The prospect of interest rate cuts next year has been dismissed by Australia’s ‘big four’ banks, casting a shadow over hopes for financial relief among borrowers. Westpac, the last of the major banks to hold out on predictions, has now joined ANZ in forecasting that rates will remain steady, rather than decreasing, as previously anticipated.

In a recent analysis, Westpac’s prediction of a rate cut in 2026 was retracted, aligning with the cautious outlook shared by its competitors. This shift signals a warning to Australian borrowers, particularly those with variable-rate mortgages, that their financial burdens may increase rather than ease in the coming years.

Sally Tindall, a financial expert, noted that the message from the banks serves as a heads-up for mortgage holders. They should brace themselves for the possibility of rising interest rates and subsequently higher monthly repayments. This development contrasts with the initial optimism that had been building among homeowners who had experienced three rate cuts and were hopeful for more.

Bullock’s announcement came as many banks and economists expected further rate cuts before the surprise inflation number, which was released in late November.

Australian Bureau of Statistics data showed inflation across the 12 months to October jumped 3.8 per cent, up from 3.6 per cent in September.

Mortgage holders may have been negatively affected by the element of surprise.

Shane Oliver, AMP’s chief economist, shared insights with SBS News, highlighting the impact of potential rate hikes. He emphasized that as interest rates climb, individuals will likely feel the pinch in their cost of living, reversing the temporary relief of recent cuts.

But now mortgage holders will be feeling pessimistic, he said.

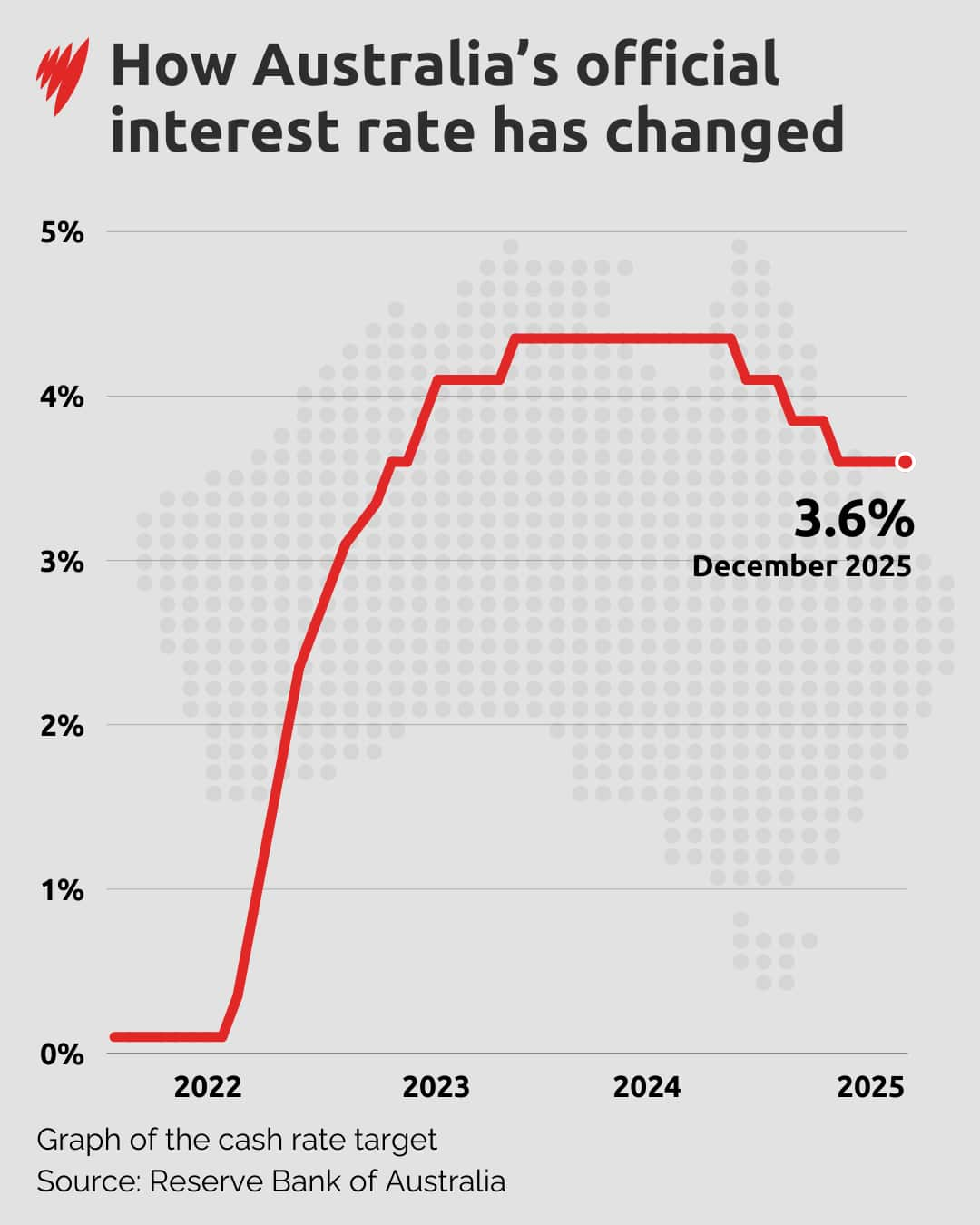

Since 2022, interest rates have increased 13 times, while there have only been three rate cuts, leading to larger mortgages for homeowners.

“Mortgage these days is, in many cases, the biggest component in a household budget,” Oliver said.

“If the interest rates start going back up again, then they can have a big dampening impact on spending and lead to renewed talk about a cost of living crisis.

“As interest rates go up, you would feel your cost of living rising again.”

Paying more in the supermarkets

But mortgage holders will not be the only group that might be impacted with experts warn a potential rise in interest rates could affect consumer goods.

Andrew Grant, an associate professor of finance at the University of Sydney Business School, suggests higher inflation may lead to a cycle of rising interest rates, forcing businesses to pass those costs on to consumers.

“The real question is around the degree to which this happens,” he told SBS News.

“For people who are just not worried about the cost of housing, whether they own their house already or they’re not intending to participate in the rental market, it will just mean that probably the inflation is gonna flow through to the cost of everyday items,” Grant said.

“Rents go up for business owners, and they’ll have to charge more for customers, as they need to overcome the cost of living themselves.”

He said this pattern might impact “a large proportion of the population that are living pay cheque to pay cheque”.

“Increasing interest rates or increasing inflation might mean that they’re paying a little bit more at the supermarket each week, they’re paying a little bit more for their electricity and energy bills, and other utilities,” Grant said.

Cost pressures push more Australians into hardship

Finder’s Cost of Living Pressure Gauge — which tracks the financial burden on Australian households monthly — shows a significant jump in financial stress from 57 per cent in October 2019 to 77 per cent in October 2025.

A June report from Anglicare Australia also paints a stark picture of how little is left after basic expenses for some workers. A full-time minimum wage worker has just $33 remaining after paying for rent, food and transport, according to the report. A single parent on the minimum wage is left with just $1, even with government assistance, while a household with two full-time workers and two children has only $5 left each week.

Kasy Chambers, executive director of Anglicare Australia, said any increase in the cost of living will “affect people on the lowest incomes”.

“We are basically seeing poverty climbing the income ladder … And that’s the difficulty that we’re seeing, and that’s what we’ll see more of,” she told SBS News.

“I think we’ll be seeing this get worse for more families before we see it get better, because the only thing we can really rely on to make a big difference is housing costs, and they don’t seem to be going anywhere quickly.”