Share and Follow

Key Points

- A Canstar survey reveals fewer Australians have a non-property related personal debt.

- At the same time, those saddled with debt owe more than in previous years.

- Experts say short-term loans carry risks.

The percentage of Australians holding personal debt, excluding home loans, has decreased slightly, dropping from 35 percent to 33 percent.

“It’s encouraging to see a reduction in the number of people in debt. However, for those who are still in the red, the total debt amount is unfortunately increasing,” she remarked in the survey. “If you find yourself in this situation, aim to tackle your debt head-on in 2026.”

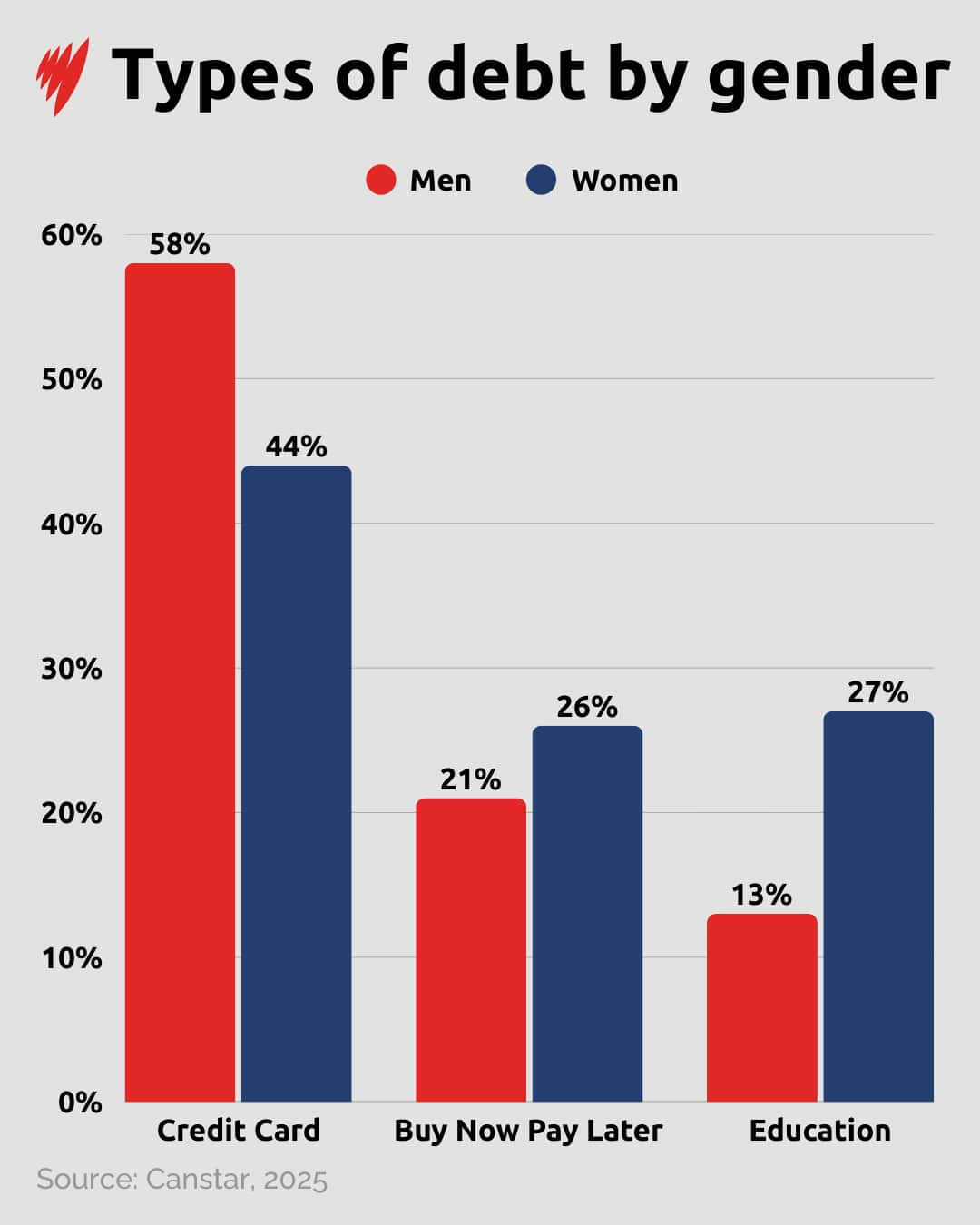

On another note, women tend to bear a greater burden when it comes to higher education loans and expenses related to Buy Now, Pay Later (BNPL) services.

Source: SBS News

Source: SBS News

Mardy Chiah, an associate professor of finance at the University of Newcastle, said taking on a short-term debt is “rarely beneficial”.

“Interest rates on personal loans and credit cards are typically high if not paid within the interest-free period, making them costly and difficult to justify for discretionary spending,” he told SBS News.

“Everyone should strive to reduce bad debts,” he said.

Dangers of buy now, pay later

“Annualised, this would represent a very high cost of 60 per cent interest rate per annum.”

Source: SBS News

Chiah warned BNPL providers can encourage overspending and impact credit scores and borrowing capacity for delayed or missed repayments.

The costs of these debts add more pressure on Australians trying to pay off their property.

“Housing remains the nation’s top financial concern. Whether it’s mortgage repayments or rents, the meteoric rise to what is, for most people, their biggest financial expense has been difficult to shoulder,” Tindall said.

Some are managing to save

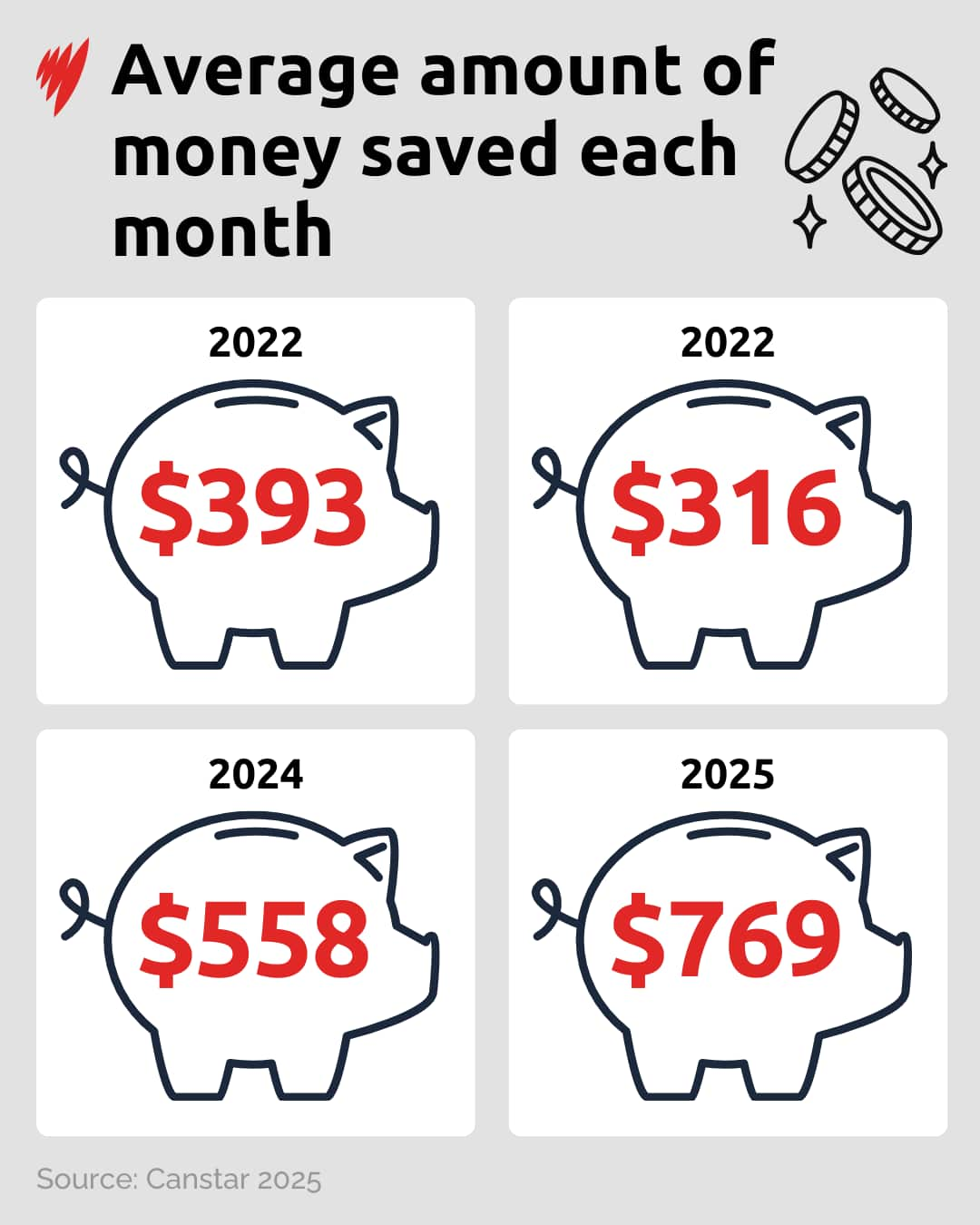

The number of people saving each month in 2025 jumped to 68 per cent, up from 62 per cent in 2024 and 51 per cent the year before.

Source: SBS News

The average put away each month has risen to $769, up from $558 in 2024.