Share and Follow

Vaibhav Raghunandan, an analyst specializing in EU-Russia relations at CREA, questions the strategy of targeting only the vessels involved in sanctions. He suggests that this approach may not be as effective as intended.

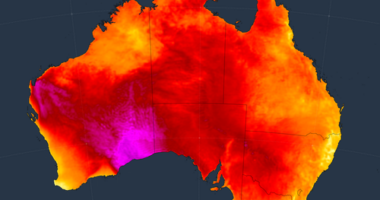

For the first time, data has surfaced showing that some tankers from the sanctioned shadow fleet continue to be part of Australian supply chains. This revelation has led one expert to criticize the federal government for merely “creating an impression of addressing the issue,” rather than taking substantial action.

Raghunandan explains, “The oil price cap is designed to limit the price at which Russian oil can be traded with nations such as India and China.” However, he points out that the measure is falling short, as refineries persist in purchasing Russian oil above this cap, with the shadow fleet playing a crucial role in these transactions.

Since February 2022, CREA has been diligently monitoring the flow of Russia’s fossil fuels and its associated revenues. They utilize real-time data provided by Kpler, which integrates maritime traffic, shipping, customs, and market information. Based in Finland, CREA also incorporates additional customs data from the EU and other countries to provide a comprehensive analysis.

They want to constrict the access of the Kremlin to those revenues, but they don’t want to limit the supply of oil to global markets.

“That means that the price cap is not working because those refineries keep buying Russian oil above the price cap and the shadow fleet is facilitating that.”

Sanctioned tankers in Australian supply chains

Since February 2022, CREA has been tracking Russia’s fossil fuel flows and revenues using real-time data from Kpler, a service provider that collates maritime traffic, shipping, customs and market data. CREA, based in Finland, also uses separate customs data from the EU and other countries.

“You’re essentially boosting and encouraging the Russian oil trade by not imposing sanctions on the refinery or putting a ban in place on refined oil products made from Russian crude itself.”

‘Crucial’ to Russia’s trade

He says shadow tankers can also be difficult to identify because they lack consistent common traits or markers.

“There may be some countries that are not willing to touch these tankers [and] some ports … But that does not mean that the operations of these tankers stop,” he says.

There’s a huge number of sanctioned tankers out at sea.

“So at any point of time, shadow tankers have been a very integral part of the supply chain for refineries that are using Russian crude.”

Australia – the biggest importer

Yet according to CREA, Australia is currently the biggest importer of oil products refined from Russian crude in third countries.

“We continue to have processes and controls for maintaining compliance with applicable trade sanctions. We conduct appropriate checks on trading counterparties and documents that are used to evidence the origin of products,” the spokesperson said.

SBS News also attempted to confirm CREA’s Australian data set with the Australian Border Force. A spokesperson for the agency said they were unable “to confirm or disclose specific details of commercial vessel movements at Australian ports” due to “legislated privacy obligations”.

‘Playing whack-a-mole’

“Australia’s imports of oil products from refineries using Russian crude is a small part of its entire consumption of these products,” he says.

Removing these from the entire supply is going to have no inflationary effect.