Share and Follow

A Nigerian man has stirred up discussions on social media after expressing frustration over his barber’s decision to implement a 7.5% Value Added Tax (VAT) on customers’ bills.

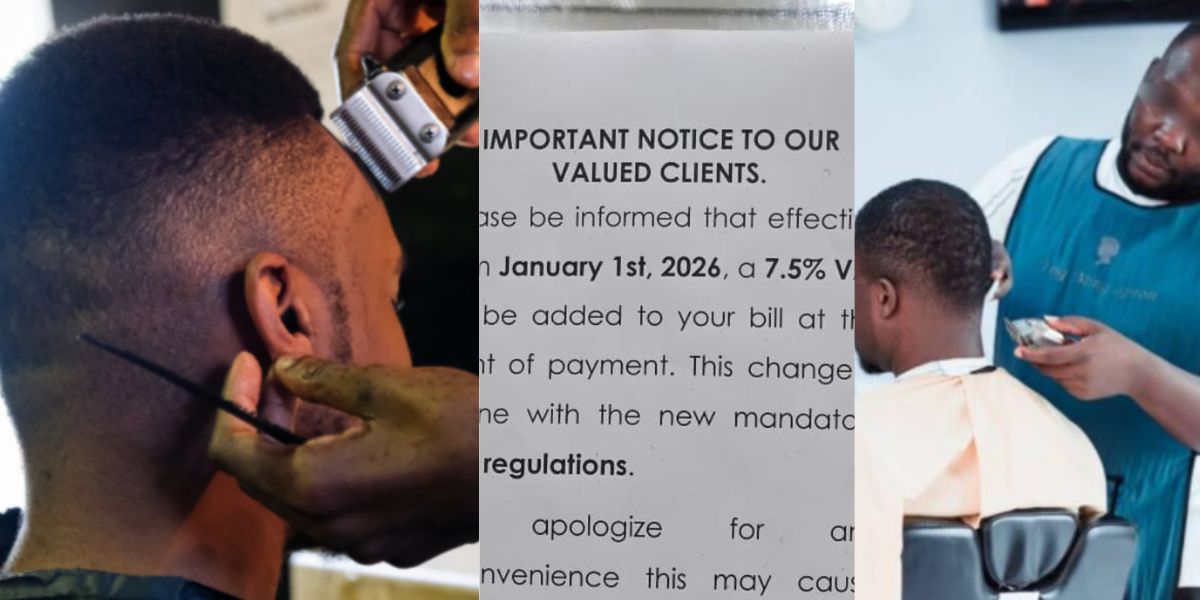

The buzz began with a widely circulated notice indicating that, starting January 1, 2026, the barber will start adding a 7.5% VAT to all transactions at the shop.

The barber clarified that this move aligns with new mandatory regulations issued by the Federal Inland Revenue Service (FIRS).

This development coincides with the federal government’s recent push to enforce tax policies slated to begin this year.

This comes amid the federal government’s enforcement of tax policies expected to take effect this year.

The notice also apologised for any inconvenience caused and thanked customers for their continued support, adding that the business looks forward to serving them better.

However, many internet users did not find the move amusing, questioning when barbers began charging VAT like large corporations.

Reactions quickly followed online. One commentator wrote, “So after a ₦5k haircut, I’ll now pay VAT? Nigeria is not a real place.”

Another added, “Small businesses are just trying to survive. If FIRS dey disturb them, what do you expect?”