The Reserve Bank’s interest rate cut will be felt as good news for millions of mortgage holders across the country.

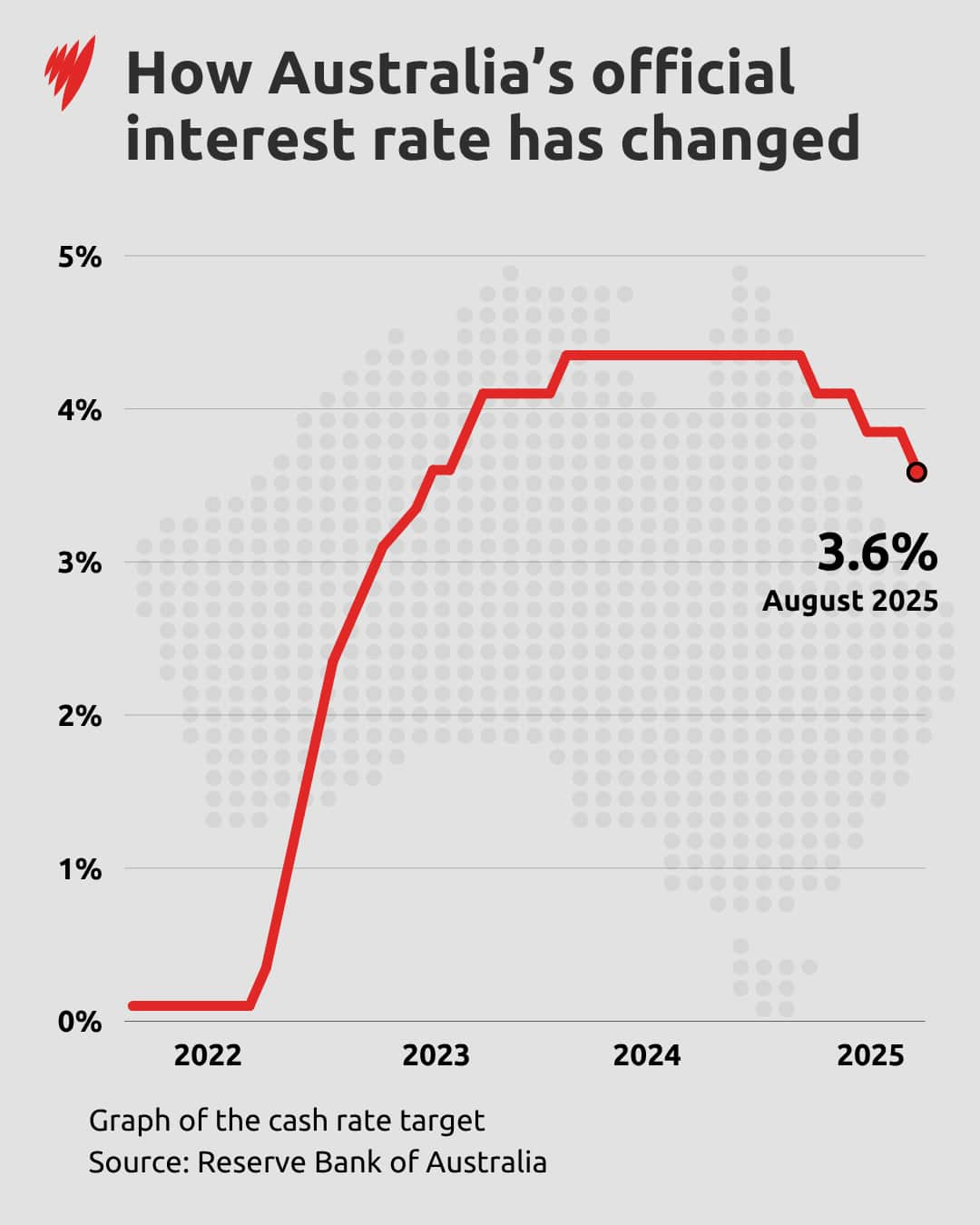

The RBA announced a reduction in the cash rate by 0.25 percentage points from 3.85 per cent to 3.6 per cent. It marks the third rate cut this year, following similar reductions in February and May.

RBA governor Michele Bullock acknowledged the cut comes as “households are still feeling the pain of higher costs”.

“The board will keep doing what it needs to do to keep inflation down and maintain a healthy jobs market because when inflation is low and stable and people can get jobs; it’s good for households, it’s good for the community, and it’s good for the broader Australian economy.”

So how much will mortgage holders save?

Household savings on the way

According to financial comparison website Canstar, mortgage holders with a $500,000 loan can expect to save around $74 per month. This estimate is based on an owner-occupier paying principal and interest with 25 years remaining on the mortgage.

Those with higher mortgages, up to $1 million, can expect to save around $148 per month.

Including the two previous rate cuts in February and May, the accumulated savings are even higher. Those with a $500,000 loan could potentially save $226 per month, while those with a $1 million loan could save up to $453 per month.

Will the banks pass the savings on?

A number of banks have promised to pass the rate cut in full to customers.

For Westpac customers, a -0.25 per cent rate adjustment will be passed on for variable interest rate home loans from 26 August.

The Commonwealth Bank says its cuts will come into effect on 22 August. Macquarie Bank announced its variable rates will be reduced as of 15 August.

ANZ and NAB have followed suit. Around 20 lenders also cut their variable rate ahead of the RBA’s announcement.

A number of major banks have promised to pass on the rate cut in full to customers. Source: AAP / Rick Rycroft

Diana Mousina, deputy chief economist at AMP, urges caution as not all mortgage holders will be eligible for an automatic reduction.

“There’s not this automatic reduction to mortgage rates just because of what the RBA does. It may take a few months for it to actually get passed through to mortgage repayments.”

Paying more now to save later

Canstar data insights director Sally Tindall suggests that some mortgage holders may benefit from keeping their repayments the same.

“For those managing to hold their budgets together, consider keeping your repayments exactly the same,” Tindall said.

“Every rate cut is another opportunity to invest back into your mortgage and potentially be debt-free months, if not years early.”

If a mortgage holder who was sitting on a $600,000 loan in February kept their repayments steady, they would be paying $272 more per month in repayments than if they had lowered them to the minimum rate.

But it would also mean shaving off three years and three months from the length of their mortgage.

Ultimately, Tindall urges mortgage holders to weigh up what is best for them.

A good time to talk to the bank

“Ultimately, any sort of rate cut can still be seen as relief, but given that rates were hiked so much it’s just taking some of that increased pressure away. Mortgage holders are still paying more than they were a few years ago.”

Mousina says that it’s important to figure out if your current mortgage is appropriate for you.

“You want to make sure your variable rate is the lowest you can have.”

Tindall says that after this rate cut, ambitious owner-occupiers should be able to set themselves a stretch target of 5.25 per cent.

“Your mortgage rate is one number where you want to be aiming for well below average.”