Share and Follow

TALLAHASSEE, Fla. – A new Florida amendment could drastically cut down how much homeowners pay in property taxes each year.

The proposed amendment (SJR 1016) was filed on Monday morning by state Sen. Blaise Ingoglia, D-11, who said he posited the bill to help “make housing affordable again.”

Under current rules, the state exempts homeowners from property taxes up to a certain level of the property’s assessed value. It works as follows:

-

The first $25,000 of assessed value — Exempt from all property taxes

-

Between $25,000 and $50,000 of assessed value — Taxable

-

Between $50,000 and $75,000 — Exempt from non-school taxes

-

Over $75,000 — Taxable

However, Ingoglia’s proposal would boost the exemption threshold, making it so that a property is exempt from all property taxes up to $75,000 — a three-fold jump from the existing $25,000 threshold.

This includes getting rid of the non-school taxes exemption between $50,000 and $75,000 in assessed value.

“In 1990, your homestead accounted for 32% of the value of your home,” Ingoglia wrote. “Today, your current homestead exemption accounts for LESS THAN 10% of the value of your home! Floridians are demanding property tax relief!”

If approved by lawmakers and DeSantis, the proposed amendment would likely go before Florida voters in the 2026 General Election to determine whether it should be enshrined in the state’s Constitution. It would have to get 60% of the electorate’s approval to pass.

But if it manages to clear all those hurdles, the amendment is set to take effect on Jan. 1, 2027.

It’s not the only piece of legislation to take aim at property taxes, though. Just last week, state Sen. Jonathan Martin filed SB 852, which would look into the possibility of eliminating property taxes altogether across the state.

That bill would require the state to conduct a study into the potential impacts of removing property taxes, as well as replacing them with funding sources from state budget cuts, sales taxes, and local consumption taxes.

According to SB 852, such a study would have to consider all of the following elements:

-

An analysis of the potential impacts on public services, including education and emergency services

-

An assessment of any possible housing market fluctuations, such as changes in homeownership rates and emergency services

-

An evaluation of whether such a shift would improve the state’s business climate

-

An examination of the potential impacts on “overall economic stability, consumer behavior, and long-term economic growth”

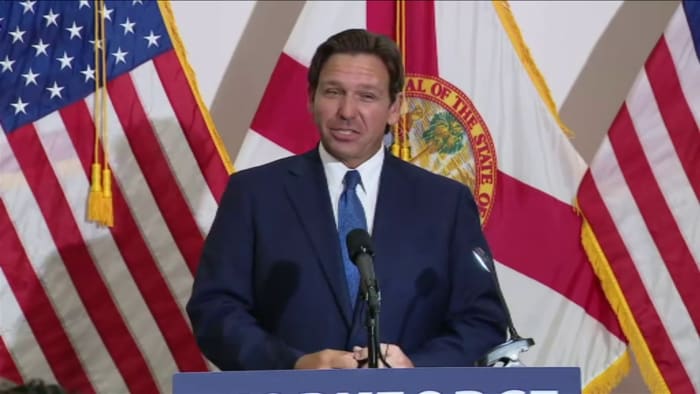

Both of these proposals come after Florida Gov. Ron DeSantis took to social media to voice his support for removing property taxes.

Earlier this month, DeSantis directly addressed the subject during a news conference in Jacksonville, according to News 6 partner WJXT.

At the time, he pointed to rising home prices — sparked by a combination of demand spikes and inflation — though he said he plans to work with the Legislature before his term ends in 2027 to potentially get a constitutional amendment on the ballot to address issues like the homestead exemption.

“We can’t control private markets, but we can control how much they can tax you. So we’re going to be working over the next year and a half to see what we can present for voters to be able to vote in the next election for some major, major property tax limitations and reliefs,” DeSantis said.

For Florida homeowners, lowering or outright removing property taxes could greatly cut down on their expenses. As a state, Florida ranks around the middle of the pack when it comes to real-estate property tax rates, WalletHub reports.

Proponents of property taxes often assert that they’re a vital part of collecting revenue for local government functions, such as public schools and police stations.

As such, removing property taxes would likely require another source of funding to make up for that lost revenue, or else the state and local governments might need to consider cutting expenses.

But on the flip side, property taxes are a relatively unpopular form of taxation — the second-most unpopular behind federal income taxes, according to a recent Gallup poll.

Opponents argue that property taxes unfairly target homeowners, who have already taken on all of the other burdens that come with homeownership. Worse yet, tax incidence means that the cost of these taxes could even end up falling downstream to lower-income renters who make use of these properties.

Regardless, property taxes are decided upon by local governments, so an amendment would have to be passed in order to make those kinds of changes.

DeSantis addressed this fact himself:

Property taxes are local, not state. So we’d need to do a constitutional amendment (requires 60% of voters to approve) to eliminate them (which I would support) or even to reform/lower them…

We should put the boldest amendment on the ballot that has a chance of getting that… https://t.co/WpOQmjNl0X

— Ron DeSantis (@GovRonDeSantis) February 13, 2025

Before voters can even decide on such a motion, an amendment would first have to be proposed via one of the following methods:

-

A citizens’ initiative

-

A proposal from the Taxation and Budget Reform Commission

So far, there have been no citizens’ initiatives regarding the elimination of property taxes, nor have lawmakers proposed legislation that would explicitly eliminate property taxes altogether. And even if they did, the amendment would still likely not go before voters until 2026 at the earliest.

Copyright 2025 by WKMG ClickOrlando – All rights reserved.