Share and Follow

CAA, the renowned talent agency, is boldly venturing into the competitive arena of venture capital, a landscape where triumphs are often outnumbered by setbacks. This strategic move signals CAA’s ambition to broaden its horizons and tap into the lucrative world of investments.

Back in 2020, CAA took its initial steps into the investment sphere by partnering with the venture capital firm New Enterprise Associates (NEA) to establish Connect Ventures. Now, this partnership is evolving into a standalone VC firm, and it’s enlisting the expertise of a seasoned Silicon Valley figure to lead the charge, as exclusively revealed by Page Six Hollywood.

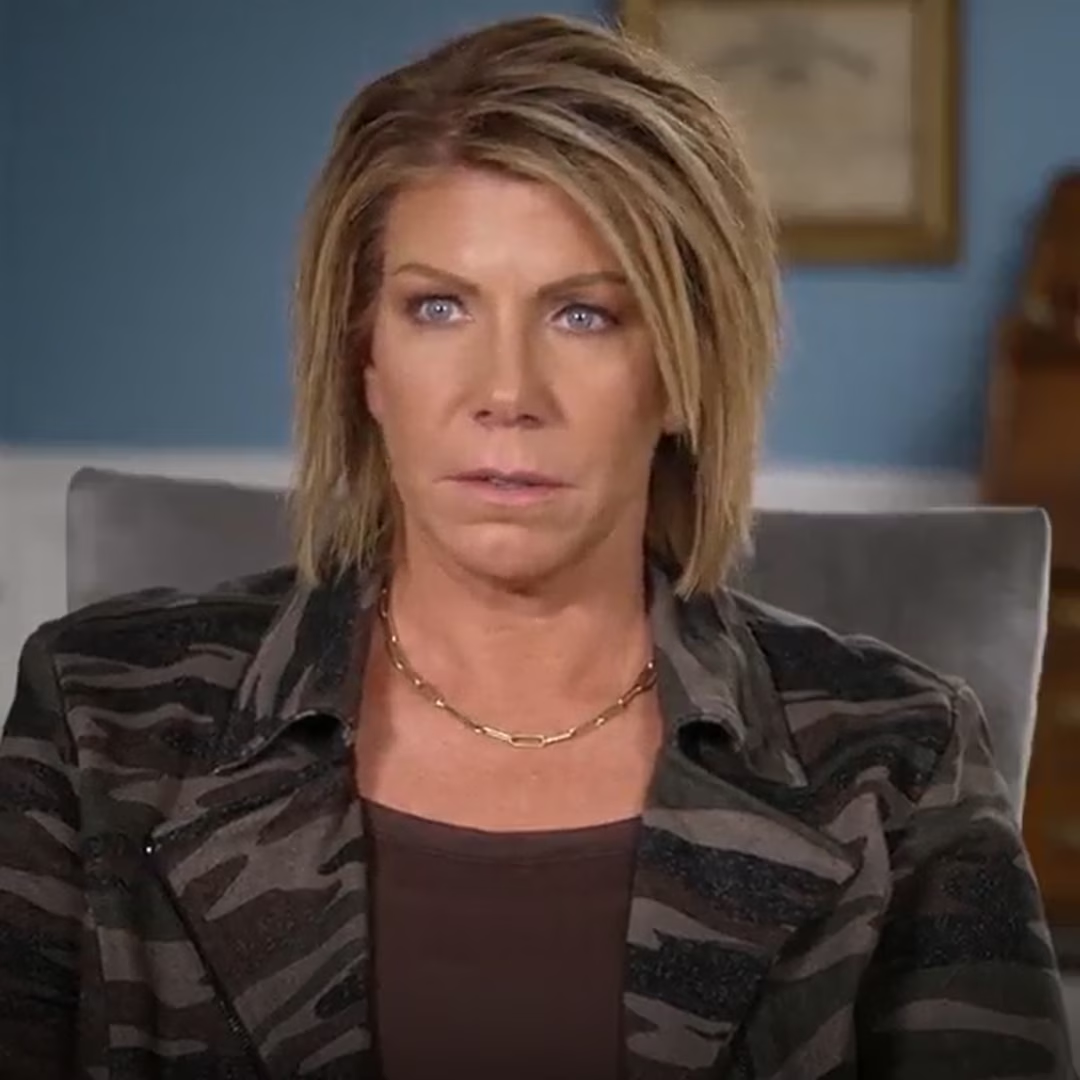

The newly independent firm will be headed by Nicole Quinn, formerly a partner at Lightspeed Ventures, who boasts a successful track record with investments such as Gwyneth Paltrow’s wellness brand, Goop. Alongside her will be Michael Blank, the CAA executive instrumental in launching the previous iteration of Connect.

Jim Burtson, the president of CAA, conveyed to Page Six Hollywood the importance of bringing someone of Quinn’s caliber on board, emphasizing that her involvement lends the venture significant credibility within the investment community. “You don’t get to this stage and this announcement without a Nicole,” Burtson remarked.

Burtson is optimistic about this new venture, viewing it as a natural extension of CAA’s strategy to diversify its portfolio. He believes that engaging with the forefront of technology, commerce, and culture can enrich their primary business operations. However, Burtson clarified that this does not imply that CAA’s clients will receive preferential treatment for their own entrepreneurial endeavors. “Nicole and Mike are building a firm,” he stated, “It is not meant to be captive to CAA.”

Quinn says that they’re eyeing many spaces that CAA is known for, including sports, media and entertainment, as well as health and wellness. The first two investments they shared with us are TMRW Sports, co-founded by Tiger Woods and Rory McIlroy, as well as Music.AI, the developer behind audio apps AI Studio and Moises.

“AI is here and it’s not going away,” Blank added. “Part of what we can do is help create that bridge for folks in various industries that have been skeptical or fearful.”

Connect Ventures will largely be based within the agency’s Century City office, and CAA’s Adam Friedman will be the liaison between the two sides as a venture partner. He’ll spend around half of his time working with Connect. Burston is also on Connect’s board.

Neither Blank nor Quinn would divulge just how big of a fund they’re working with, but they did tell us they’re looking to lead or co-lead early-stage rounds — seed and Series A — with plans to drop between $5 and $15 million per investment.

In layman’s terms, these lead to the kind of equity stakes that get you board seats.