Share and Follow

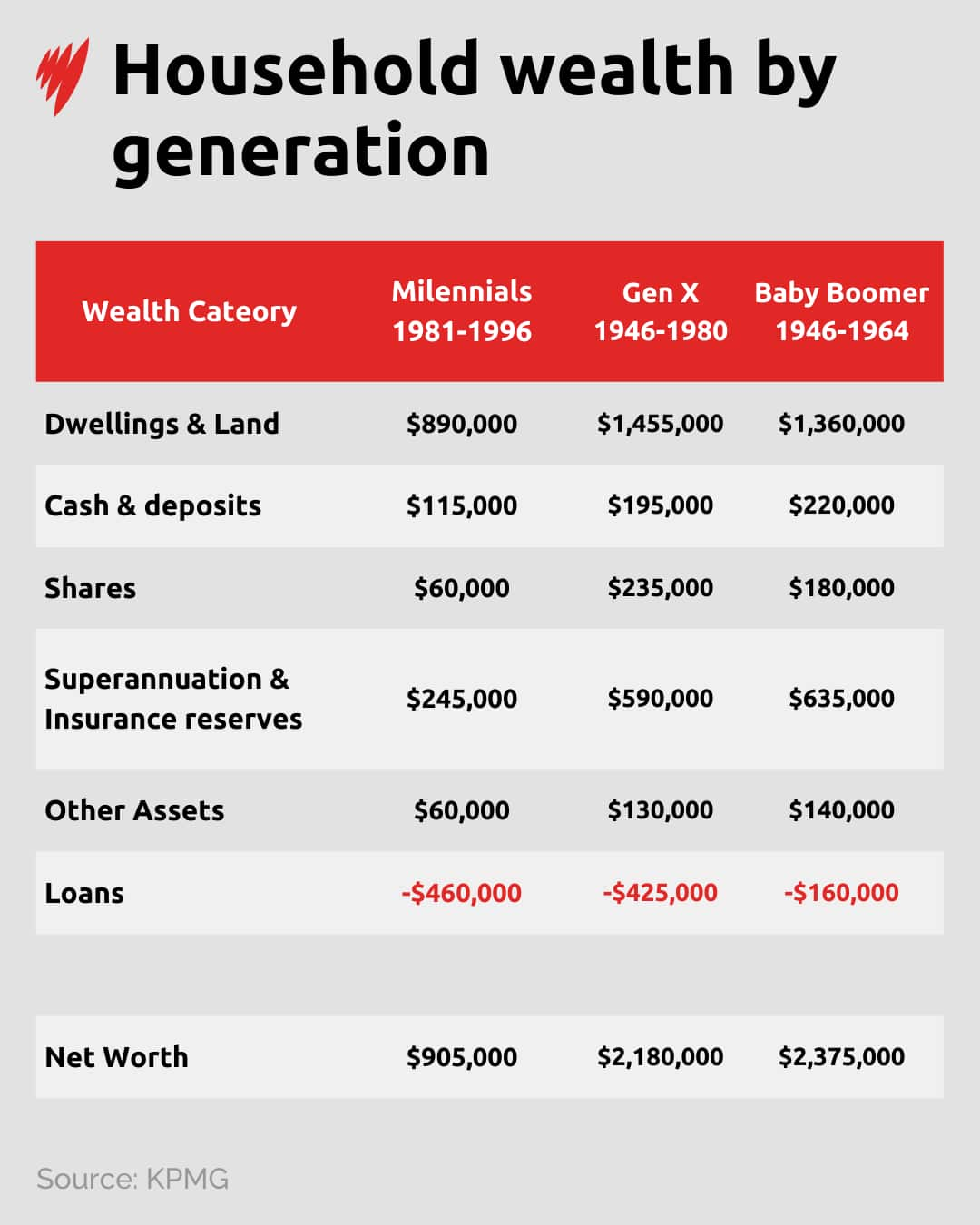

In the landscape of generational wealth, Gen X has carved out a significant niche, boasting more property and share investments than their counterparts. However, when it comes to overall net worth, baby boomers still lead the pack, according to a fresh analysis.

Consultancy firm KPMG, drawing from Australian Bureau of Statistics data on income and wealth, reveals that baby boomers—those born between 1946 and 1964—enjoy the highest average net worth, clocking in at $2.375 million. Gen X, born from 1965 to 1980, follows closely with an average net worth approaching $2.2 million.

The report highlights a narrowing gap in net worth between these two generations. Just a year ago, KPMG noted that Gen X had surpassed baby boomers in property and shares, a significant milestone in the shifting dynamics of wealth distribution.

Despite these advancements, both Gen X and boomers remain considerably wealthier than millennials, the generation born between 1981 and 1996, whose average net worth stands at $905,000.

This disparity is partly due to the opportunities presented by historically low interest rates, which allowed younger homeowners to increase their wealth significantly. Unfortunately, those unable to enter the property market during this period may face the grim prospect of being permanently priced out.

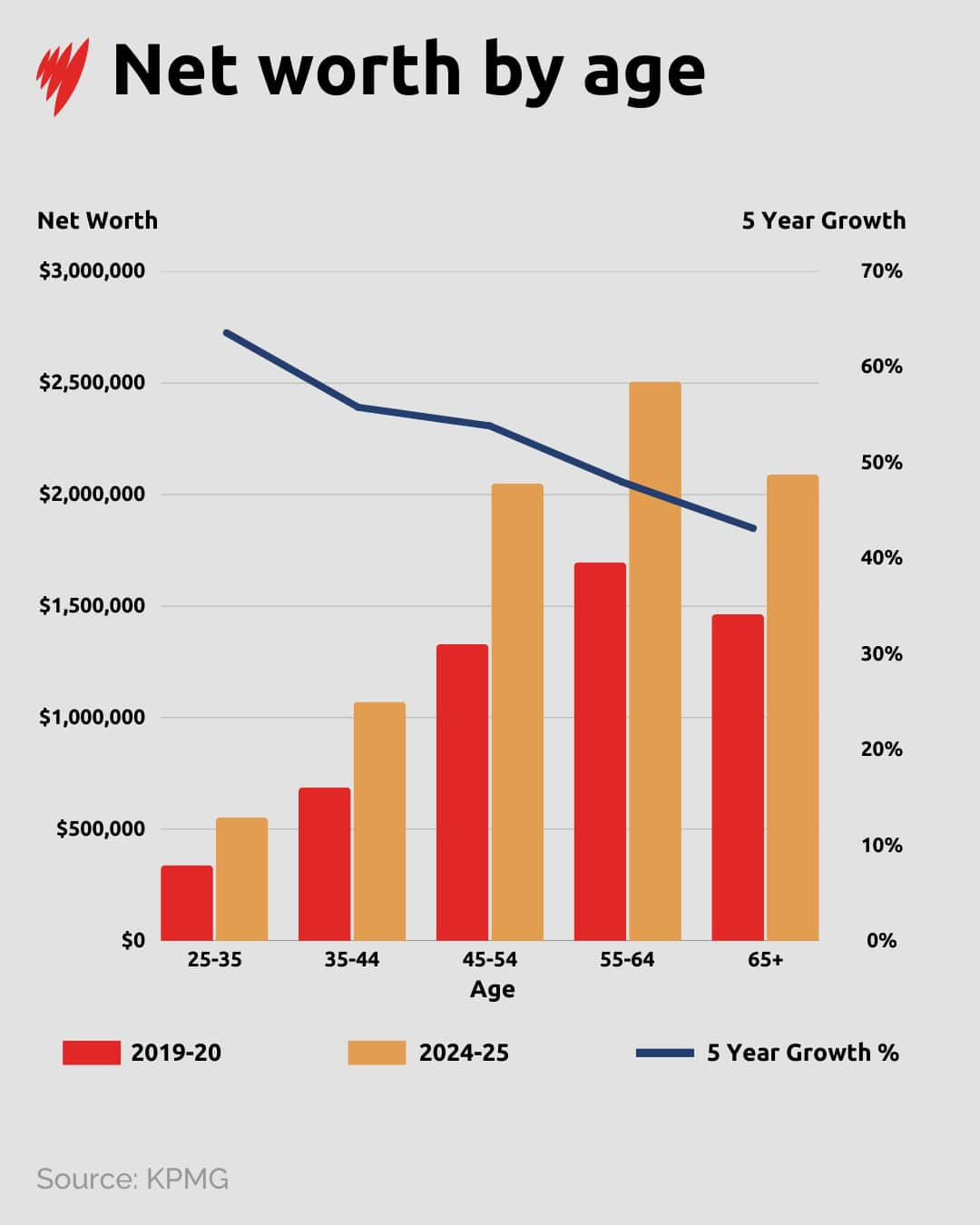

The average household wealth for Australians aged 25 to 34 rose from $340,000 in 2019–20 to $550,000 in 2024–25 — an increase of 63 per cent.

KPMG urban economist Terry Rawnsley said the increased wealth of younger Australians was largely driven by those who purchased property when interest rates were “ultra-low” in 2020 and 2021.

“For young Australians able to get into the market they are starting to see strong growth, but for those aged under 30, many of whom have been locked out of housing, wealth accumulation will be a much tougher task,” Rawnsley said.

“With interest rates now at much higher levels, that home ownership window is now firmly closed.”

Source: SBS News / KPMG

However, younger Australians will likely retire with far more superannuation than those exiting the workforce today, according to the analysis.

The 55 to 64 age group had super balances averaging $756,000, compared to $151,000 for 25 to 34-year-olds and $289,000 for 35 to 44-year-olds.

With decades left of their working lives, younger generations will benefit from higher mandatory employer contributions, which will be invested for longer.

“Their superannuation will be coming off a far higher base than their parents. This means the wealth they will eventually accumulate from super will be far higher than today’s retirees,” Rawnsley said.

The amount you need for a comfortable retirement can vary widely, however, depending on whether you own your home, according to some models.

‘The great wealth transfer is in full swing’

The report — which also analysed household wealth by generation — found baby boomers had the highest net worth overall, while gen X had the most property wealth.

Gen X households had an average property wealth of $1.445 million, compared to $1.360 million for baby boomers.

Source: SBS News / KPMG

Rawnsley attributed the shift to an inter-generational wealth transfer.

In 2024, analysts estimated Australia’s over-60s are expected to transfer $3.5 trillion to younger generations in the next 20 years, dubbing this the ‘great wealth transfer’.

“The great wealth transfer is in full swing, as baby boomers start downsizing properties and moving that wealth into cash. They are also beefing up their super accounts as they begin to spend in retirement or hand down wealth to their children,” he said.

“This has meant gen X is atop the mantel as the wealthiest property owners.”

Millenials had larger debts than other generations, likely owing to property loans.

“For the average millennial household, the property they own is still largely a liability, which explains why their net worth is less than the average value of their property,” Rawnsley said.

Lucas Walsh, professor of youth studies at Monash University, told SBS News the wealth transfer came at the expense of Australians who did not expect an inheritance.

“More goes to wealthier families and less goes to others,” he said.

“This divide is striking … and I think will present problems to social cohesion, as people become less happy with their lives under these conditions.”

Walsh said the wealth transfer would continue, but he expected it to narrow.

“We can expect the wealth accumulated by previous generations to have less and less relative value if property prices keep going up and the cost of living keeps increasing,” he said.

Property remains primary driver of wealth

The report shows home ownership remains the cornerstone of wealth accumulation, which includes property, superannuation, shares and other assets minus debts.

Households aged 55 to 64 had the highest average property wealth at $1.529 million, while those aged 25 to 34 averaged $575,000.

“This wealth profile is reflecting a lifetime of super contributions and exposure to the share market and purchasing homes when they were more affordable,” the report states.

Source: SBS News / KPMG

“Many young people in this group are just entering the housing market, which leaves them with large mortgages,” Rawnsley said.

“Combined with HECS debts, this makes them the most leveraged generation with an average loan size of $346,000, offsetting total assets of $899,000.”

With many young people priced out of the housing market, Rawnsley said he expected many would focus on building their share portfolios as a way of accumulating wealth.

For the latest from SBS News, download our app and subscribe to our newsletter.