Share and Follow

The ABS attributed much of the jump to surging electricity prices, which rose 13.1 per cent in the 12 months to July, compared to a 6.3 per cent fall in the 12 months to June.

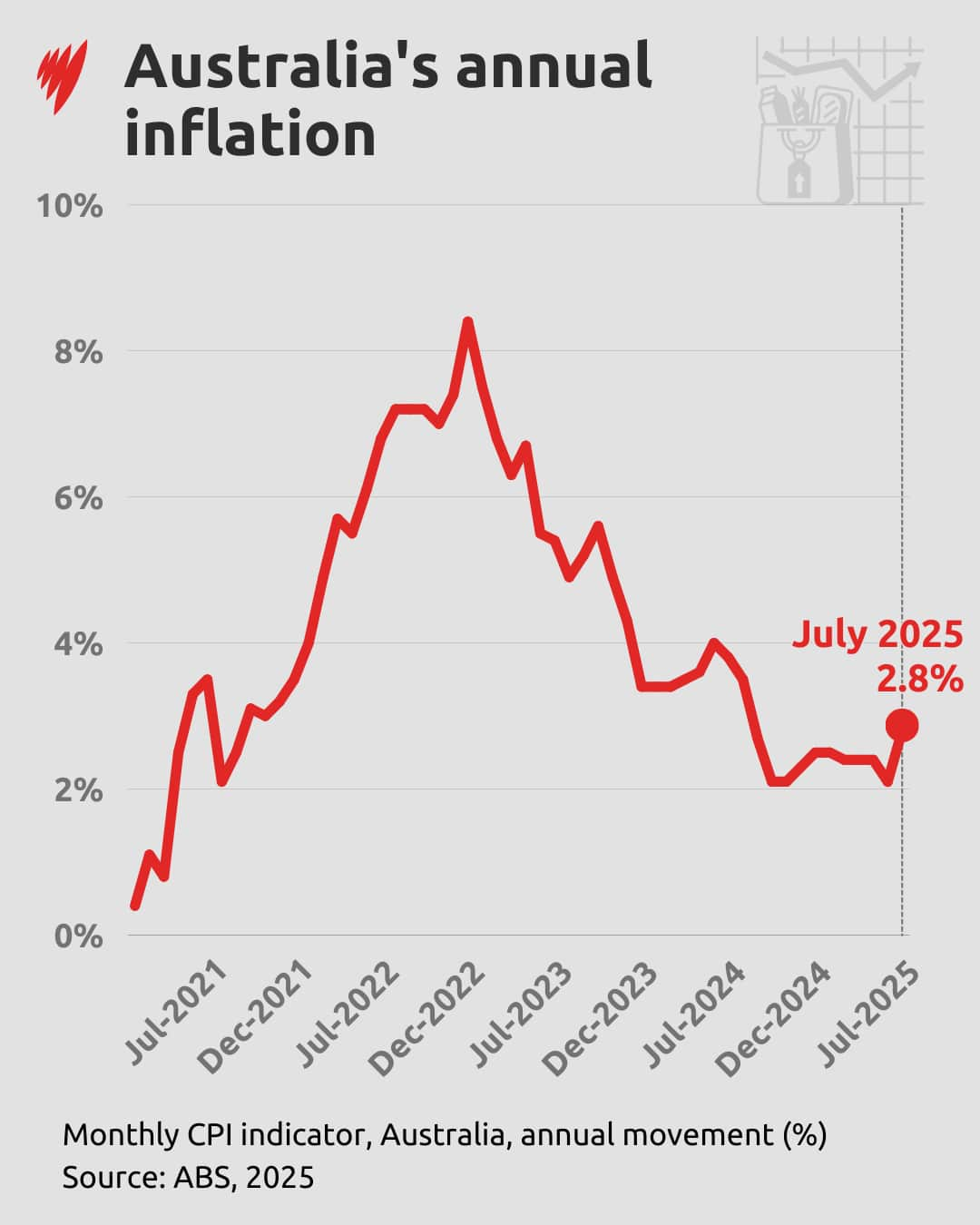

Inflation posted a resurgence in July, with consumer prices rising 2.8 per cent annually, according to figures from the Australian Bureau of Statistics. Source: SBS News

“The large annual rise in electricity costs was due to households using up the state government and Commonwealth energy bill relief fund rebates in some capital cities, as well as price increases following annual electricity price reviews in July,” the ABS said in a statement.

“The surprise was strength in travel and timing of electricity subsidy payments and so [it] is not as material as it looks at face value,” he said.

Even so, it raises the risk that the all-important trimmed mean — a measure of underlying inflation that removes the biggest price swings — for the September quarter comes in above the central bank’s forecast, he said.

What do inflation figures mean for borrowers?

“They were looking for core CPI to be at 2.6 per cent for December 2025 and here we are now 2.7 per cent with about five months left to go for the year,” he said.

Sycamore said electricity prices should level out in the next month and inflation could steady. The RBA will be placing more emphasis on quarterly trimmed mean figures due in October.