Key Points

- The Coalition has set a target to grow the number of small businesses in Australia by 350,000 over four years.

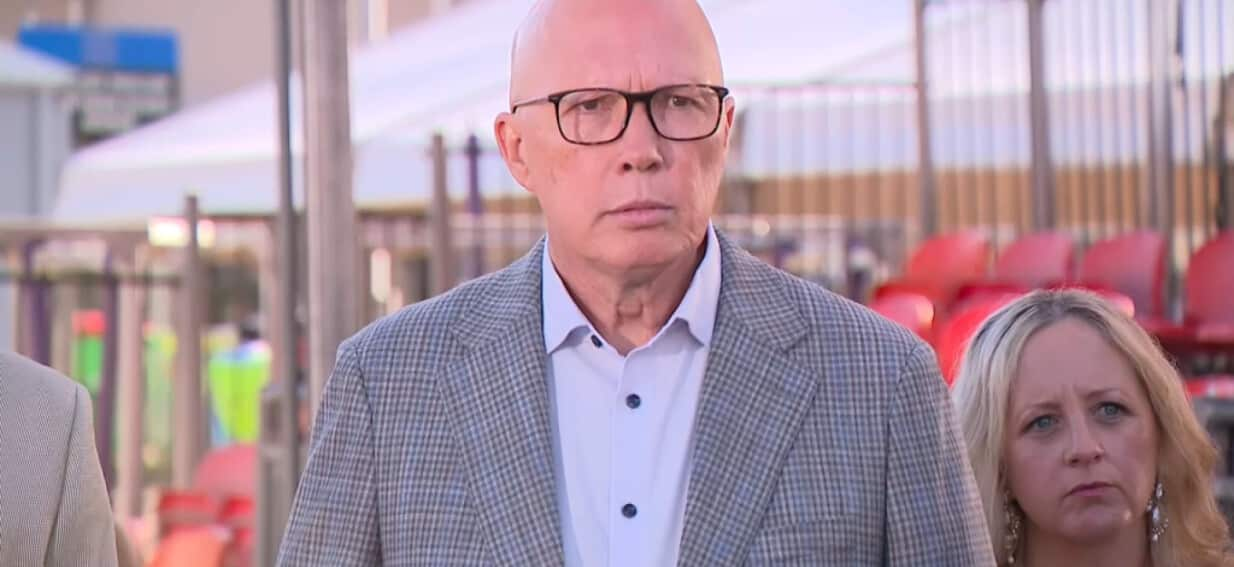

- Peter Dutton unveiled staggered three-year tax offsets to help small and family businesses reinvest.

- Dutton also said he won’t support Labor’s plan to enshrine penalty rates in law, calling it yet “another stunt”.

Opposition leader Peter Dutton has announced tax incentives to aid small businesses and revive entrepreneurship, should he win office in the upcoming federal election.

“I want to make sure we can help businesses grow in the most amazing country in the world,” he said, while at the Royal Easter Show in the Labor-held electorate of Reid.

Dutton has set a target of 350,000 new small businesses to open in four years, supported by a proposed “entrepreneurship accelerator” scheme.

Under that arrangement, new incorporated businesses would only have to pay tax on a portion of their income in their first three years of operating to encourage reinvestment.

In the first year, businesses would pay tax on 75 per cent of the first $100,000 of taxable income and 50 per cent of the second $100,000.

In year two, it will reduce to 60 and 40 per cent respectively.

In year three, it will reduce again to 50 and 30 per cent respectively.

Any taxable income above $200,000 will be taxed at the marginal tax rate.

“Someone with a bedroom at the back of the house or part of the garage where they’re now producing or they’re now providing a service to a bigger company — they want their business to grow,” Dutton said.

“We want to encourage small business in this country.”

In addition, businesses will be eligible for a “tech booster” as part of the overall package.

That denotes a tax deduction of $2,000 for tech upgrades of $4,000 or more, in addition to existing offsets on company tax liability for a given year.

Eligible businesses include those with an aggregated turnover of less than $10 million and no more than 20 shareholders.

Property developers are specifically excluded.

Labor’s penalty rate ‘stunt’

Meanwhile, Dutton has rejected if re-elected.

“If you are after another stunt from the Labor Party, go no further than this,” he said.

Labor’s rationale for the change is that it will prevent business groups, such as the Australian Retailers Association, from applying to the Fair Work Commission to cut the provisions from award agreements.

But Dutton said it’s up to an independent umpire to set the conditions.

“It’s been abided by from both sides of politics and we don’t propose any departure from the current arrangements,” he said.

Dutton’s bracket creep ‘aspiration’

The announcement for small and family businesses rolls off the back of a late campaign pitch to index personal income tax — a plan which has not been given a timeline.

Asked why the policy was mentioned during the back end of the campaign, Dutton said on Saturday that the Coalition had undergone a “stepped process” which involved “going through and looking at different policies and options”.

“I want to make sure that we can clean this mess … and make sure we can introduce the reforms necessary because bracket creep whacks every taxpayer,” he said, referring to a situation where .

But Dutton earlier described the plan as “an aspiration”, telling reporters in the NSW Hunter region on Friday that his government will “get the budget in a position where we will index the bracket.”

Prime Minister Anthony Albanese has taken aim at the comments, saying they made “no sense”.

“I’ve never seen before in an election campaign an alternative Prime Minister say I’m going to increase income taxes on 14 million taxpayers, but I have an aspiration to do something about it down the track,” Albanese said on Friday, while campaigning in Brisbane.

The Opposition plans to axe the , promoting an alternate plan to cut the fuel excise by 25 cents a litre for a year from 1 July this year.

For the latest from SBS News, and .

Visit the to access articles, podcasts and videos from SBS News, NITV and our teams covering more than 60 languages.