Share and Follow

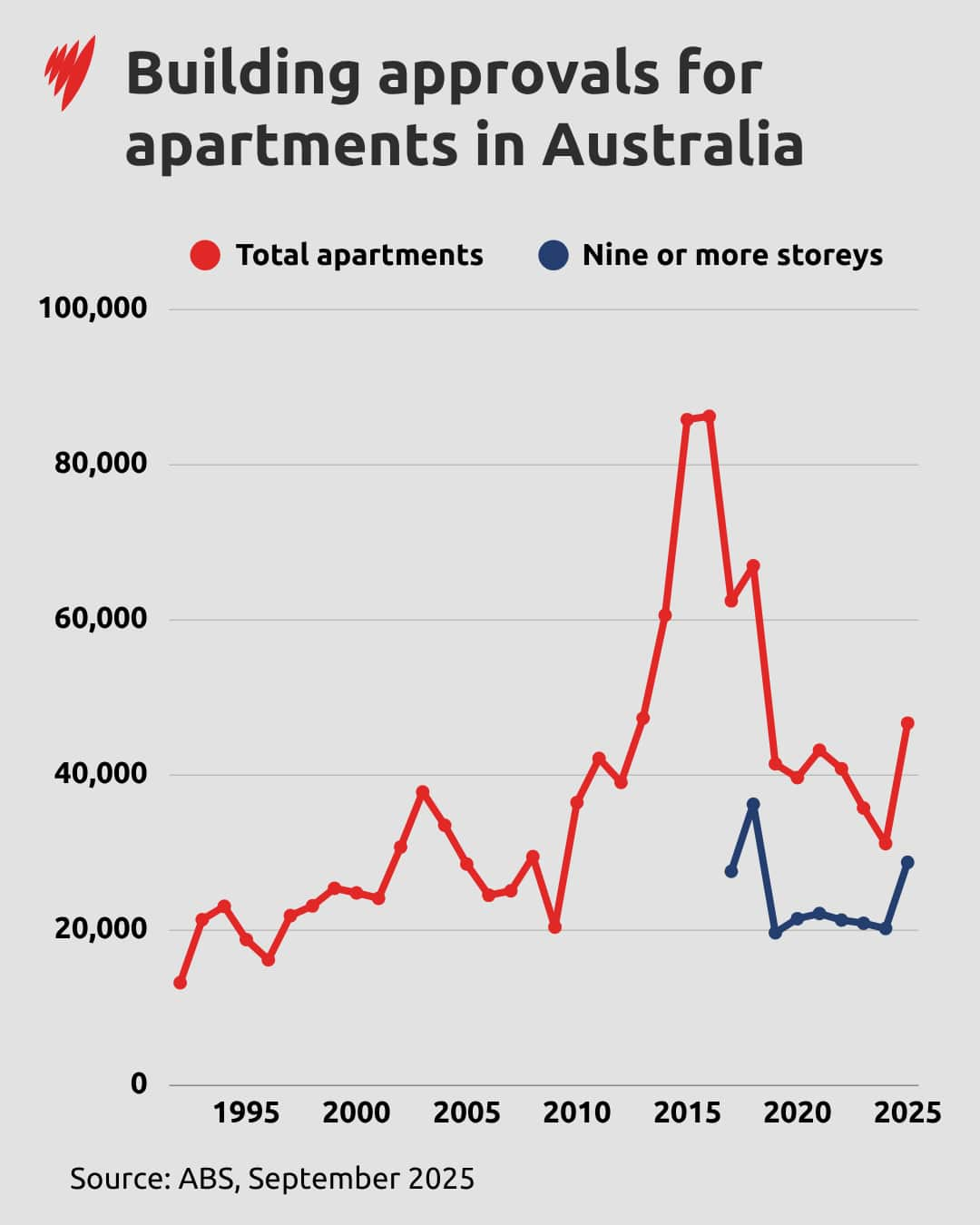

Recent data reveals a significant uptick in apartment approvals, reaching levels not seen in nearly three years. According to the Australian Bureau of Statistics, September witnessed the approval of 5,430 apartment units, marking the highest count since December 2022.

The increase in approvals includes developments for buildings rising more than nine storeys, signaling a trend towards higher-density living. This shift is captured in the latest statistics, highlighting a burgeoning interest in constructing towering apartment blocks.

However, as local governments continue with plans to rezone areas for these towering complexes, there is growing debate over their impact on housing affordability. The question remains: can a surge in apartment construction effectively drive down housing costs?

Rezoning impacts housing affordability

Since its rezoning in 1999, 179 apartment buildings have been constructed in the Green Square urban renewal area, ranging in size from three to 29 storeys.

The Green Square urban renewal area in Sydney, in which the suburbs of Alexandria, Beaconsfield, Waterloo, Zetland and Rosebery were rezoned from industrial to mixed-use and 179 apartment blocks built, is one of the biggest urban renewal projects in Australia. Source: SBS News

One of the objectives of the renewal was to retain a socially diverse population, but the report observed that in the first five to 10 years, the proportion of people with well-paid jobs and higher incomes had increased in Green Square and surrounding suburbs, including Alexandria, Beaconsfield, Waterloo, Zetland and Rosebery.

To address this, the council developed a policy to ensure around 330 units would remain under the ownership of a community housing provider for low to moderate-income households. Developers are now required to set aside 3 per cent of residential development as affordable housing or to provide a monetary contribution towards this.

“Social housing is the sole responsibility of the state and federal governments and is not an area the City of Sydney has remit over,” the spokesperson says.

Apartments are not always affordable

Her apartment is across the road from Green Square town centre and this has allowed her to stay close to the city. But she says the unit is not particularly affordable.

For the people that really need housing, I don’t think they’d find it here.

Waterloo homeowner Deborah Nixon lives close to Zetland and finds it very convenient, although she would like to see more green space. Source: SBS News

RMIT University urban planning lecturer Liam Davies says simply allowing more apartments to be built won’t make properties affordable.

“If we take affordable housing as housing which is affordable to people on low or very low incomes, it won’t make a lick of difference because all it does is stop it getting more unaffordable,” Davies says.

People that are priced out, won’t be priced in.

“They’re just less expensive than areas like Potts Point [in Sydney].”

Many apartment blocks have been built in Docklands, Melbourne. Source: AAP / James Ross

However, while extra supply doesn’t automatically make housing affordable, it can keep a lid on price increases.

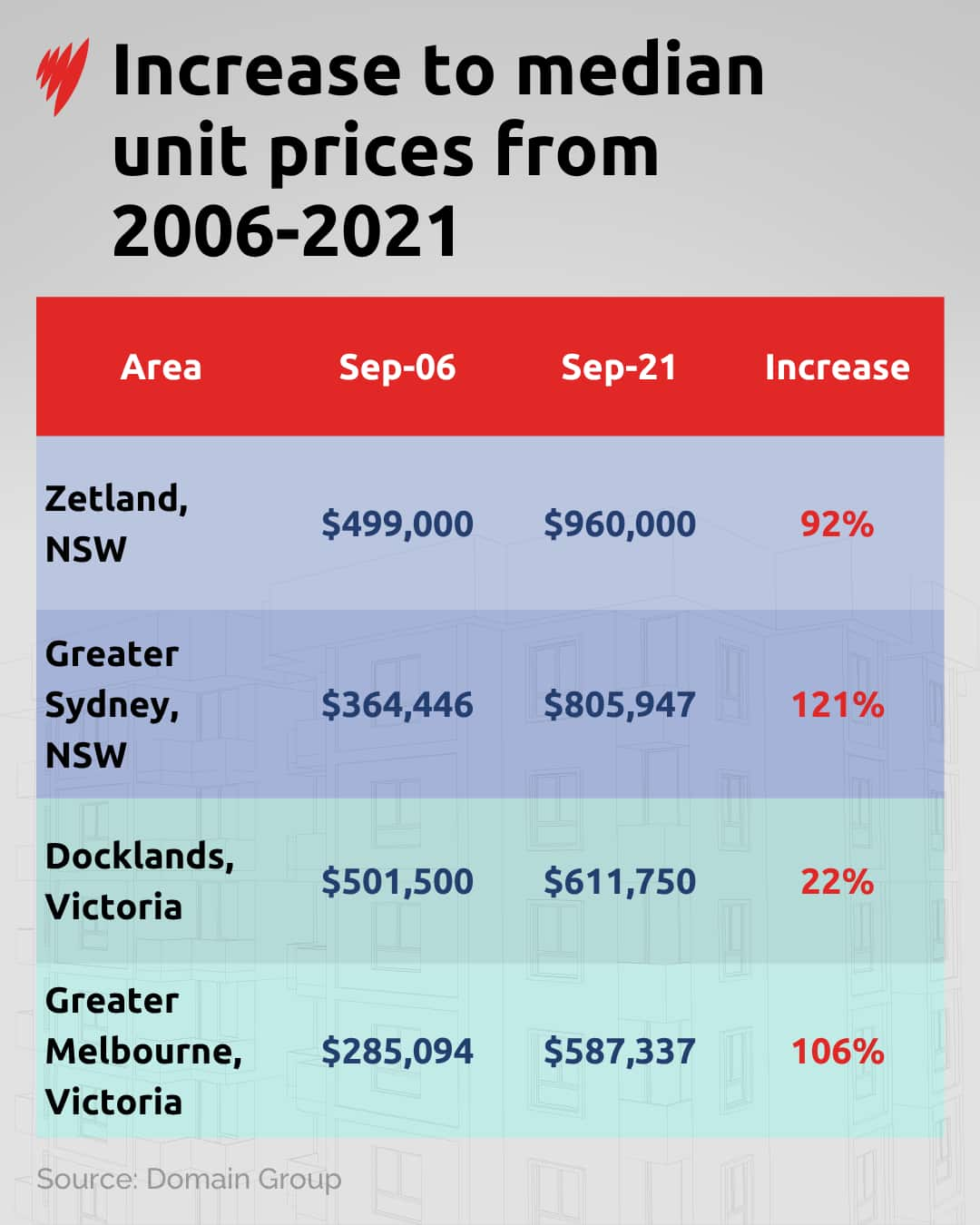

Unit prices in Zetland during the same time period have also grown by 92 per cent, rising from a median price of $499,000 in September 2006 to $960,000 in September 2021, according to Domain.

Median unit prices grew more slowly in areas with large amounts of apartments such as Zetland, when compared to the broader Sydney area. The same happened in Docklands compared to greater Melbourne. Source: SBS News

This is lower than the 121 per cent increase across Greater Sydney, despite Zetland being located just a few kilometres from the central business district.

But the median unit price in Zetland is still higher than Sydney’s overall ($805,947).

Supply doesn’t equal affordability, but it can help

Banks will also reduce lending in urban areas with price declines because they don’t want to be left with bad mortgages.

He points out that in gentrifying areas, run-down terrace houses that may previously have been a sharehouse for three or four people have been renovated and turned into family homes.

In gentrifying areas, terrace houses that used to be home to many young renters have been renovated, making them unaffordable. Source: AAP / Bianca De Marchi

“That’s part of the reason why cities have become less affordable, we sort of lost that cheap and cheerful sharehouse market,” he says.

If the market had provided more apartments and townhouses, this would have prevented some people from being squeezed out at the bottom end of the market, Rawnsley notes.

Apartments don’t necessarily help families

This has implications for families who want dwellings with at least three bedrooms, as developers often don’t build large multi-bedroom apartments suitable for families.

You’re increasing the supply of two-bedroom dwellings [through the construction of apartments] and maintaining those prices reasonably stably or at least halting the increases — but you’re reducing the supply of three-bedroom dwellings.

Davies says knocking down houses to build two-bedroom units means you’ll probably see fewer families living in a certain area, and more renters.

What this means is you can have a more rotational population — people aren’t going to be living there for the long haul.

He says building more mid-rise, almost Parisian-style apartments of around five storeys may be more desirable than high rises.

Buildings on the Rue de Rivoli, which runs through the centre of Paris. Source: Getty / Delmarty J/Alpaca/Andia/Universal Images Group

Grattan Institute modelling released on Thursday found one million homes could be unlocked in Sydney if developments of up to three storeys could be done without a planning permit (as long as they met clear standards).

It says allowing three-storey townhouses and apartments on all residential land in capital cities could lift housing construction across Australia by up to 67,000 homes a year. Over a decade this could cut rents by 12 per cent and reduce the cost of a median-priced home by $100,000.

Supply needed at every level, experts say

“We’ve got more than 25,000 social and affordable homes in planning or construction with over 5,000 social and affordable homes completed,” she tells SBS.

Federal Minister for Housing Clare O’Neil says more than 5,000 social and affordable homes have been built in the past two years. Source: AAP / Joel Carrett

However, there are concerns about the slow delivery of homes, with an audit underway into the operation of the Federal Government’s Housing Australia Future Fund (HAFF), an investment vehicle established two years ago to support the construction of social and affordable housing.

“It’s faster, cheaper, and it worked the last time Australia faced a housing crisis in the post-war years. We know we can do it. We’ve done it before.”

“It just falls apart because some councils are willing to say ‘don’t worry about it’ and then nothing happens,” he says.

We should have it consistent across the country.

Income caps for certain schemes can also squeeze out families earning slightly more than the threshold.

“The scale of the problem is so big you need to be doing all these different actions.”