Share and Follow

(NEXSTAR) — While the national housing supply recently reached a four-year high, buying a home in some U.S. cities may be especially difficult in 2025, a new Zillow report suggests.

To make its predictions, Zillow reviewed multiple factors — including how quickly homes have been selling, and its own forecast for home value growth — in the 50 most populated cities nationwide.

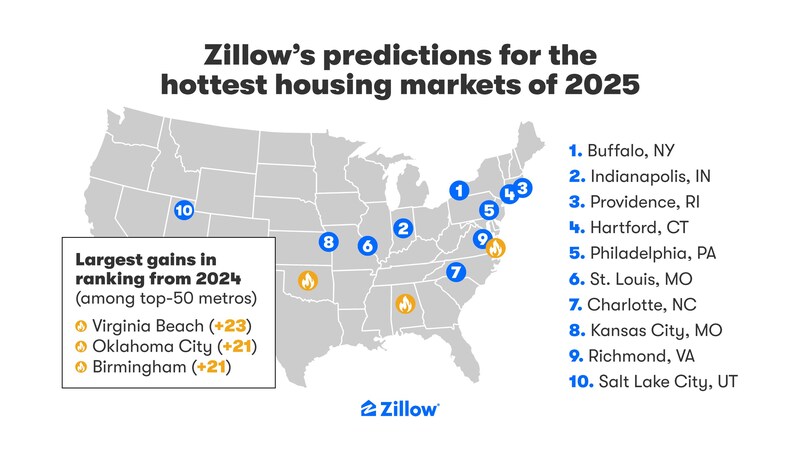

Overall, Zillow’s analysis determined cities primarily on the East Coast could have the hottest housing markets of 2025.

Where are the hottest housing markets?

For the second year in a row, Buffalo, New York, held the top spot on Zillow’s list. The company pointed to the city’s relative affordability and job market as the driving factors behind Buffalo’s competitive real estate status.

“Construction that keeps pace with an area’s growth remains a crucial piece of keeping homes available and accessible. In chilly Buffalo, competition among buyers will remain hot, with employment growing far faster than builders are adding homes,” said Skylar Olsen, Zillow’s chief economist.

The second-hottest market, Zillow predicts, will be Indianapolis. The metro, like other Midwestern cities that landed toward the top of the list, tend to have “lower-than-average home prices and rent costs,” which have fueled the competition for buyers.

Zillow’s hottest housing markets for 2025 can be seen on the map below:

Virginia Beach, Virginia, jumped more than 20 spots over last year’s rankings. According to Zillow, it earned the No. 13 spot on its list thanks in part to “job growth that has far outpaced new home permitting.” Alternatively, Memphis, Tennessee, dropped 30 spots because the number of new homes being built is outgrowing job growth.

Also dropping significantly in the ranks were three Ohio metros — Cincinnati, Columbus, and Cleveland — which ranked as Nos. 2, 3, and 8 in 2024, respectively. This year, they ranked as Nos. 11, 12, and 14, respectively.

Other major metros that dropped down in the rankings were Orlando and Tampa, Florida; Atlanta, Georgia; Las Vegas, Nevada; and Los Angeles, California. You can view Zillow’s full list here.

Tampa itself dropped 19 places down the list, landing on 29. Orlando dropped down 14 places.

What will home buying look like in 2025?

Regardless of where you’re shopping for a new home, it could still be difficult. Mortgage rates could be unpredictable throughout the year, Olsen warns, but there is good news: “Shoppers nationwide should see more options for sale than in recent years, along with slow and steady price growth.”

Zillow currently reports that the strongest housing markets for sellers are in the Northeast. That includes multiple New York cities — Rochester, Syracuse, Buffalo, and New York City — as well as metros in Connecticut, Massachusetts, and Rhode Island. The only non-Northeastern city considered a “strong seller’s market” is San Jose, California.

Cities primarily in the south, from Florida to Texas, are considered buyer’s markets. Zillow ranks Cape Coral, Florida, at the top of that list, followed by McAllen, Texas; New Orleans; Miami; and Jackson, Mississippi.

The average 30-year mortgage rate hit 6.85% by to end 2024, the highest reported since July 2024, according to data from Freddie Mac. In a statement, Freddie Mac’s chief economist Sam Khater said “an overwhelming undersupply of homes” is plaguing the market.

The Federal Reserve could cut rates, albeit slowly, in 2025, which could prove beneficial to mortgage rates. (While the Fed doesn’t set mortgage rates, it does influence them.) Long-term mortgage rates generally track the yield on the 10-year Treasury note, which, in turn, is driven in part by the market’s outlook for inflation and the Fed’s benchmark rate.

That means that, at least indirectly, cuts to the Fed’s key rate can put downward pressure on mortgage rates, even if they don’t move in lockstep.

It’s also unclear how President-elect Donald Trump could impact such rates. He did say Tuesday that “interest rates are far too high” while speaking at a press conference at his Mar-a-Lago club.