Share and Follow

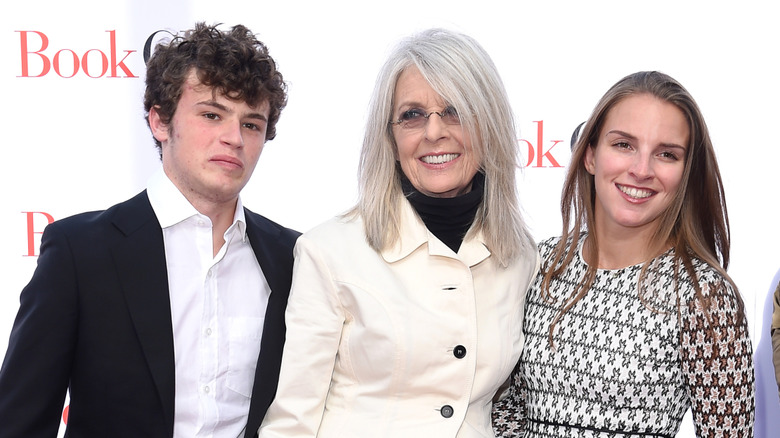

Hollywood is mourning the loss of beloved actress Diane Keaton, who passed away in October 2025 at 79. Renowned for her roles in classics like “The Godfather” trilogy, “Annie Hall,” and “The First Wives Club,” Keaton died at her California residence due to complications from pneumonia, her family announced. Keaton, who opted for adoption over marriage, leaves behind her two children, Dexter and Duke. As the entertainment world grieves, attention has turned to the future of her substantial estate. While her children seem the obvious heirs, legal expert Tre Lovell suggests the situation may be more complex.

Whether Diane Keaton’s children will inherit her fortune largely depends on their inclusion in her estate plan. Tre Lovell noted that without a will or trust, Dexter and Duke would inherit her assets under California law, provided there are no complications. However, he pointed out potential restrictions: assets with designated beneficiaries, such as life insurance or retirement accounts, wouldn’t automatically go to them. Additionally, inheritance could be affected if the children don’t qualify as heirs under state law, which is unlikely since they are adopted, or if the estate’s debts exceed its assets, which doesn’t seem to be the case here.

If Keaton’s children are absent from her will or trust, the estate would go to the named beneficiaries. Yet, given her close relationship with her children, it seems unlikely she would exclude them entirely. For more on Keaton’s life and legacy, including her impressive homes, stay tuned.

Keaton’s kids are likely to inherit her fortune, but with some restrictions

The likelihood of Diane Keaton’s children inheriting her million-dollar fortune mainly depends on whether or not she chose to include them in her estate plan. According to Tre Lovell, if she didn’t set up a will or trust prior to her passing, then Daisy and Duke are most likely entitled to inherit her assets and properties in accordance with the California law. But even then, there are a few restrictions. “(1) They won’t automatically inherit any assets that are held outside of the estate that have separate beneficiaries designated to receive (i.e. life insurance policies, retirement assets (SAG pension), property held in joint tenancy, etc.),” said the attorney. “(2) If they don’t qualify as ‘heirs’ under California law (here, however, reports are that the kids are adopted, thus they should qualify); or (3) If, for some reason, the debts exceed the assets of an estate and there is nothing to inherit, which does not seem to be the case here.”

Lastly, in the event that her kids aren’t included in Keaton’s will or trust, then the estate should go to the beneficiaries listed in those documents. However, considering how close she was to her children, there’s a very slim chance that Keaton would exclude them entirely from her estate plan. Speaking of her assets, see also: Where did Diane Keaton live and how big were her houses?