Share and Follow

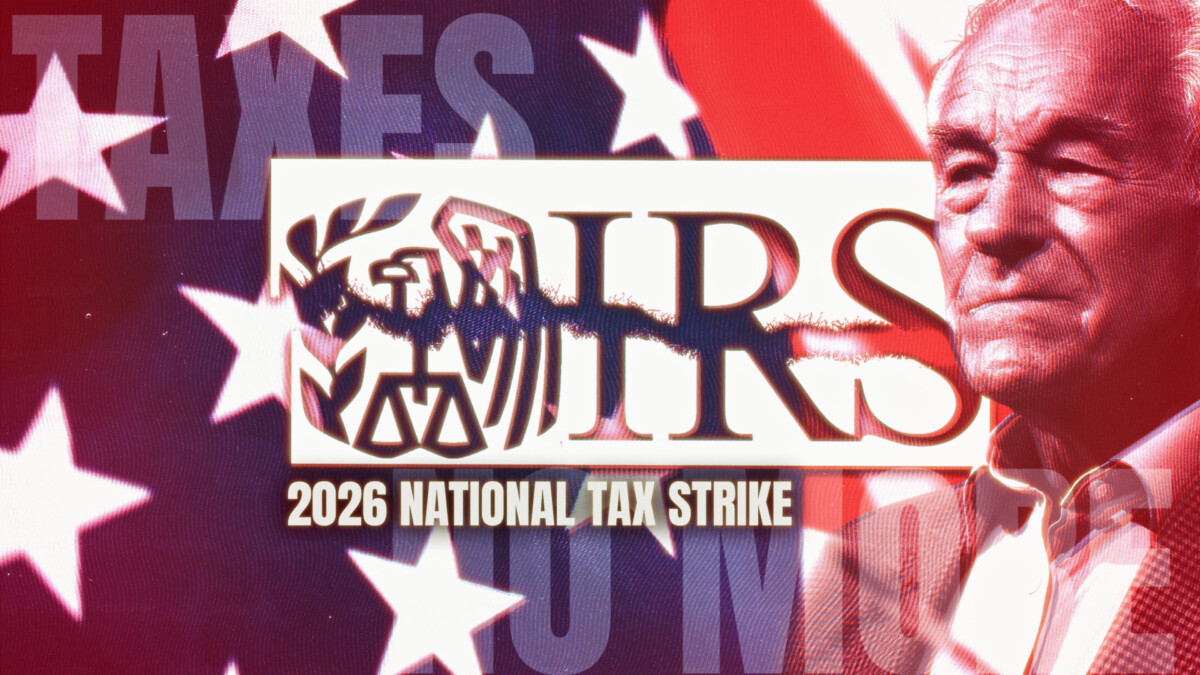

Outraged over funding for foreign wars and Somali fraud, a growing movement of prominent voices is calling for a National Tax Strike to reclaim America from a corrupt establishment.

The anticipated National Tax Strike of 2026 is emerging as a significant populist movement challenging the entrenched bipartisan political system. Many Americans believe this system has failed them by misusing their resources to support foreign conflicts and global agendas, leaving domestic issues unaddressed. The momentum is building among supporters of former President Trump, who feel disillusioned by a government that appears to prioritize international interests over their own, prompting a call for a large-scale tax protest in 2026.

The movement gained traction following revelations about fraudulent activities involving Somali entities and persistent U.S. funding of military efforts in regions like Israel and Ukraine. High-profile politicians, such as Representative Marjorie Taylor Greene, have voiced their support for this growing initiative. This proposed tax strike transcends political lines, representing a profound ethical stance against what many perceive as a government failing its fundamental responsibilities to its citizens.

The Government’s Betrayal: Funding Foreign Wars, Ignoring Americans

Under the leadership of both major parties, the U.S. government has been accused of consistently placing foreign aid and perpetual warfare above the needs of the American populace. With the national debt soaring to nearly $40 trillion and the cost of living spiraling, many Americans are feeling financially strained.

In a statement on the platform X, Rep. Marjorie Taylor Greene expressed the sentiments of many, saying, “Nearly every Trump supporter I interact with on X has reached a tipping point, planning a tax revolt in 2026. And rightly so! Americans toil tirelessly, struggle to make ends meet, while their tax contributions are funneled abroad for foreign causes… Meanwhile, Americans see little benefit!” This perceived betrayal has deeply eroded public confidence, suggesting that regardless of party control, the government continues to neglect its citizens.

The Moral Case for Rebellion

Prominent commentators are framing the payment of taxes as direct complicity in the government’s crimes, including murder and the destruction of civilizations. Specifically, podcast host Andy Frisella declared, “If you don’t rock the boat, there ain’t going to be no boat… Every American should highly consider organizing and not paying f*cking tax period.”

Andy Frisella calls for a national tax strike.

“If you don’t rock the boat, there ain’t gonna be no boat.” pic.twitter.com/9oh59nk685

— Real AF with Andy Frisella (@RealAFShow) December 30, 2025

Libertarian commentator Dave Smith responded to the question “what are we paying taxes for?” by stating, “Taxes are the price we pay to destroy civilizations.”

Political commentator Savanah Hernandez echoed this defiance, declaring, “F*ck it, I’m not paying taxes this year. And then when the IRS comes after me, I’ll blow that up into a huge national story about how the government will destroy your life over a couple thousand dollars meanwhile the Pentagon just failed their 8th straight audit in a row.”

The Somali fraud scandal has become the “last straw” for many. It galvanizes a movement that sees a tax strike as the only remaining tool to force accountability. Clint Russell of Liberty Lockdown captured the sentiment, stating, “Hey, cool. If the Somali fraud was the last straw LFG!”

These powerful statements expose the profound moral injury inflicted upon principled Americans who are forced to fund a system that violates their deepest-held beliefs. A national tax strike represents a direct, non-violent challenge to the legitimacy of a government that has broken its covenant with the people. It reasserts the principle that the consent of the governed is paramount.

Conclusion: The Warning and the Call to Action

The call for a 2026 National Tax Strike is the inevitable result of a government that has abandoned its people. It chooses instead to serve foreign powers and a globalist war machine. If principled Americans continue to fund their own destruction and the murder of innocents abroad, the nation will collapse under the weight of its own corruption and moral decay.

The time for compliance is over. The 2026 tax revolt is a defiant stand for freedom, a moral imperative, and the last best hope to restore the promise of an America that puts its own people first.

The apparent massive welfare fraud committed by Somali-Americans in Minnesota has animated anti-immigrant sentiment in the US. The corruption appears to go deep.

But are there other causes to the current crisis?

Also today: Pentagon sends more free stuff to Israel…

Watch… pic.twitter.com/4nEC017Nc8

— Ron Paul (@RonPaul) December 31, 2025