With the Reserve Bank of Australia (RBA) set to announce the new cash rate target on Tuesday, many economists and the big four banks are anticipating a rate cut of 0.25 percentage points.

It could be welcome news for mortgage holders, who were left in limbo after the RBA kept rates on hold at 3.85 per cent at its last meeting.

So why are economists saying a reduction to 3.6 per cent is a done deal, and how much could you save?

‘No reason to wait’

David Bassanese, chief economist at fund management firm Betashares, told SBS News he is predicting a rate cut at the RBA’s meeting.

He said he would be “staggered” if the RBA does not cut the rate, “given signs of a softening labour market and a good Q1 CPI [quarter one consumer price index] report”.

“I expected them to hold off on the cutting rate in July, but I see no reason to wait now,” Bassanese said.

After previous rate cuts, the big four banks have passed on reduced rates for mortgage holders with variable loans.

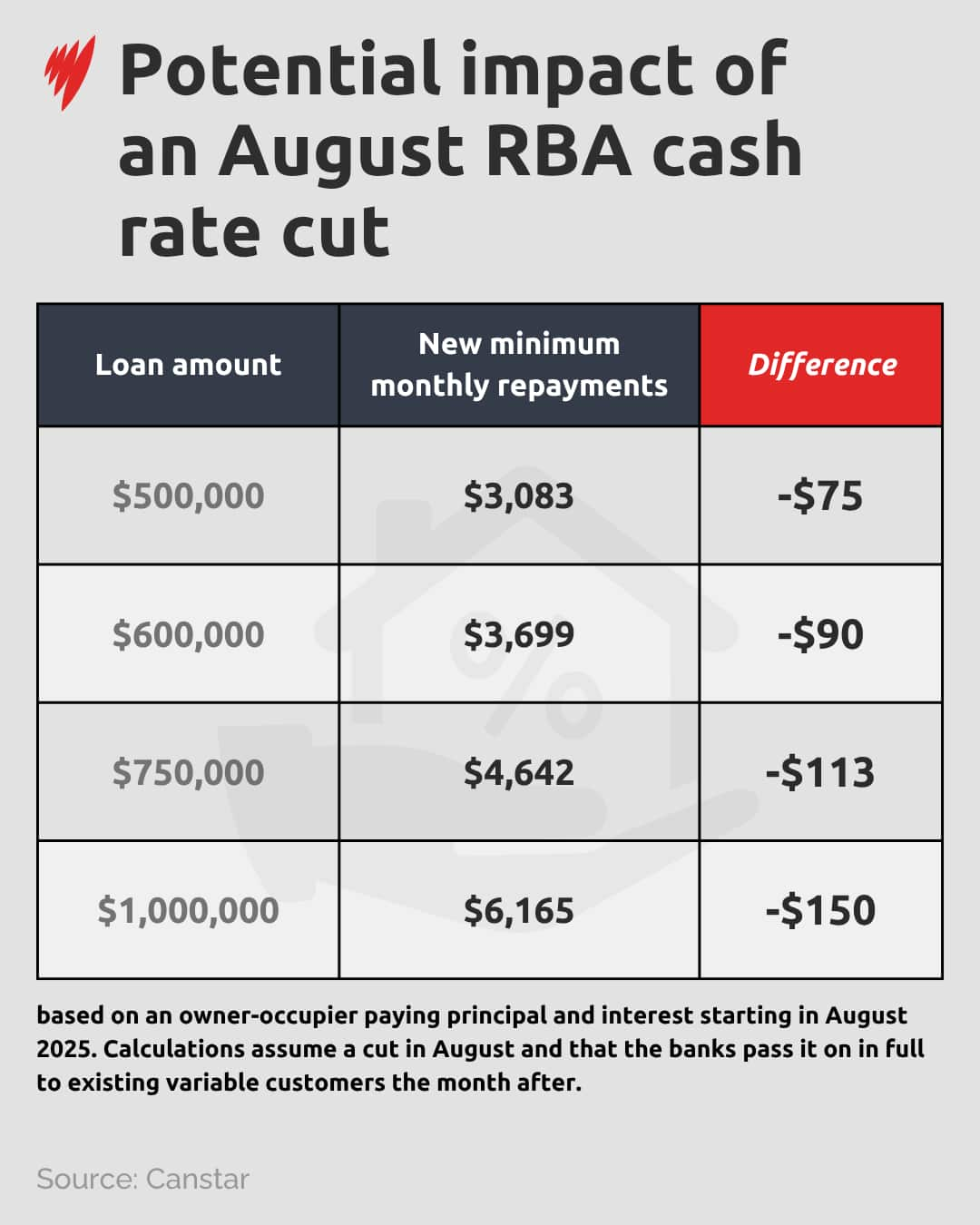

Financial comparison site Canstar predicted an owner-occupier on a $500,000 loan could save around $75 per month following a 0.25 percentage point cut.

The larger the loan, the greater the savings.

An owner-occupier on a $500,000 loan could save around $75 per month following a 0.25 per cent rate cut, according to Canstar. Source: SBS News

Devika Shivadekar, an economist at financial services firm RSM Australia, told SBS News an official rate cut this week should create optimism, with further relief expected in the coming months.

“Last month’s quarterly Consumer Price Index print likely provided the RBA with some comfort leading into this week’s meeting, and we expect to see the cash rate cut by 0.25 per cent to 3.6 per cent,” she said.

The ‘big four’ banks are all predicting a rate cut on Tuesday, with Westpac predicting a total of four cuts this financial cycle, in August and November, and again in February and May, taking the cash rate to 2.85 per cent.

The ‘big four’ banks are all predicting a rate cut on Tuesday. Source: SBS News

Commonwealth Bank and ANZ are estimating a 0.25 percentage point cut in August and another in November, taking the cash rate to 3.35 per cent, while NAB is forecasting 0.25 percentage point cuts in August and November, and another in February, taking the cash rate to 3.10 per cent.

What does it mean for businesses?

Shivadekar said cash rate decisions can have a profound impact on businesses, with large investments and other buying decisions linked closely to RBA movements.

“Uncertainty over US tariffs has left Australian companies, particularly small and medium-sized enterprises, battered and bruised in recent months.

“Data on business performance is mixed, with larger players faring better in this environment than their smaller peers. Overall, though, the global volatility we’ve seen in the second quarter has weighed on investment decisions.”