Share and Follow

Job cuts are on the rise, with one of the few real-time economic indicators showing an acceleration in layoffs.

ADP, a leading payroll-processing company, announced on Tuesday that private sector employers have been reducing their workforce by 13,500 jobs each week since late October. This marks a significant increase from the approximately 2,500 weekly job losses reported in their previous update.

This surge in layoffs comes at a time when Washington is attempting to restart its labor data operations, which were stalled due to the longest government shutdown in U.S. history, delaying several critical economic reports.

With the Bureau of Labor Statistics’ key employment report postponed until mid-December, ADP’s informal job count has become a vital source of insight into the current labor market.

For many workers, these figures come as little surprise.

Layoff tracker Challenger, Gray & Christmas recorded 153,074 job cuts in October alone — a staggering 175 percent jump from last year and 183 percent from September.

It was the sharpest October spike since 2003, when companies were reeling from the dot-com collapse.

Major employers have added to the drumbeat.

More Americans are searching for jobs, ADP said, as companies are handing out more pink slips to staffers

Over the past three months, Amazon, Apple, UPS, Intel, Verizon, AT&T, Walmart, Target, Ford, and GM have all made headlines for slashing white-collar staff — a broad corporate reset that shows little sign of slowing.

Those job losses are starting to creep into the government’s latest reporting.

Last week, the BLS released its September jobs report weeks later than expected. While the topline jobs figure outperformed expectations, the data found that more Americans are claiming unemployment checks.

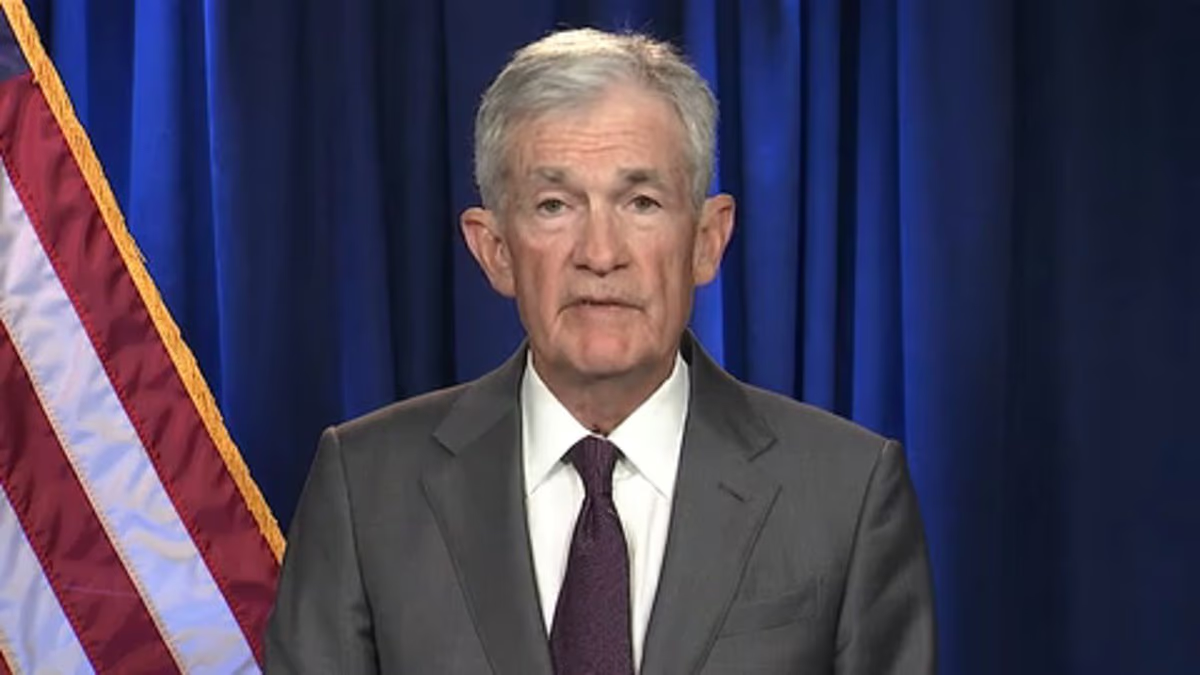

And the timing is creating an unusually tricky puzzle for the Federal Reserve.

The central bank is still trying to tame inflation while keeping the labor market healthy, but unemployment has been inching up while inflation has drifted back to around three percent this year.

The bank’s main tool, benchmark interest rates, is its most effective instrument for helping employees find work and keeping prices down.

Typically, higher interest rates cool consumer prices, while lower interest rates elevate job openings.

But both unemployment and inflation have continually crept upward this year, making the Fed’s decision-making process extremely murky.

The unemployment jump is the latest complication for the Fed to clear, as central bankers struggle to tame inflation

Giant US emplployers – like GM, Walmart, Apple, Amazon, and UPS – have all announced recent layoffs

‘There is no risk–free path,’ Powell said after cutting rates in October.

Complicating matters further: the shutdown forced the BLS to skip several key updates on jobs and prices, leaving Fed officials heading into their December 9 and 10 meeting without the data they typically rely on.

Even with the gaps, several policymakers have signaled they’re ready to cut interest rates again.

It’s a shift that’s already pushed Wall Street to expect a reduction next month.

Yesterday, stocks rebounded after a wobbly performance last week on optimism of an impending rate cut.