Share and Follow

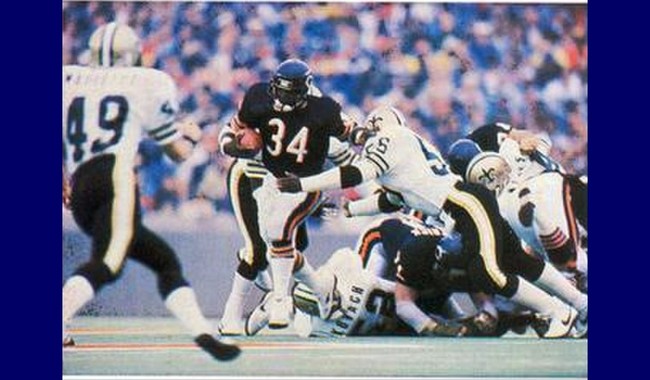

Growing up in Chicago, my childhood was filled with memories of attending football games at Soldier Field with my late father. I vividly recall experiencing my first game there as a young boy. Years later, my father and I shared the excitement of attending the 1985 Super Bowl in New Orleans, witnessing the Chicago Bears’ dominant victory over the New England Patriots. Recently, in January, my son and I watched the Bears stage an incredible comeback against their long-time rivals, the Green Bay Packers. Although they fell short in the same playoffs against the LA Rams, with Caleb Williams’ memorable long touchdown pass not quite sealing the win, the experience was unforgettable.

Throughout these years, and for over a century, the Chicago Bears have been deeply intertwined with the identity of the city. However, this longstanding association may soon face a significant change.

The prospect of this change feels almost counterintuitive to the natural order of things.

While the notion might sound like satire, the reality of it is unsettling.

MORE: Good Things Happen in Chicago, Too: Bears Send Green Bay Packing With Comeback for the Ages

The Chicago Bears released a statement on Feb. 19 further supporting their possible move to northwest Indiana.

“The passage of SB 27 would mark the most meaningful step forward in our stadium planning efforts to date,” the Bears wrote in a statement, speaking about Indiana legislation. “We are committed to finishing the remaining site-specific necessary due diligence to support our vision to build a world-class stadium near the Wolf Lake area in Hammond, Indiana.”

It just seems to flout the nature of the universe:

@ChicagoBears unveiled their new logo as the team inches closer to moving to Indiana.#chicagobears #indianabears#nfl pic.twitter.com/OqIpyl2YTr

— B-THURSTEE!!!😈🇨🇦 (@BThurstee) February 20, 2026

That is clearly parody, but the thought still stings.

MORE: Good Things Happen in Chicago, Too: Bears Send Green Bay Packing With Comeback for the Ages

Memories: How Dad and I Ended Up at the ’86 Super Bowl Watching the Greatest Defense of All Time (VIP)

The news came as a surprise to Illinois Gov. JB Pritzker, who had been negotiating with the team and thought they were making progress toward a deal. Here’s a Pritzker spokesman, Matt Hill:

Illinois was ready to move this bill forward.

After a productive three hour meeting yesterday, the Bears leaders requested the ILGA pause the hearing to make further tweaks to the bill.

This morning, we were surprised to see a statement lauding Indiana and ignoring Illinois. https://t.co/T9BEhDTtFq

— Matt Hill (@thematthill) February 19, 2026

The argument is one we’ve seen in many cities: namely, when building a stadium, who pays for what, what tax breaks are doled out, and what concessions will be made by each side to get it done. It’s not necessarily a left-right issue; some people from all political bents believe that taxpayers shouldn’t be helping rich sports leagues, others argue that the economic stimulus a stadium provides to the area more than pays for itself.

In this case, the Bears want more concessions, but the Illinois government under JB Pritzker wants to save Illinois’ taxpayer dollars to pay for illegal alien healthcare and woke social programs.

Although it’s complicated, one thing is crystal clear: The Bears would not be Da Bears in freakin’ Indiana (no offense, Indiana folks), and Chicago would be left without one of its crown jewels. That would be the team’s — and the city’s —worst-ever defeat.

Imagine being the governor who lost the Bears, a century-old cornerstone of Chicago.

This is the ultimate indictment of JB’s policies: a state made so expensive and so mismanaged it can’t even keep its most iconic institution. pic.twitter.com/5W6sUL6Hya

— Darren Bailey (@DarrenBaileyIL) February 19, 2026

Editor’s Note: RedState isn’t just your go-to source for politics and news – we cover culture, sports, and nature too.