Share and Follow

Futures for the S&P 500 fell 0.9 per cent before the opening bell, while futures for the Dow Jones Industrial Average were down one per cent. Nasdaq futures slid 1.1 per cent.

Brent crude, the international standard, climbed $4.58 ($7.07) to $73.94 ($114.08) per barrel, also the largest single-day jump since the Russian invasion.

Oil prices are likely to rise in the short term but the key question is whether exports are affected, said Richard Joswick, head of near-term oil at S&P Global Commodity Insights.

“When Iran and Israel exchanged attacks previously, prices spiked initially but fell once it became clear that the situation was not escalating and there was no impact on oil supply,” he wrote in an emailed analysis.

“Oil price risk premiums could rise sharply if Iran conducts broader retaliatory attacks, especially if on targets other than in Israel,” Joswick said.

China is the only customer for Iranian oil but could seek alternative supplies from Middle Eastern exporters and Russia, he said.

Iran’s oil trade is restricted by Western sanctions and import bans, and Israel exports only small amounts of oil and oil products.

The cause of the crash is unknown.

GE Aerospace, which makes engines for Boeing, is down close to two per cent after it announced it was postponing next week’s investor day in light of the tragic crash.

In Europe at midday, Germany’s DAX dropped 1.3 per cent and the CAC 40 in Paris gave up 0.9 per cent. Britain’s FTSE 100 slipped 0.2 per cent.

The yield on the 10-year Treasury fell to 4.35 per cent from 4.41 per cent late on Wednesday and from roughly 4.80 per cent early this year.

In currency trading early on Friday, the US dollar rose to 144.12 yen, while the euro eased to $1.1511 ($1.78). The yield on US 10-year Treasurys fell to 4.35 per cent. Bond yields and prices move in opposite directions.

Treasurys and the dollar often rise when investors feel less inclined to take risks.

Coming later on Friday is the University of Michigan’s consumer sentiment report.

Next week brings the Federal Reserve’s two-day policy meeting where it will make a decision on its benchmark interest rate. The nearly unanimous expectation on Wall Street is that the US central bank will stand pat again.

The Fed has been hesitant to lower interest rates, and it’s been on hold this year after cutting at the end of last year, because it’s waiting to see how much US President Donald Trump’s tariffs will hurt the economy and raise inflation.

In Asia, Tokyo’s Nikkei 225 fell 0.9 per cent to 37,834.25 while the Kospi in Seoul edged 0.9 per cent lower to 2,894.62.

Hong Kong’s Hang Seng retreated 0.6 per cent to 23,892.56 and the Shanghai Composite Index lost 0.8 per cent to 3,377.00.

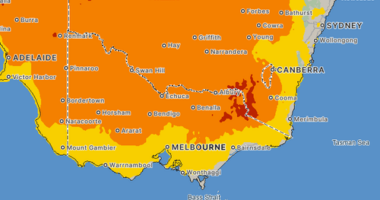

Australia’s S&P/ASX 200 drifted 0.2 per cent lower to 8,547.40.

“An Israeli attack on Iran poses a top ten of our global risk, but Asian markets are expected to recover quickly as they have relatively limited exposure to the conflict and growing ties to unaffected Saudi Arabia and the UAE,” said Xu Tiachen of The Economist Intelligence.