Share and Follow

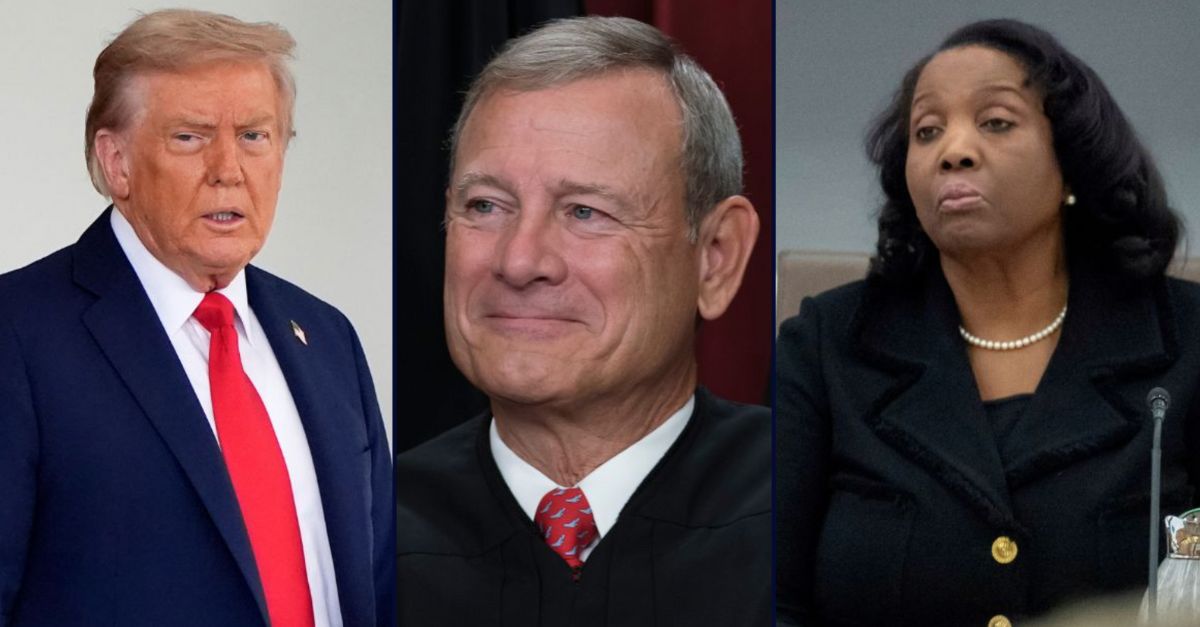

Left: President Donald Trump stands outside the White House, Monday, Aug. 18, 2025, in Washington. (AP Photo/Alex Brandon). Center: Chief Justice of the United States John Roberts joins other members of the Supreme Court as they pose for a new group portrait, at the Supreme Court building in Washington, Oct. 7, 2022 (AP Photo/J. Scott Applewhite, File). Right: Board of Governors member Lisa Cook listens during an open meeting of the Board of Governors at the Federal Reserve, June 25, 2025, in Washington. (AP Photo/Mark Schiefelbein, File).

A collection of Federal Reserve Board chairs and U.S. Treasury secretaries serving from the Bill Clinton, George W. Bush, Barack Obama and Joe Biden presidencies filed a brief at the U.S. Supreme Court on Thursday expressing full-throated support for the institution Lisa Cook serves, as President Donald Trump attempts to fire her over a mortgage fraud allegation referred to the DOJ for criminal prosecution.

Former Federal Reserve Board chairs Alan Greenspan and Ben Bernanke — with Greenspan serving in that role from Presidents Ronald Reagan to George W. Bush — and former Treasury Secretaries Janet Yellen, Timothy Geithner, Lawrence Summers and Henry Paulson, are among the amici curiae, or friends of the court, who urged SCOTUS not to permit Trump to oust Cook from the board before her lawsuit to stop her firing runs its course.

To allow the firing now, the brief says, in a situation in which Cook has not been charged with a crime but has been accused of “apparent misrepresentations […] in applying for home mortgages” prior to her confirmation to the board, would not only “threaten” the congressionally intended and “designed” independence of the Federal Reserve, but would also have the potential to severely impact the economy, through resulting “higher inflation and higher borrowing costs” — the opposite of the Trump administration”s stated goals.

Citing their “practical experience with policymaking in the United States and around the world—including with countries that have threatened or reduced central bank independence,” the amici implored the justices not to open the door to politicization of the Fed when the nine can simply leave the status quo in place, let Cook’s legal process play out, and not spook the markets in the short and long term:

Any reduction in the Federal Reserve’s well-earned reputation of independence would hamper its ability to influence independent decisionmakers and could ultimately lead to greater inflation. The same outcome will follow from actions that appear to politicize its membership or erode its ability to engage in monetary policymaking free from political influence.

Sectors that pay close attention to the Federal Reserve—including the financial markets, the public, employers, and lenders—are watching the current dispute over the President’s removal of Governor Cook to judge how credible the Fed will be going forward. Those audiences will be more skeptical of the Fed’s independence and commitment to long-term low-inflation policies if it appears that a member of the Board of Governors is being removed based on allegations that are actively under challenge in litigation.

The DOJ has pushed for Cook’s immediate removal, most recently telling SCOTUS that Trump’s determinations about Cook’s “conduct, ability, fitness, or competence” to serve are within his “unreviewable discretion.”

Claiming Cook “applied for two loans for her personal benefit, and was able to obtain favorable interest rates by misrepresenting where she lived,” the administration said the allegations put the governor’s “trustworthiness” in question, thereby establishing “cause” for her firing.

But, the amici say, leaving the merits aside, removing Cook now will erode Fed independence and lead to unintended consequences that, on balance, simply aren’t worth inviting.

“Granting the government’s request to remove Governor Cook from the Board immediately would upset these longstanding protections and the essential functions they serve. Doing so would expose the Federal Reserve to political influences, thereby eroding public confidence in the Fed’s independence and jeopardizing the credibility and efficacy of U.S. monetary policy,” the signatories summed up. “Maintaining the status quo while the lawfulness of the termination is adjudicated, in contrast, would serve the public’s interest by safeguarding the independence and stability of the system that governs monetary policy in this country.”

Cook was expected, by order of Chief Justice John Roberts, to respond to Trump’s bid to fire her by 4 p.m. on Thursday. To date, her attorneys have called the attempted firing “unlawful” and the allegations against her “unsubstantiated and vague.”

In Cook’s brief opposing Trump’s bid for a stay of an order blocking her firing, she repeated that the “flimsy, unproven” and yet “conveniently timed” mortgage fraud allegations cannot be “cause” for removing her and “eviscerat[ing]” the Fed’s independence — especially in light of SCOTUS’ “history and tradition” rulings of recent years:

The President’s stay application asks this Court to act on an emergency basis to eviscerate the independence of the Federal Reserve Board. For decades, the Board’s insulation from direct presidential control has allowed the American markets and economy to thrive. And as the Court recognized earlier this year, the Board’s independence is uniquely entrenched in the Nation’s history and tradition. Yet the President now requests that the Court precipitously depart from that view and allow him to remove Governor Lisa D. Cook from the Federal Reserve Board “for cause” and without process based on flimsy, unproven allegations of pre-office wrongdoing—allegations conveniently timed following the President’s criticism of the Board’s policy decisions. Granting that relief would dramatically alter the status quo, ignore centuries of history, and transform the Federal Reserve into a body subservient to the President’s will.