Share and Follow

EL PASO, Texas (Border Report) – Uncertainty over U.S. tariffs on Mexican exports continues to slow down one of the border’s largest employers.

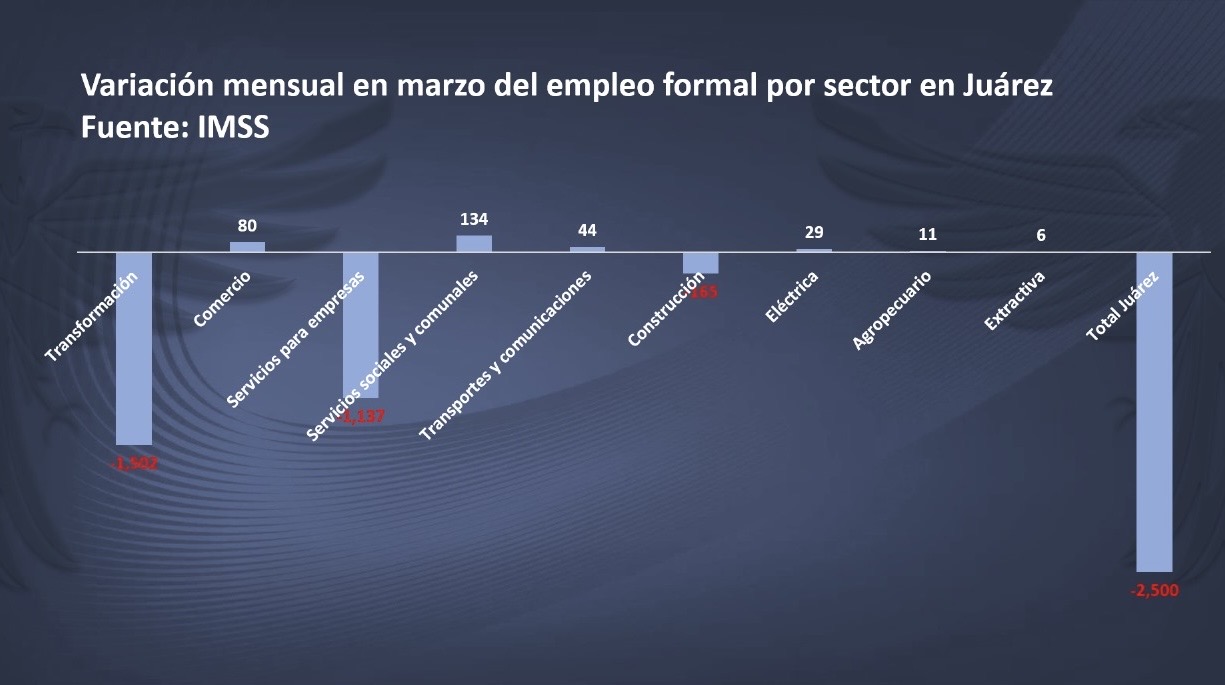

The city of Juarez, Mexico, lost 2,500 jobs between February and March, and 1,502 of those were jobs in maquiladoras, a Mexican business leader said.

“We are very concerned because we depend too much on maquiladoras,” said Thor Salayandia, head of the Border Entrepreneurial Block and national vice president of the Mexican Chamber of Industry. “This job loss is due primarily to turbulence related to tariff wars. Maquilas are uncertain what changes this will bring to their operations.”

He was referring to President Donald Trump’s on-again, off-again tariffs imposed on Mexico. At one point, all Mexican exports to the U.S. were to pay a 25% tariff, which was then paused and now applied only to steel, aluminum and autos. Separate tariffs also loom on exports not complying with U.S.-Mexico-Canada Agreement content rules.

Tariff uncertainty has paused new maquiladora investment and expansion, adding to mounting worries regarding rising wages and coming changes to Mexico’s judicial system, Salayandia said.

Judges in Mexico will be elected through popular vote in June, instead of vetted and put through a confirmation procedure. The worries, when it comes to businesses contesting a new government regulation, is that a judge that identifies with the ruling party will never rule against the government.

“The minimum wage is higher in Juarez and other border cities. Factories are looking into other places. All of that is affecting job growth and we don’t see a near-term recovery,” Salayandia said. “We have placed all of our eggs into one basket – maquiladoras are our biggest employer, and they are the ones losing the most jobs with this uncertainty.”

Maquiladoras employ about 300,000 workers in Juarez. Most assemble automotive parts, electronics and medical equipment for the U.S. market.

Salayandia said the one bright spot amid tariff uncertainty is that small and mid-sized Mexican businesses have a chance to become suppliers in the USMCA chain with countries like China being out of favor with the U.S.