Share and Follow

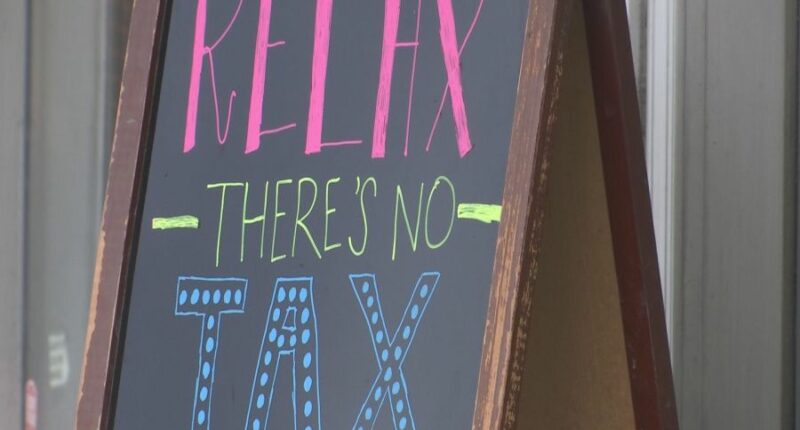

SOUTH CAROLINA () – South Carolina’s annual tax-free weekend kicks off today and it could mean major savings on back-to-school essentials. It could mean major savings on everything from pencils to notebooks to laptops.

South Carolina families are expected to spend nearly $700 per student this back-to-school season, and this weekend could help cut that number. The state’s tax-free weekend is back, and stores are preparing for what’s often considered their busiest shopping rush of the year.

From today through Sunday, shoppers across South Carolina won’t have to pay the usual 6% state sales tax – or any local sales tax – on select items. This includes school supplies, clothing, shoes, and even tech like computers and printers.

Both in-store and online purchases qualify as long as they’re made during the 72-hour window. With more than $1.3 million in tax savings reported last year, this weekend is a major win for both families and retailers.

“Tax-free weekend is a great way for South Carolinians to prepare for the school year. Last year, shoppers bought more than $22.3 million of tax-free items during tax free weekend. As a result, shoppers saved more than $1.3 million in sales tax,” said Cydney Milling, the South Carolina Department of Revenue Deputy Director of Tax Policy Services.

This is a great time for everyone, from teachers to parents, to save money on classroom supplies or dorm shopping. Remember, the savings end Sunday night, so don’t wait too long to grab that backpack, notebook, or uniform.

TAX-FREE WEEKEND: AUGUST 1–3

- School Supplies: Backpacks, notebooks, calculators

- Clothing & Shoes: Uniforms, sneakers, everyday wear

- Tech & Computers: Laptops, printers, software (bundled)

- Online & In-Store: All eligible items qualify both ways

- Tax Savings: 6% state + local sales tax waived

- Bed & Bath: Sheets, pillows, towels, shower curtains

“This is a great time to save on lots of items you plan to use in the classroom or for school assignments. Those include headphones and earbuds, musical instruments, uniforms such as band and sports uniforms, swimwear gear, graduation caps and gowns. You can stock your dorm room comforters, mattress pads and toppers, towels, pillows and pillowcases and shower curtains are all tax exempt,” detailed Milling.

Stores located near South Carolina’s borders should expect more foot traffic as neighboring shoppers from Georgia and North Carolina are expected to join in on the weekend.