Share and Follow

National Australia Bank (NAB) will start using selfies to help combat the spread of identity theft from next month.

The bank said the new feature will be a breakthrough in the fight against cybercriminals.

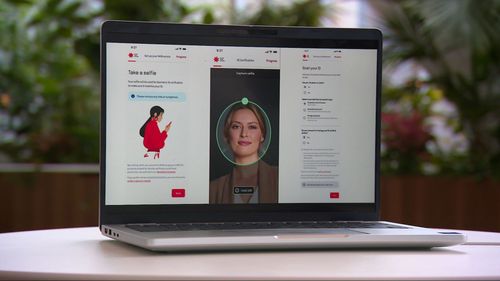

NAB said new customers will verify their identity using their biometric data, also known as full facial recognition.

It’s designed to stop stolen licences and passports being used to open dummy bank accounts, which is a fast-moving problem in the world of scams.

“Over 255,000 Australians a year have their identity stolen or compromised,” Head of NAB group investigations Chris Sheehan told 9News Finance Editor Chris Kohler.

”Now that number, I suspect, is on the low side.

“We’re confident we’re going to make a real difference.”

Industry analysts support the move, but say with more data actually comes more exposure.

“What we need to worry about is where is this information being held,” technology expert Trevor Long said.

”This is the last thing we want, our names, our details and photos of ourselves being hacked.”

NAB said there are no plans to make existing customers verify in this way and that anyone concerned should visit a branch in person to open a new account.

The move comes as the ACCC reports scam losses are increasing, with $175 million lost in just the first half of this year alone.