Australians are reporting the highest levels of financial stress in over a decade, according to a new report card on the nation’s welfare.

The Australian Institute of Health and Welfare’s (AIHW) latest Australia’s Welfare report, released on Thursday, found 21 per cent of people aged over 15 felt some level of financial stress in 2023 — the highest since 2012.

In April 2025, 35 per cent of adults found it “difficult or very difficult” to get by on their current income, an increase on both pre-pandemic and early-pandemic levels.

An expert has highlighted concerning data indicating that many individuals are facing significant financial hardships. However, another voice in the field suggests that the situation may not be as bleak as it appears at first glance.

The data reveals that individuals living in disadvantaged communities and those grappling with severe psychological stress are particularly susceptible to financial strain.

Those who reported financial stress most often included single parents (43 per cent), renters (37 per cent) and people who have had a serious personal injury or illness in the past year (31 per cent).

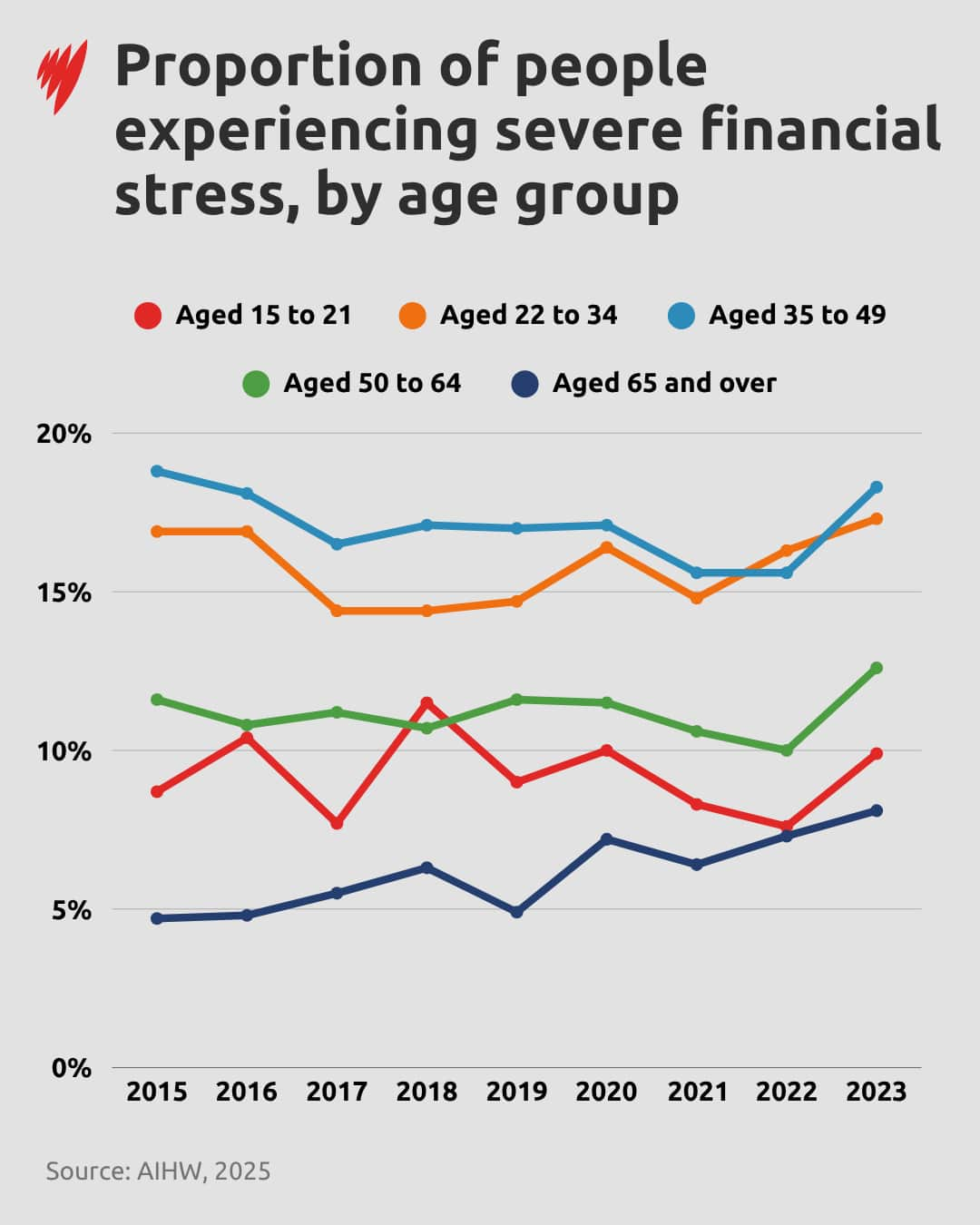

Among the various age groups, those aged 35 to 49 are identified as the most likely to experience financial distress, according to the findings.

Social researcher Grant Dusting from McCrindle has noted that this report aligns with other data he has encountered. He emphasizes the necessity of delving deeper into the statistics, as overarching figures can sometimes obscure the true challenges people are facing.

Grant Dusting, social researcher at McCrindle, said the report is in line with data he’s seen and highlights the importance of looking beyond the big picture, which can “mask” how tough people are finding things.

“It’s clear that a lot of people are doing it tough,” he told SBS News. “In particular, renters, single parents and 35 to 49 year olds in terms of the high risk of financial stress.

“People from the mid-twenties to under forties have made the biggest reductions in spending.”

Same groups, same pressures

But Ben Phillips, associate professor at the Australian National University’s Centre for Social Research and Methods, said this isn’t anything new — and he can’t see it changing anytime soon.

“As much as we talk about cost of living pressures, it’s the same groups that are really the ones in trouble — and they’re not that much different to the past,” he told SBS News.

He said those on welfare payments, including JobSeeker, disability support and the pension, “are the people who are facing serious stress”.

“Their rates of financial stress are miles above people with a mortgage or even your average renter. They’re probably four or five times higher, their rates of financial stress compared to your typical household,” Phillips said.

He said government plans to boost housing supply won’t have a significant impact.

“They’ve got a housing plan to build new houses and to boost social and affordable housing, but I think it’s pretty small fry,” he said. “I don’t think it’s going to make any major difference.”

Poverty and housing pressures

It comes as the University of New South Wales’ Poverty in Australia 2025 report found one in seven Australians — or 3.7 million people — are living below the poverty line, up from one in eight in 2020-21.

Yuvisthi Naidoo, senior research fellow at UNSW’s Social Policy Research Centre, said: “This is unacceptable in one of the wealthiest countries in the world.”

She said poverty rates decreased in 2020 when JobSeeker payments were temporarily doubled during the COVID-19 pandemic, but have since “sharply risen” following their removal and increasing house costs.

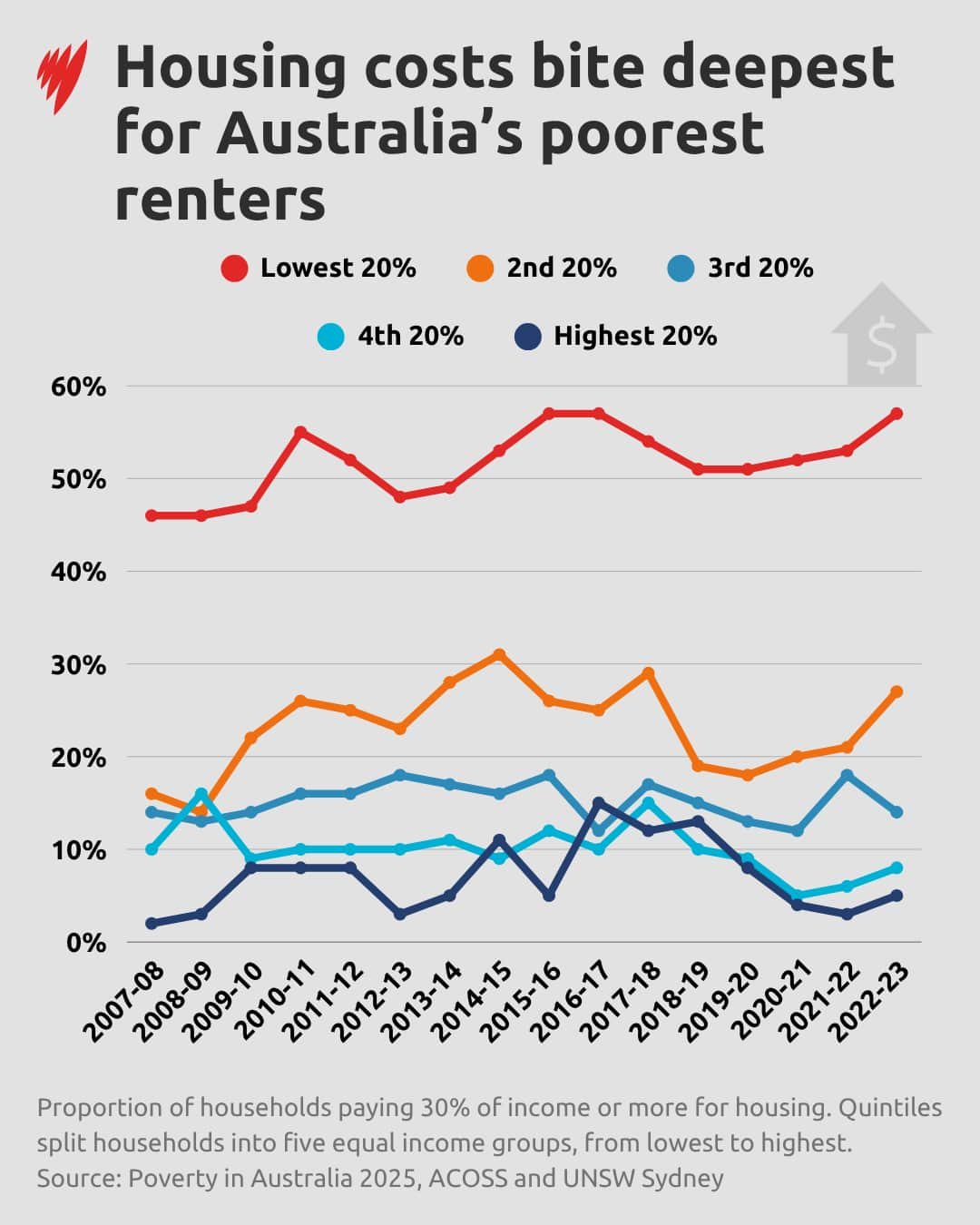

“The steep increase in rents in recent years has had a particularly severe impact on people with the lowest incomes,” she said.

The share of low-income renters spending more than 30 per cent of their income on rent — known as rental stress — climbed from 52 to 57 per cent from June 2021 to June 2023. Source: SBS News

From June 2021 to June 2023, the median advertised rent for units rose 40 per cent in Sydney, 34 per cent in Melbourne and 41 per cent in Brisbane.

The share of low-income renters spending more than 30 per cent of income on rent — known as rental stress — climbed from 52 to 57 per cent over the same period.

An Anglicare Australia report found just 1.7 per cent of rental properties were affordable for an aged care worker, 1.5 per cent for a nurse, and 1.1 per cent for a construction worker.

Is the gap growing?

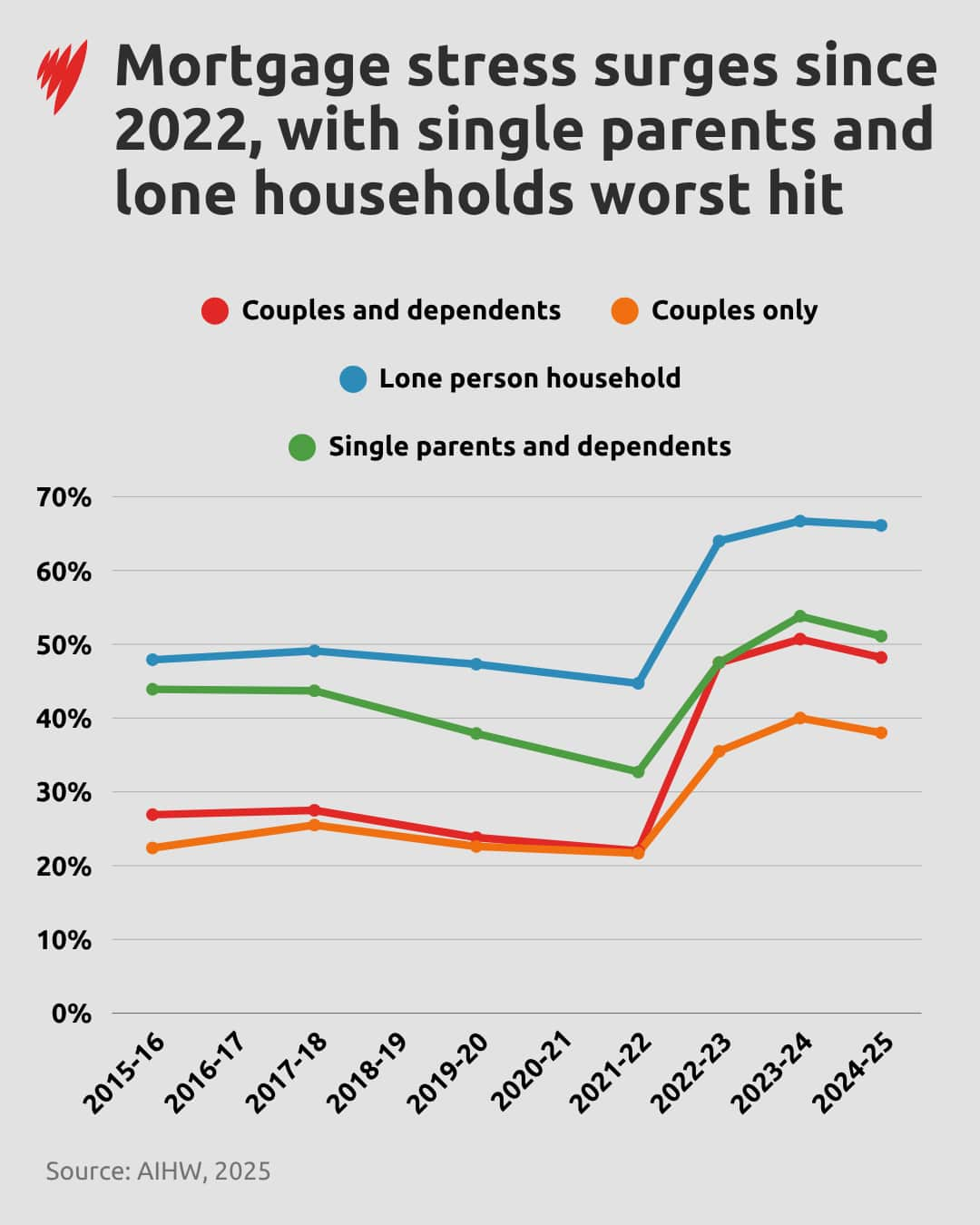

The AIHW report found one in five rental households were low-income households in housing stress, while one in seven low-income households with a mortgage were also struggling.

Dusting agrees housing is a “huge factor” alongside the rising cost of living, a tough job market for entry-level workers and unequal wealth creation.

“In the last few years, a lot of wealth creation has happened through the stock market,” he said.

“Anyone who has exposure to investments and shares and stocks, they’ve been pretty good over the last few years — and that tends to be people who are more established and older.”

One in seven low-income households with a mortgage is struggling, with one expert saying high interest rates are hurting them the hardest. Source: SBS News

Phillips said while it’s “absolutely true” that younger Australians are finding it harder to buy homes, on the rental front, things aren’t much worse than before COVID-19.

Research by Phillips this year found advertised rents had increased in recent years, particularly for advertised rents. But, it said, affordability had only moderately worsened because it had been offset, in part, by income growth.

However, many low-income families continue to face “substantial financial pressures”, he wrote.

Phillips said higher interest rates have hit mortgage holders hardest, but because they’re often higher-income earners, that doesn’t translate to “substantially” higher financial stress.

Real wages have recovered, with growth in nominal wages and moderating inflation, according to the report. Real household income has also grown after two years of declines. Source: SBS News

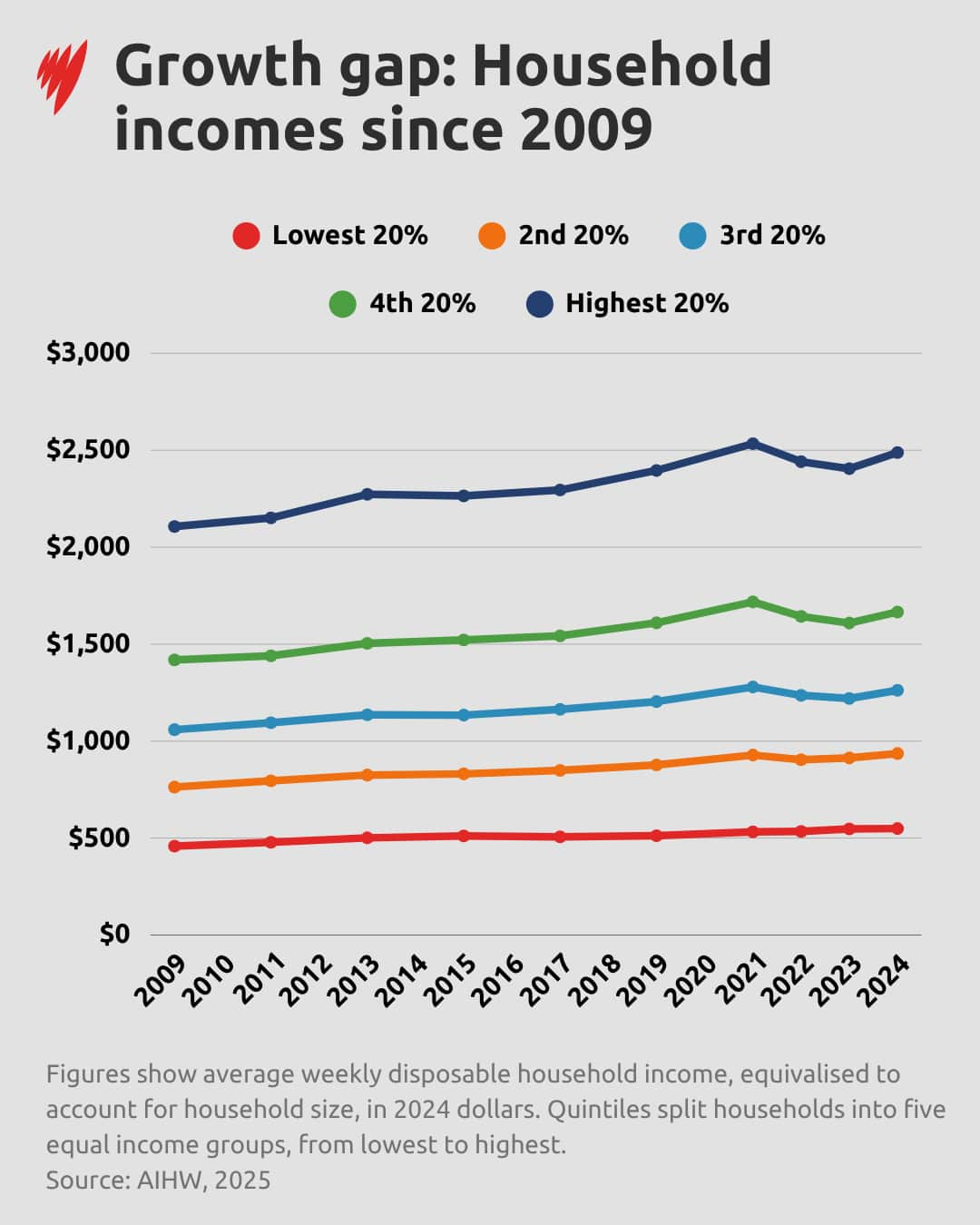

Real wages have recovered, with growth in nominal wages and moderating inflation, the report found. Real household income has also grown after two years of declines.

But that growth wasn’t experienced equally, with higher-income households having the fastest real income growth (3.5 per cent) and lower-income households seeing the slowest (0.3 per cent).

But Phillips believes the gap between the rich and poor isn’t widening.

“I don’t think income inequality has changed that much … that means that the top are doing about the same as those at the bottom in terms of how they’re improving,” he said.

‘Not disastrous’, but ‘not uniform’

Phillips said while the report might look worrying at first glance, Australia’s overall financial picture remains relatively stable.

“We’re probably in a similar position to what we were pre-COVID in terms of financial living standards and financial stress … it’s probably not as good as what people might want. But I also don’t think it’s disastrous either,” he said.

“In the last couple of years, income has come back a little bit and now it’s starting to come forward.

“Inflation is not as strong and wage growth and employment is still pretty reasonably strong, so things are returning back to normal.

“It’s not unusual to see those sort of numbers of people in some form of financial stress. It doesn’t mean that they’re in dire straits, but it does mean they’re having some troubles keeping their head above water.”

Dusting said the data is a reminder that “society is not uniform” and that top-line numbers can conceal struggle.

“The data shows that for a really sizable number of Australians, these are really difficult times economically,” he said. “But I think some of that impact is hidden when you just look at the top line … it does seem to be covered up a bit.”

He said policymakers need to be “very conscious” to ensure the gap between the rich and poor doesn’t widen further.

“It’s not inevitable, but we need people in decision-making roles to really look at the data and to listen to their communities.”