mold quickly followed.

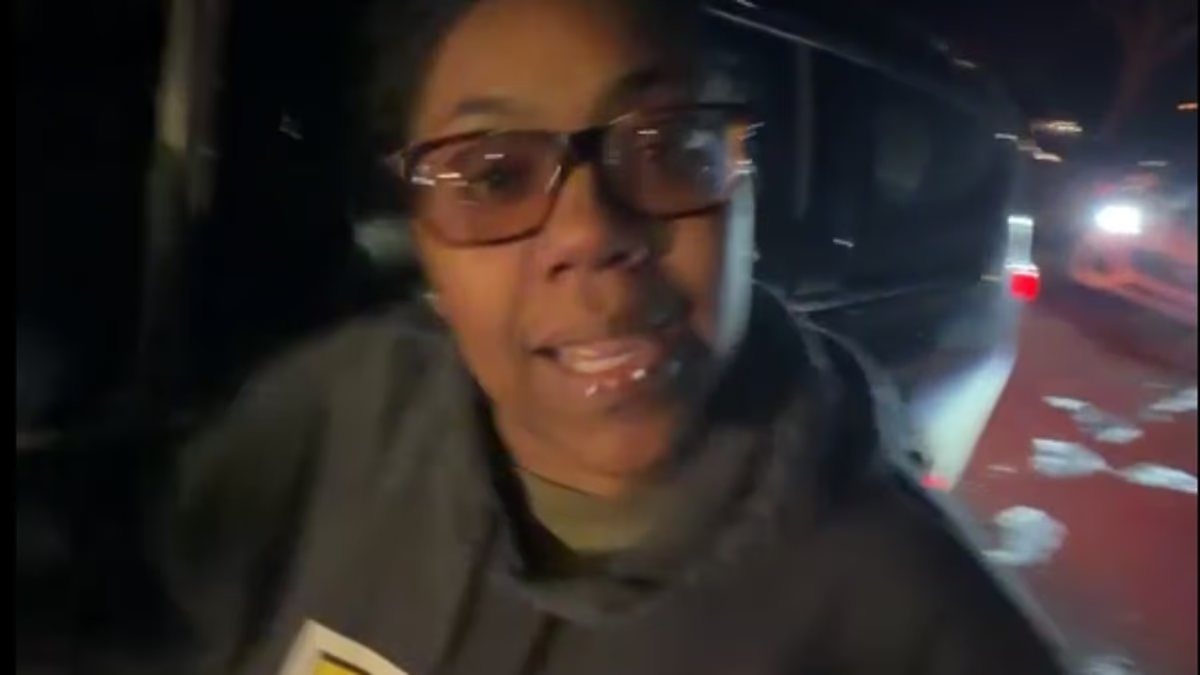

Lorraine Wuyts says the moisture inside her home, combined with the storm damage, created the perfect conditions for mold to grow.

“The smell is really bad,” she explained. “I’ve never been that scared. I was actually shaking.”

The storm had torn a large hole in the roof, large enough for Lorraine to see sunlight streaming into her living room. She quickly acted, securing a tarp with the help of her sister. But she still worried about the unseen damage.

Despite paying for mold coverage as part of her insurance plan with Citizens Insurance, Lorraine says her insurance adjuster didn’t check for mold, claiming nothing was visible.

“He looked around, but it’s not like he went up into the ceiling,” she said. “He missed a lot of the damage.”

When she received her settlement paperwork, the insurance company agreed to pay for repairs to the roof, but nothing for mold remediation. Lorraine believes the insurer should have tested her home for mold given the extent of the damage.

That’s when she reached out to Alex Duensing, a public adjuster, to investigate further. Alex reviewed Lorraine’s policy and found that it included mold and mildew coverage, worth at least $10,000. However, after submitting the claim to the insurance company, they say the insurance provider denied it, citing that the field adjuster hadn’t found any visible mold.

“When I came down here, I was shocked,” Duensing said. “I thought it was just water damage, but there was an apocalyptic hole in the roof.”

According to Arpad Kolbe, a licensed mold assessor in Florida, it’s crucial to conduct proper mold testing, which includes taking samples and sending them to a lab.

“You can’t just look at the damage and assume there’s no mold,” he said.

In Florida, only licensed professionals are qualified to assess mold, and you have to be licensed to remediate it.

Kolbe explained, “Many false claims come in, so insurance companies want to be cautious. But homeowners don’t always know the right steps to take when they make a claim.”

When we reached out to Citizens about the mold claims and whether or not their adjusters are licensed to assess for mold they told us, “Field Adjusters are not required to be licensed to assess for mold. When needed, a third-party mold assessment company would be hired to determine if mold is present and to what extent for possible remediation on a covered loss,” Michael Peltier, a spokesperson for Citizens said in an email. “Mold testing is done on a case-by-case basis, so we would need the claim number or other policyholder info to see what’s up here.”

‘Make sure it’s safe’:

Getting an assessment

Despite the setback, Lorraine and Alex have taken additional steps to fight the initial claim. They’ve even received a letter from the Florida Department of Financial Services outlining the issue. The letter confirmed that mold testing is only covered if it is deemed necessary by the field adjuster or if visible mold is detected during the inspection.

Peltier, also told us be email, ”The Citizens adjuster should be made aware of any new updates/findings. Citizens will investigate those new findings/supplements as it relates to the claim and address accordingly per the insured’s policy. The bottom line is that Citizens will do everything it can to properly handle a covered loss per an insured’s policy when new information/damage is claimed or found.”

Meanwhile, Lorraine Wuyts just wants to get her home safe and livable again.

“I just want to make sure it’s safe and healthy here,” she said. “I want to be able to move on and fix this.”

As Florida continues to face the effects of frequent storms, mold is becoming a growing concern for homeowners and insurers alike.

“Insurance companies could guide their customers, explaining the steps to take when making a claim and offering resources to help them assess the situation properly,” Kolbe said.