Share and Follow

CHICAGO (WLS) — ABC News, ABC-Owned Television Stations and the ABC7 Chicago I-Team are finding that too many Black and Latino homeowners are being “highballed.”

They are more likely to pay higher property taxes because their homes are assessed at relatively higher values, and sometimes, because of higher tax rates in their communities.

But in Cook County, Illinois, a new study says the problem is starting to improve.

Twila Hayes says her family home in the south suburbs of Chicago is slipping away.

READ MORE | ‘Highballed’: How low income, communities of color are overtaxed in New York City

“Oh, I was stunned. I thought it was outrageous,” Hayes said.

It started with a staggering Cook County reassessment. Her home’s value jumped from $116,000 to $240,000. Then, the tax bill more than doubled to more than $12,000 a year.

“It’s absolutely a nightmare,” Hayes said.

Hayes’ property tax bill, which gets paid from her mortgage escrow, meant an increase to her mortgage payment.

“I was paying $950 a month. And then, it went to $2,304 a month,” Hayes said.

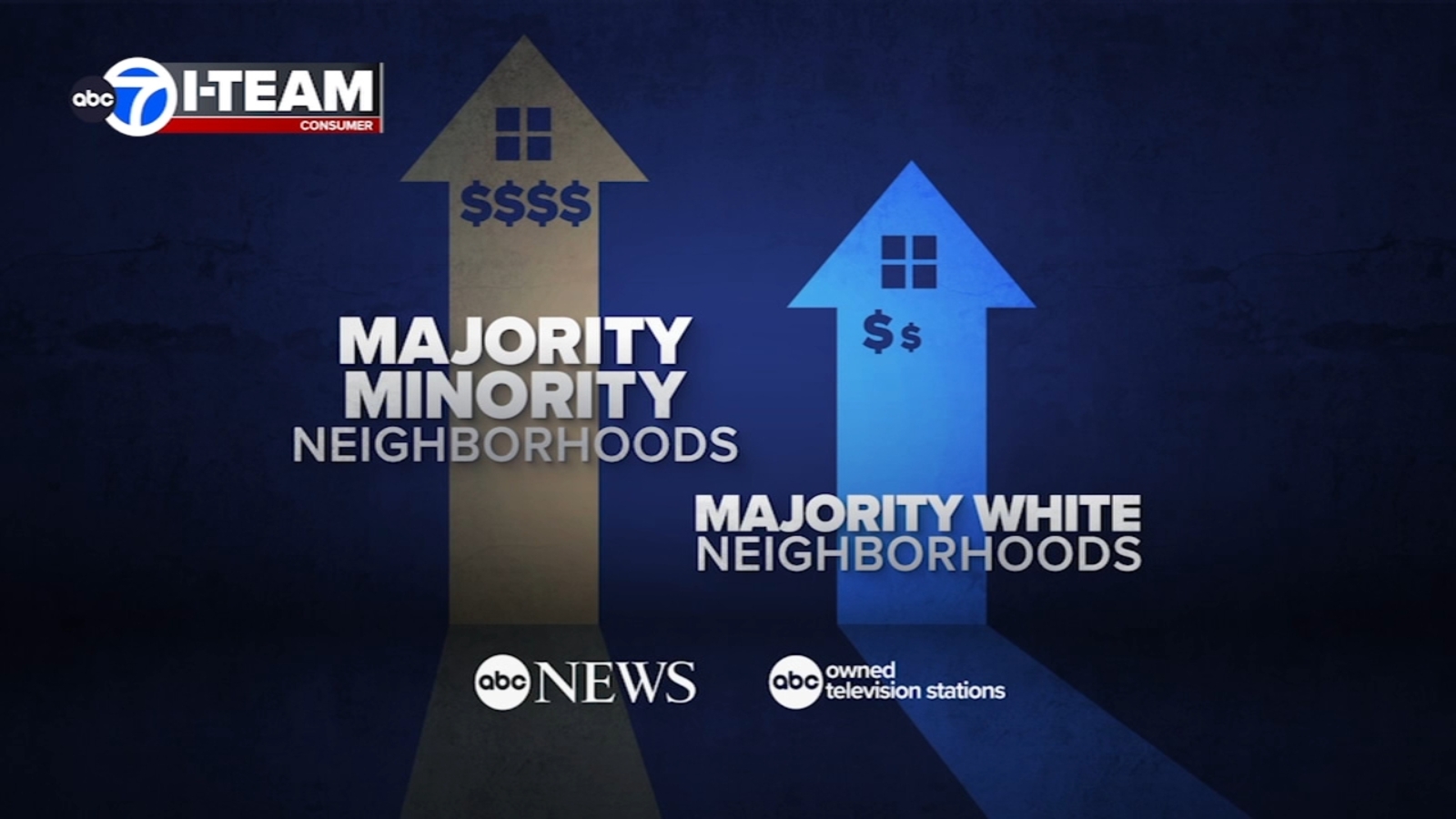

An ABC News analysis found that nationwide, homeowners in majority-minority neighborhoods are too often paying more in property taxes as a percentage of their home’s total value than homeowners in majority-white neighborhoods.

In Cook County, the I-Team found that more than 11,000 properties in the south suburbs saw their property tax assessments increase two-fold, or more, in its most recent assessment. The most recent assessment for the north suburbs showed only 0.2% of properties saw their assessed value double or more. In the city of Chicago, over 12,000 properties more than doubled in assessed value between the last two assessment cycles, mostly on the South and West sides of the city.

“They are creating urban deserts where people have to leave their homes,” Hayes said.

The I-Team first reported in 2024 about how higher assessments can hurt people in Chicago’s south and southwest suburbs more.

SEE ALSO | Cook County Assessor to correct thousands of property tax assessment errors in south, west suburbs

That’s because the state of Illinois relies heavily on municipalities to pay for schools when compared to most states. So, south and southwest suburbs have higher property tax rates, mostly to fund schools. The north suburbs have lower property tax rates because they have higher-valued homes, more businesses, and more wealth to go around.

“We tend to see then, African American and Latino communities are paying higher tax rates,” said University of Chicago Professor Christopher Berry

READ MORE | South suburban homeowners say property tax assessments raised up to 650%: ‘I will probably move’

Berry studies public policy and urban innovation. His recent study helped expose the problem of people of color too being “highballed” by assessors across the nation.

Click here for Berry’s notes on Cook County.

“Lower-value homes are systematically over assessed, the assessor says that lower valued homes are worth more than they are, whereas for high value add homes, the assessor says they’re worth less than they are,” Berry said. “For a long time, Cook County was one of the worst offenders. They’ve made substantial improvements in the assessor’s office over the last few years, and these problems have been substantially reduced.”

So, what is Cook County Assessor Fritz Kaegi doing differently? The I-Team asked him.

“And what we did is we took dead aim at this problem. We brought in data scientists who used a different kind of model that didn’t build in those kinds of biases that plague areas like ours across the country,” Kaegi said.

That meant no more lumping together vastly different neighborhoods and taking a closer look at specific locations.

“So, if you’re averaging homes in sales prices of homes in Woodlawn with the sales prices of homes in Hyde Park, where homes are more highly valued, you may end up over assessing the homes,” Kaegi said.

However, the University of Chicago study does not say assessments are necessarily lower, just more accurate, when compared to sales of homes.

“I mean, how, where am I going to get all this money to continue to pay?” Hayes said.

Hayes did get a small reduction on her assessment when she appealed, but it is still not enough.

“And if we are off on our assessment on homes like Twila’s, we’re ready to listen. We walk humbly and we’ll take it into account in our assessment,” Kaegi said.

“You’ll look again?” asked ABC7 Chicago I-Team Consumer Investigator Jason Knowles.

“We absolutely will. We’re happy to do it,” Kaegi responded.

The I-Team also sent Hayes’ documents to the Board of Review and the state’s property tax appeal board to see what else can be done.

Kaegi is also supporting a proposed state bill which would provide state funding to help struggling homeowners in Cook County who have seen property tax bills spike by 25% or more.

Kaegi also pointed to a study from the Cook County Treasurer’s Office, showing that businesses appeal more, and they win more appeals, shifting the tax burden to the homeowner. Kaegi says the Board of Review, not his office, is granting most of those business appeals. But businesses may have more resources to fight and win when there is an overassessment.

Copyright © 2025 WLS-TV. All Rights Reserved.