The average superannuation balance for Australians has passed $172,000 for the first time, but some people’s retirement savings are increasing at a “glacial pace”.

In a report released on Friday, the Association of Superannuation Funds of Australia (ASFA) predicted “substantially better retirement incomes” in the years ahead.

While the report is new, the data is at June 2023 when the average super balance was $172,834, according to ASFA’s analysis of Australian Taxation Office data. By that point, the superannuation guarantee had increased from 10 per cent to 10.50 per cent and has since grown to 12 per cent.

While no additional increases are currently on the horizon, Mary Delahunty, CEO of the Association of Superannuation Funds of Australia (ASFA), expressed to SBS News that robust investment returns and a developing superannuation system are expected to continue enhancing account balances.

“Consider your investment over a 30-year period. Superannuation funds have historically yielded average returns of approximately 7.5% annually, even when factoring in the impacts of the Global Financial Crisis and the COVID-19 downturns,” she explained.

Delahunty said that there have been “volatile times” in recent years, but that superannuation is a long-term investment.

“It’s built to weather short-term storms, so markets will go up and down,” she said.

These observations are based on data from June 2023, as reported by SBS News.

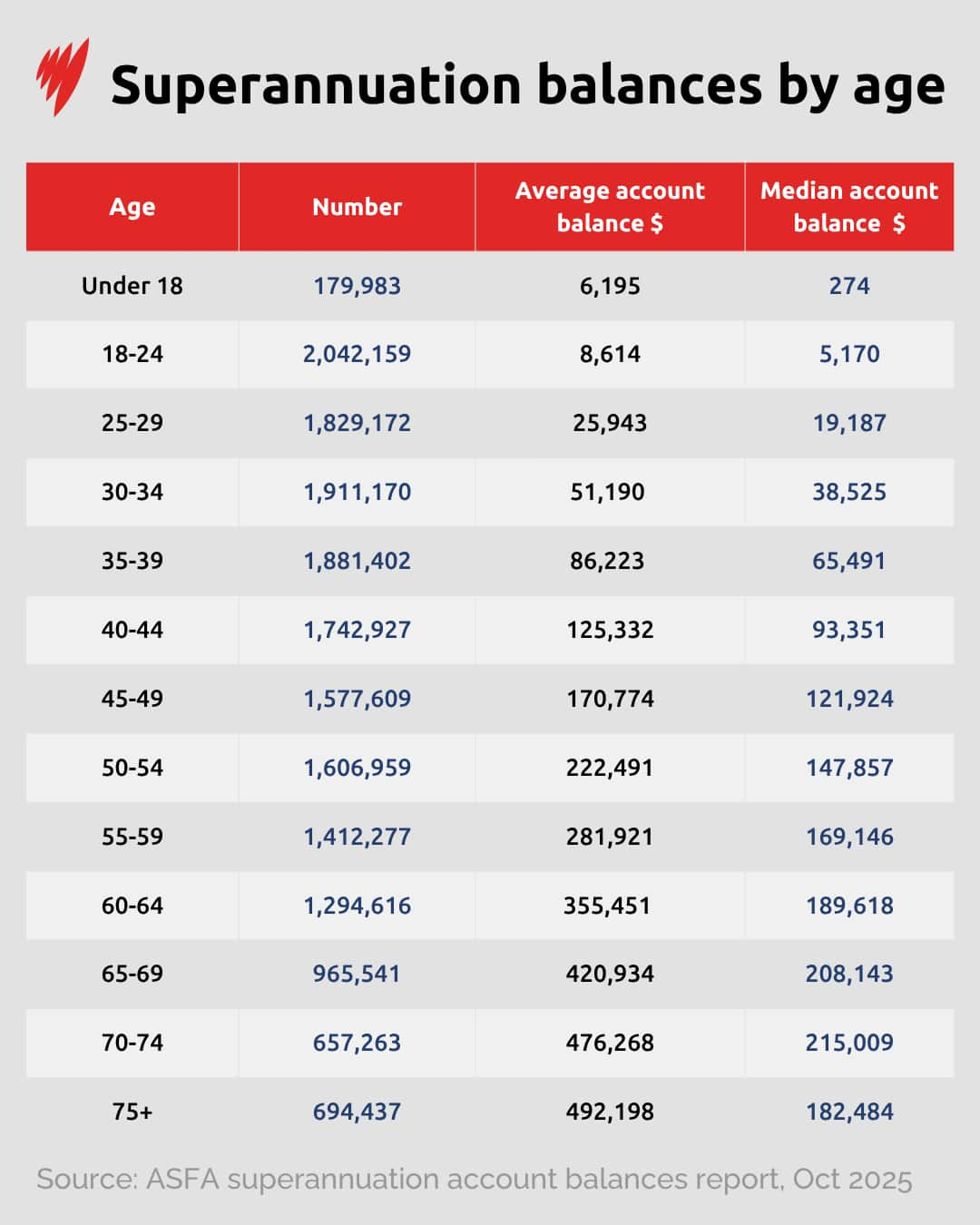

For Australians approaching the typical retirement age, specifically those aged between 60 and 64, the average superannuation balance stands at $355,451.

The average superannuation for an Australian nearing typical retirement age, from age 60 to 64, is $355,451.

This average increases with age, with those aged over 75 averaging $492,198.

Delahunty said these are strong balances, but looking at the median, or midpoint, value can give a more accurate description of how most Australians are faring.

For someone aged between 30 and 34 years old, the median superannuation balance is $38,525.

People aged between 50 and 54 years old have a median balance of $147,857.

And someone aged between 70 and 74 years old has a median balance of $215,009 in their superannuation account.

How are people funding their retirement?

Superannuation is increasingly becoming the main source of income for retirees, according to the ASFA report.

Fewer people relying on the age pension is a “historic shift”, Delahunty said, and is a result of workers contributing funds for over three decades.

“A 30-year-old today with $30,000 in super and earning a median wage, they will retire with $610,000. That’s above the $595,000 needed for a comfortable retirement [assuming home ownership],” she said.

“It really is an incredible effort.”

The result is that the super system has generated around $1 trillion in additional household savings that Australians wouldn’t otherwise have, Delahunty added.

Where are the gaps?

The increase in the average superannuation is “good news”, but gaps remain.

One of the key factors driving disparity is a person’s gender.

At ages 60 to 64, men average about $396,000 in superannuation savings while women average around $313,000.

However, the gap between the balances of men and women is shrinking

Women now hold 43.6 per cent of the total superannuation assets, up from 41.9 per cent five years ago.

Delahunty described this as “heading in the right direction, albeit at a glacial pace”.

“The main culprits are career breaks for caring responsibilities, and then women tending to work part-time and then women being paid less,” Delahunty said.

There are also differences in superannuation balances when you look at geographical factors.

Delahunty said this is due to superannuation “reflecting” your working life.

“Mining towns like Newcastle have average balances of around $199,000 because mining pays well,” she said.

“Coastal towns like [South Australia’s] Victor Harbor also have higher balances, but for different reasons; they’re the retirement destinations full of people who’ve accumulated super over early careers.

“Meanwhile, younger towns like Darwin tend to have lower balances as workers haven’t had as much time to build up their savings.”

Proposed changes to superannuation in the works

Delahunty said that changes to superannuation are looking to offset gendered disparity in savings, with superannuation on paid parental leave on the way.

The changes include the removal of tax on unrealised capital gains, which Treasurer Jim Chalmers said “was a genuine sticking point” for critics, hoping its removal will mean “no excuses but to support” the changes.

Australians on lower incomes will also see a change to their super tax offset, which will increase from $500 to $810 as the government expands the eligibility criteria from a $37,000 cut-off to $45,000.

If you are worried about your superannuation balance, Delahunty said the best thing to do is engage with it early on.

Ensuring you have one account can reduce the fees you are required to pay, and contributing extra money each week can also make a difference.

“Don’t wait until you’re 50,” she said.

“For many people, even $20 a week in their twenties can mean tens of thousands extra retirement thanks to compound returns.”

This article is general information. Please see a professional if you need financial advice.