Share and Follow

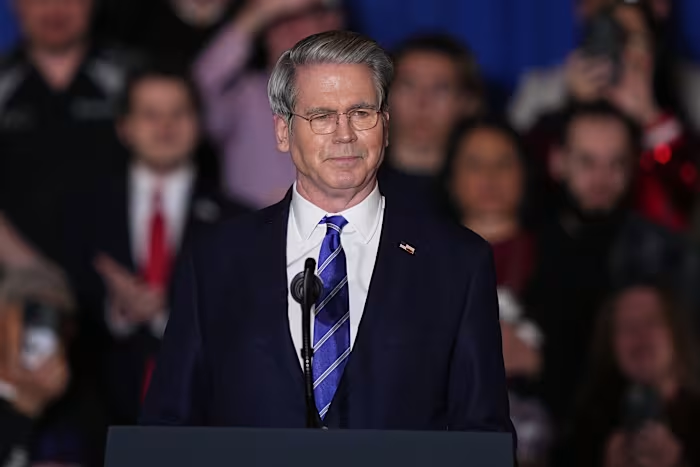

WASHINGTON – Amidst a heightened federal immigration crackdown in Minnesota, the Treasury Department, led by Secretary Scott Bessent, is intensifying scrutiny over financial transactions between residents and businesses in the state and Somalia. Bessent shared this development with reporters during his recent visit to Minnesota.

In a bid to tackle fraud within the state, Bessent revealed that his department has initiated a series of measures, including probing into four unnamed businesses that facilitate money transfers abroad. The aim is to enhance the oversight of these financial transactions.

This visit coincides with rising tensions in Minneapolis, following an incident where an Immigration and Customs Enforcement officer fatally shot a woman in a neighborhood south of downtown. The event has sparked protests and heightened tensions between federal authorities and local leaders.

Under the directive of President Donald Trump, efforts have been intensified to enforce immigration laws, particularly targeting the Somali community in this predominantly Democratic state. In line with this, Bessent has been tasked with identifying fraudulent activities. Last month, the Treasury announced an initiative to focus on money service businesses, particularly those handling remittances to Somalia.

These actions have been partly triggered by several fraud cases, such as the high-profile accusation against Feeding Our Future, a nonprofit organization alleged to have misappropriated $300 million in coronavirus relief funds intended for school meal programs.

Gov. Tim Walz, before he ended his bid to serve a third term this week, said that fraud will not be tolerated in Minnesota and that his administration “will continue to work with federal partners to ensure fraud is stopped and fraudsters are caught.” Walz, who came under heavy criticism from Republicans who said his administration should have caught the Feeding Our Future fraud earlier, said he was “furious” with “criminals that preyed on the system that was meant to feed children.”

The founder of Feeding our Future, Aimee Bock, was charged with multiple counts involving conspiracy, wire fraud and bribery and was convicted in March while maintaining her innocence.

Bessent declined to comment on specific investigations but said he had met with several financial institutions on Friday to ask them to do more to prevent fraud. The department has not disclosed which institutions Bessent spoke with.

Key Treasury actions include Financial Crimes Enforcement Network investigations into Minnesota-based money services businesses, enhanced transaction reporting requirements for international transfers from Hennepin and Ramsey counties, and alerts to financial institutions on identifying fraud tied to child nutrition programs.

“Treasury will deploy all tools to bring an end to this egregious unchecked fraud and hold perpetrators to account,” Bessent told reporters on Friday.

Bessent’s announcement was met with some criticism. Nicholas Anthony, a policy analyst at the libertarian Cato Institute, said Bessent is “building a legacy of financial surveillance and control.”

“The announcement that he is stopping Americans from sending their money abroad and increasing surveillance under the Bank Secrecy Act should be condemned,” Anthony said.

Some Somali leaders said last month they had received anecdotal reports about community members being detained by federal agents but had no details. Those leaders and allies including Walz and Minneapolis Mayor Jacob Frey have vowed to protect the community.

During a speech on Thursday about the Republican Trump administration’s economic agenda at the Economic Club of Minnesota, Bessent referred to the alleged fraud, without mentioning the Somali community that his department is targeting.

“I am here this week to signal the U.S. Treasury’s unwavering commitment to recovering stolen funds, prosecuting fraudulent criminals, preventing scandals like this from ever happening again, and investigating similar schemes state by state,” Bessent said.

Copyright 2026 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed without permission.