Share and Follow

Politicians have basically given up on addressing our debt crisis. For decades, the national debt has grown at an unsustainable rate. Today, it stands at a mind-boggling $37 trillion.

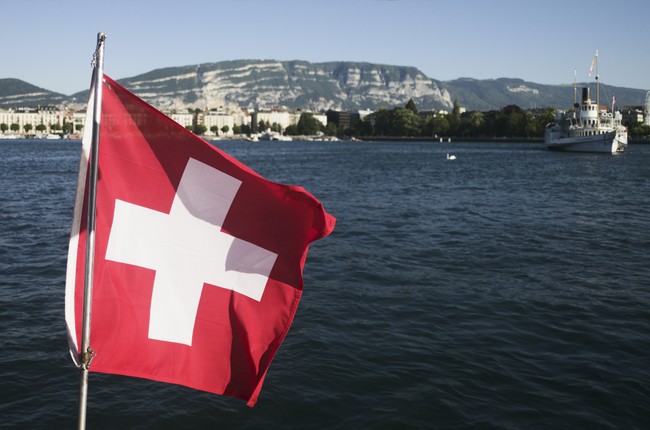

Both political parties have thrown in the towel. But before we give up, we should understand how other countries have solved their debt crisis. Among the most successful of these countries is Switzerland.

In the early 1990s, Switzerland was experiencing unsustainable growth in debt that threatened economic stability and long-term economic growth. Swiss citizens had been successful in enacting debt brakes at the cantonal and municipal level. Swiss citizens asked the obvious question: if we have been successful in enacting effective fiscal rules at the cantonal and municipal level, why can’t we do so at the federal level?

The initiative and referendum gave Swiss citizens the power to amend the constitution at all levels of government. In 1991, they used the referendum process to incorporate a debt brake into the federal constitution, with support from 85 percent of the electorate. The debt brake imposes a cap on the growth in federal spending equal to the long-term rate of growth in the economy. The government may incur deficits in response to emergencies, but it must balance the budget over the business cycle. The Swiss maintain their version of a rainy-day fund to achieve these targets. With this debt brake in place, the Swiss reduced debt to 30 percent of national income.

America is at a turning point in addressing our debt crisis, much like the Swiss faced three decades ago. Since the tax revolt was launched in the 1970s, citizens have been successful in enacting effective fiscal rules in their state and local constitutions and charters. Since then, most states have been successful in balancing their budgets and limiting debt. If we can impose fiscal discipline at the state and local level, why can’t we do so at the federal level?