The cost of a comfortable retirement is higher than it’s ever been, according to the Association of Superannuation Funds of Australia (ASFA).

The peak body’s CEO, Mary Delahunty, said, fortunately, the average balance of superannuation accounts has also risen to a record high.

The average balance is sitting at $172,834 for nearly 18 million superannuation account holders over the age of 15. For those aged 65 to 69, the average balance is around $420,934.

“More Australians than ever before are reaching retirement with meaningful super behind them,” she said.

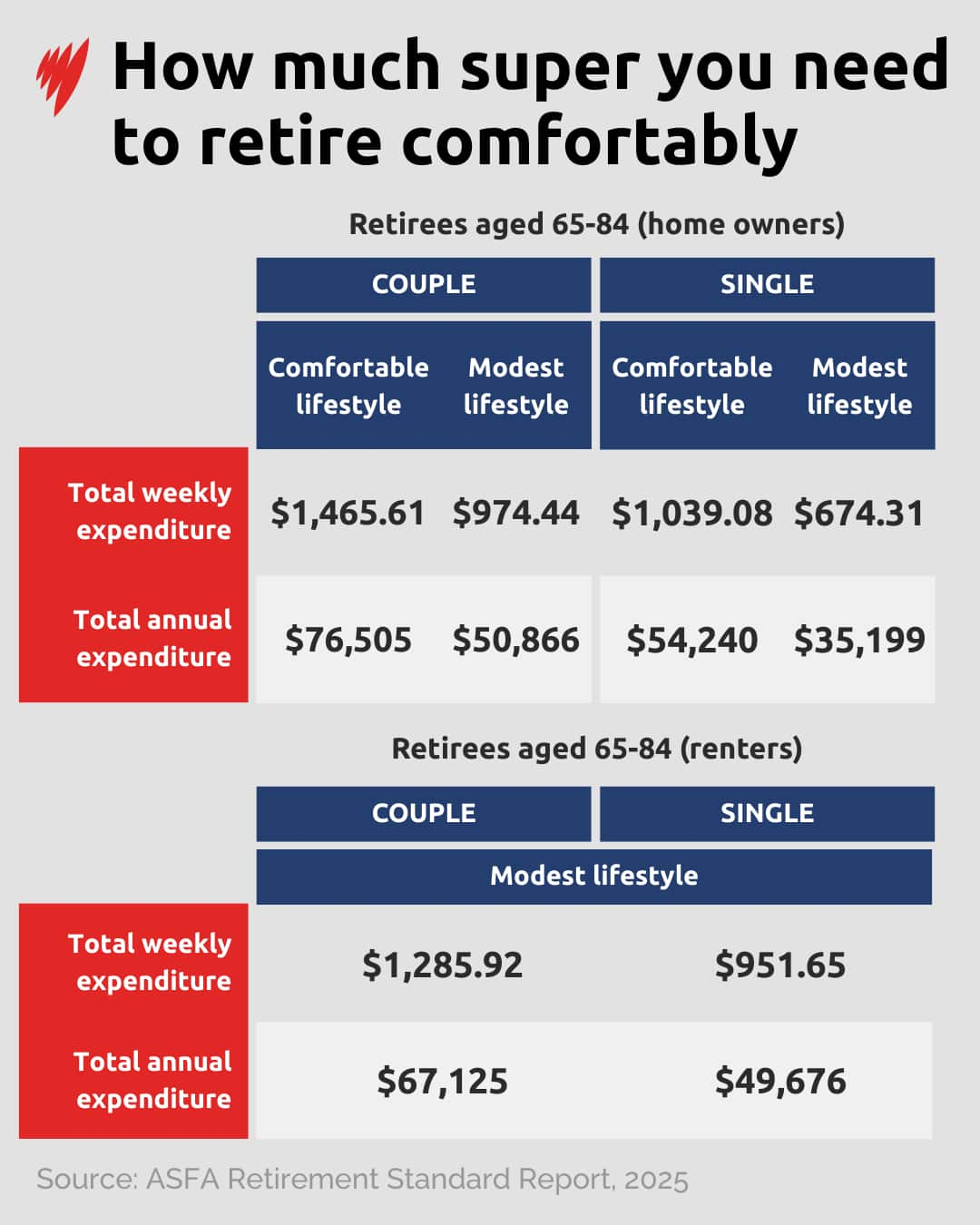

Retirement can appear daunting for many Australians as they consider the financial requirements for a comfortable life after their working years. Recent figures from the Association of Superannuation Funds of Australia (ASFA) shed light on this, revealing the annual financial needs for retirees.

For couples who own their homes and are 65 or older, ASFA estimates that an annual income of $76,505 is necessary to maintain a comfortable lifestyle. In contrast, a single retiree will require approximately $54,240 each year.

There are many factors that influence how much money you’ll need, such as age pension eligibility, whether you own your home, and your living situation.

Most calculations consider a more modest budget option versus a more comfortable lifestyle, including things like overseas travel and subscriptions to streaming services.

According to ASFA, coupled homeowners 65 and over will need $76,505 each year to live comfortably in retirement.

These figures represent a noticeable increase from the previous year, with the required amounts rising by 3.5 percent for couples and 3.6 percent for singles. This uptick is closely tied to the ever-increasing cost of living, a concern that resonates with many across the nation.

As Australians plan for their future, understanding these updated financial benchmarks is crucial. It offers a clearer picture of what is needed to secure a retirement that allows individuals to enjoy their golden years without financial stress.

That’s an increase of 3.5 per cent and 3.6 per cent respectively compared to this time last year, and it’s directly connected to the rising cost of living.

The group estimated retirees over 85 who own their home would need less money, offering about $71,104 as a guide for a couple and $47,534 for a single person.

A separate estimate from Super Consumers Australia, a group that advocates for lower- and middle-income super consumers, suggests that a typical single homeowner will need around $322,000 in superannuation for a comfortable retirement.

Couples will need a combined $432,000.

In contrast, for those living a ‘modest lifestyle’, the estimated annual budget was approximately $20,000 lower, as they typically spend less on health insurance, cars, and take fewer holidays, among other expenses.

Experts say it may take even less in superannuation to have a secure retirement, especially if you own your own home.

Joey Moloney, the deputy director of the housing and economic security program at the Grattan Institute, previously told SBS News the real cost of retirement could be even lower, as retirees typically spend less once they stop working.

“When you look at people’s spending habits from pre-retirement to post-retirement, what you see is that people spend less in retirement and increasingly so as retirement goes on,” he said.

“Pensioners benefit from a bunch of discounts on council rates, electricity, medicines and other benefits that add up to an implicit income of thousands of dollars a year.”

Where have prices risen most?

In the September quarter alone, electricity prices have risen by 9 per cent.

Over the past twelve months, the increase is closer to 25 per cent.

Meanwhile, the cost of eating out has risen by around 1.3 per cent, while those staying in are paying 9.3 per cent more for media services.

Delahunty said the holidays will be a challenging time for many retirees because prices have risen fastest in the things they spend most on, like “food, energy and health”.

“Some older people may cut back on pricier gifts, travel and social occasions to stay on top of the basics,” she said.

“The challenge now is to keep strengthening the system so every Australian has the best possible chance of a comfortable, dignified retirement, not just at Christmas but all year round.”

The information in this article is general in nature and is not intended as financial advice. You should consult with a licensed professional to make the decisions that are right for you.