Share and Follow

A MAN lost his life savings in a matter of hours after receiving what appeared to be an alert from Bank of America’s fraud department.

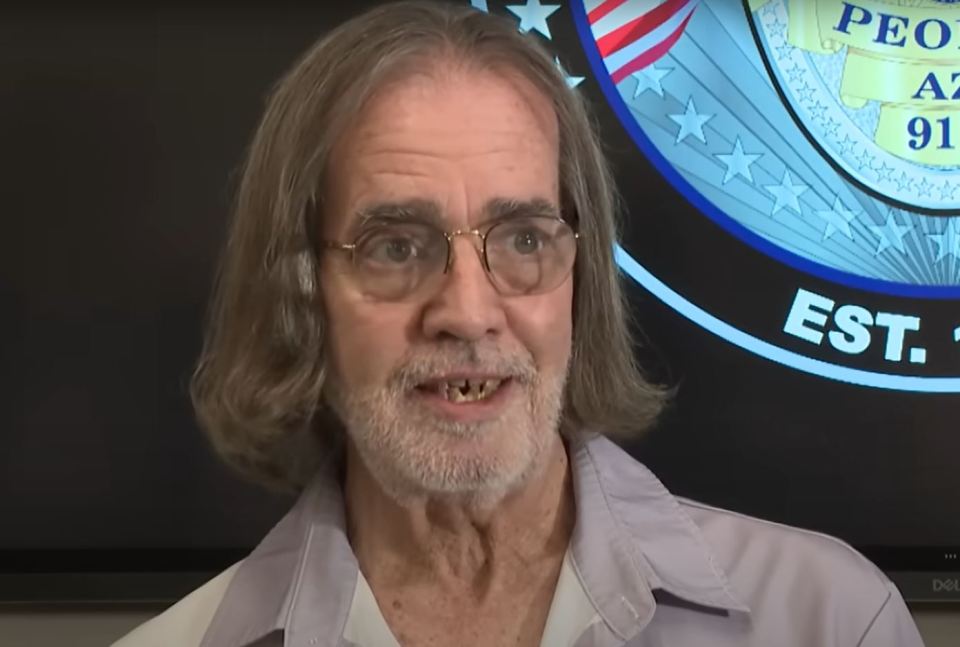

Dave from Peoria, Arizona, was duped into draining his own bank account of $27,000 after his phone was “turned into a weapon” with an alleged Best Buy purchase.

Back in January, Dave’s phone alerted him to a text that seemed to be a fraud check about a recent purchase on his card.

It read: “Did you authorize the following activity for a purchase for $399 @BestBuy #2440 on 01/29/2025?

“If you authorized the activity, reply YES, if not, reply NO.”

Dave replied with the latter and was given a phone number to contact to keep his bank secure.

“They just said, ‘Your whole account is in jeopardy,'” he told 12 News.

“It sounded like they were from Bank of America.” he added, noting that he even did the right thing and asked the person on the phone for an ID number which they provided.

The fraudster managed to convince Dave that an employee from Bank of America itself was trying to steal his bank account information.

They told him to stay on phone, go to nearby branch and empty his accounts in order to move the cash into a new, secure one.

Dave who was panicked at the thought of his compromised bank account, made two separate withdrawals totalling $27k – the entirety of his life savings.

“At that point, they gave me instructions on how to use my iPhone to tap into an account” that was connected to his Apple wallet, he explained.

“I was panicking. This is my life savings and I don’t have any assurances but they sounded so real.”

Dave then went to bank’s drive-thru ATM to deposit the cash into the new account before soon realising he “just didn’t feel right” about the situation and called the cops.

He then discovered that in a matter of hours his money had vanished.

Detective Michael Finney, who took on Dave’s case, told 12 News that the sophisticated scam saw Dave “participate in his own fraud”.

Expert Advice: How to protect yourself from fraud

Craig Costigan, the CEO of fraud experts NICE Actimize gave the following tips to readers of The U.S. Sun on how to stay safe from fraudsters.

- As the saying goes, trust but verify. Always question your text and email communications. It may not be from who you think it is. Look for giveaways that it is a scam email. If your bank contacts you about a fraud via a text or email, call the number on the back of your credit or debit card to contact the fraud department directly – much safer than giving data to an impersonator.

- Protect your personal identifying information such as social security cards, your blank checks and other IDs.

- Always be vigilant. Even the safest and most careful among us have encountered fraudsters – we survived

because we reported the activity immediately to our providers, changed our passwords and checked our credit reports for unusual activity. - If you are not applying for credit, you might also consider placing a freeze on your credit reports, such as Experian, TransUnion and Equifax, so fraudsters can’t open accounts in your name. You can easily unfreeze your credit when you want to open a new account.

“They used Dave as the victim to participate in his own fraud,” he said.

“They basically turned his phone into a weapon to hold him hostage.”

After five months of investigation, Finney managed to recover 90% of Dave’s money – a rarity for such cases where the recovery window is usually just 72 hours.

“I’d be completely destitute,” Dave said, had the cops not retrieved the majority of the funds.

The fraudsters were traced to Florida where it is hoped further investigation will bring justice.

Bank of America urges customers to follow a three-step process to stay safe from scammers:

- Pause: Scammers often try to create urgency. Take a moment to think. Does the request feel off? If it doesn’t make sense, don’t reply to a message, hang up. Trust your gut. It’s okay to say no.

- Verify: Before you send money, share a code or give personal information, verify the request. Contact the person directly using a trusted source. This could be the phone number on the back of your card or a bank statement

- Stay vigilant: Scammers count on silence. Talk with friends and family about messages and requests that don’t feel right. A scammer’s story may change depending on who they are trying to target, but the red flags often stay the same.

It is also advised not to call any phone numbers you are given other than the one on the back of your credit or debit card.

If you receive a call from someone claiming to be from the bank, cut off and call back using the legitimate number.

More information can be found on the Banks Never Ask That website and Bank of America’s Fraud Prevention page.