Share and Follow

The Group of Seven (G7) said Saturday that it will allow American companies to be excluded from a global minimum tax imposed by other countries, creating instead a “side-by-side” agreement where regular American tax rules would apply.

In 2021, nearly 140 countries agreed to tax multinational companies at a minimum rate of 15 percent, regardless of where they were headquartered, in a deal aimed at preventing conglomerates from seeking out tax havens. The Biden administration was then a proponent of the deal, as it was in line with its plans to raise the corporate tax rate.

The Friday move by the G7 is nonbinding and still requires approval from the OECD, the intergovernmental organization that established the 2021 agreement. But the G7 members, which include the world’s largest economies, dominate the OECD.

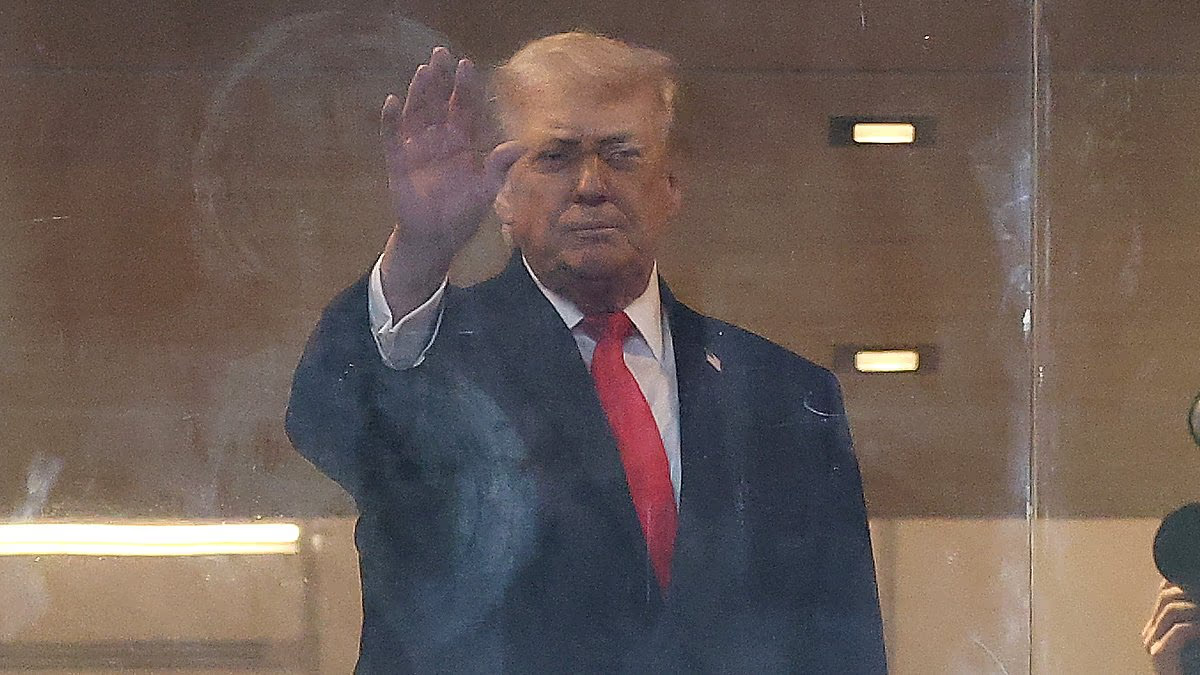

The G7 statement is a major win for the Trump administration, which has pushed for the United States to be exempted from the tax agreement.

The “big, beautiful bill” now making its way through the Senate initially included a “revenge tax” that would have imposed a levy of up to 20 percent on investments from countries with economic policies deemed to be unfair to American businesses, a broad definition that could have included the OECD deal.

The language was pulled Thursday after Treasury Secretary Scott Bessent said progress with the G7 had been made, a move celebrated by congressional Republicans.

“We applaud President Trump and his team for protecting the interests of American workers and businesses after years of congressional Republicans sounding the alarm on the Biden Administration’s unilateral global tax surrender under Pillar 2,” wrote Sen. Mike Crapo (R-Ind.) and Rep. Jason Smith (R-Mo.), the chairs of each chamber’s tax policy committee.