Criminals are offering Australians as little as $200 to rent out their bank accounts, turning people into “money mules”.

The Australian Federal Police (AFP) warned this week that renting, selling or sharing your bank account details is illegal and can expose you to serious risk, even if you don’t realise a crime is being committed.

The AFP said in many cases, people are offered between $200 and $500, or promised a cut of the transferred funds, simply for receiving and passing on money through their personal bank accounts.

That money is often funnelled through cryptocurrency platforms or withdrawn in cash to make it harder to trace.

AFP detective superintendent Marie Andersson said criminals rely on everyday Australians to help move their money.

“It is illegal to rent, buy or sell bank accounts, and doing so supports the criminal ecosystem,” Andersson said.

“Your account may be housing money derived from scams, extortion, drug trafficking and terrorism.”

The AFP said a 26-year-old woman was jailed in April this year as part of a money laundering syndicate which used money mules in Sydney and Melbourne to pick up and deposit cash — which was alleged to be the proceeds of criminal activity — into bank accounts.

These accounts were used to launder $3.8 million in proceeds of crime, which were ultimately transferred overseas.

Mule accounts a ‘key tactic in a criminal’s playbook’

According to the Commonwealth Bank, many people who act as money mules are not aware they are doing anything wrong.

Some are recruited through job scams or social media ads offering easy income, while others are approached by friends or acquaintances. Young people, students and new arrivals to Australia are often targeted.

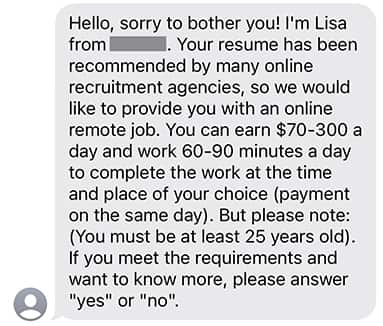

An example of a money mule scam text message. Source: Supplied / Commonwealth Bank

Australian Banking Association CEO Anna Bligh said mule accounts were a key part of a scammer’s business model and banks were focused on identifying, investigating and shutting them down.

“Using mule accounts to hide and move stolen money around is a key tactic in a criminal’s playbook,” Bligh said.

“I urge Australians to steer clear if you’ve seen an advertisement or are approached to rent or sell your bank account. There’s a good chance you’re being recruited to hide the profits of criminal activity.”

To stay safe, the AFP and banks recommend:

- Never sharing your bank account or login details with anyone

- Avoiding job offers that involve receiving and forwarding money.

- Reporting anything suspicious to your bank, Scamwatch or ReportCyber.