Share and Follow

Introduction: Mortgage fears and London Tech Week

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

UK borrowers face further interest rate hikes this year as the fight against inflation continues.

A Bank of England policymaker is warning this morning that the UK central bank may need to make “further increases” to borrowing costs as it tries to ease the cost of living crisis.

Jonathan Haskel, a member of the Bank’s Monetary Policy Committee, suggests that more than one increase in interest rates may be needed.

Writing in The Scotsman today, Haskel says the BoE mustn’t allow inflation to become ‘embedded’ in the economy, saying:

We are monitoring indicators of inflation momentum and persistence closely.

My own view is that it’s important we continue to lean against the risks of inflation momentum, and therefore that further increases in interest rates cannot be ruled out.

As difficult as our current circumstances are, embedded inflation would be worse.

Expectations of higher interest rates has caused turbulence in the mortgage market in recent weeks.

Ian Stuart, CEO of HSBC UK Bank, told Radio 4’s Today programme that inflation is looking sticky, and probably won’t fall “quite as fast” as hoped.

That means that borrowing costs are unlikely to start falling again soon.

Stuart explains:

Well, I don’t have a crystal ball. But…. inflation is not falling as quickly as a lot of people have predicted.

So as long as that is the case, then our house view is that rates will probably increase a little bit more and will probably stay a little bit higher for longer.

Bank of England base rate is currently 4.5%, the highest level since 2008.

The money markets are anticipating that rates could hit 5.5% by the end of the year, meaning people who must remortgage their loans face higher repayment costs.

Stuart says:

So, not the mortgage news we’d be looking for.

He doesn’t believe rates will fall back to 1%, and warns that rates won’t start to fall until inflation is much lower than it is today (it was 8.7% in April).

Mortgage rates in UK have jumped sharply in recent weeks due to sticky inflation.The market expects BOE to increase the rate to 5-5.5%. The current rate is 4.5%. How far mortgage rate will go up if the benchmark rate has to increase to 5.5%? Ticking timebomb in UK property market pic.twitter.com/Qb4GgdGtaw

— Winston (@WKyaw7) June 5, 2023

Stuart explained that HSBC was forced to ‘put a pause on business’ coming in from brokers last Thursday, due to a supply and demand issue as people tried to secure mortgages.

The Nationwide Building Society raised its mortgage rates last week, adding to the pressure on the market.

New analysis suggests that around 2.6 million households with a mortgage could have to pay thousands of pounds more in repayments next year.

The Times reports today:

City figures said the mortgage market was going through a “complete reset” and that only a third of borrowers who are on cheap fixed-term deals had come off them so far.

Analysis by Capital Economics found that a third of such households, equivalent to 3.2 million, are paying interest rates of 3 per cent or more. By the end of next year that will have risen to 5.8 million as the impact of higher interest rates passes through to the market.

Also coming up today

London’s Queen Elizabeth II Centre is hosting London Tech Week, the 10th gathering of the UK’s largest technology event.

PM Rishi Sunak, chancellor Jeremy Hunt and Secretary of State for Science, Innovation and Technology Chloe Smith are attending, as Britain pitches itself as a tech superpower and “the best place in the world to invest”.

Asia Pacific (APAC) investors with over £100bn of funds will be there, the government reports, and could put money into fintech, clean tech, life sciences and Artificial Intelligence firms.

An ‘elevator pitch’ will be run at the London Eye, where 25 tech firms will have 30 minutes to pitch their latest innovations to investors before their pods circle back to the ground…..

The agenda

-

Morning: London Tech Week panel discussion with Secretary of State for Science, Innovation and Technology Chloe Smith chancellor Jeremy Hunt, and HSBC and SVB UK.

-

9am BST: Prime minister Rishi Sunak gives keynote address to open London Tech Week

-

9am BST: China’s new yuan loan for May

-

1pm BST: India’s industrial production data for April

-

3pm BST: Bank of England policymaker Catherine Mann gives a webinar

-

4pm BST: US inflation expectations for

Key events

KPMG: Stickier inflation means higher interest rates

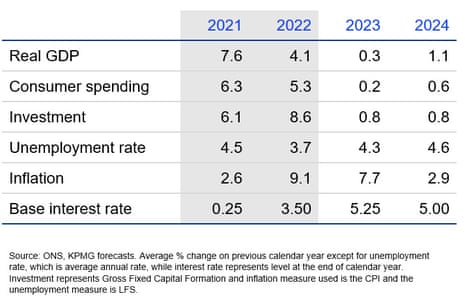

Economists at KPMG are also warning that UK interest rates will continue to rise this year, due to stubborn inflation.

Their latest economic forecasts, released this morning, show a brighter growth picture -but high inflation for longer than hoped.

KPMG say:

-

Given the latest surveys, we no longer expect a recession in the UK, but growth is forecast to remain sluggish by historical standards.

Read Related Also: Thug who helped kicked a total stranger to death sues Home Office

-

Inflation is on the way down, but the pace of moderation is slower than we previously thought. This will likely necessitate further interest rate increases and more pain to come for borrowers.

-

The upside revision to our forecast means no plain sailing. Risks remain skewed to the downside, with ongoing fragilities potentially yet to be fully uncovered.

Yael Selfin, chief economist at KPMG UK, said:

“We’ve seen a slightly stronger momentum for the UK economy but risks are still elevated on the downside. A stickier inflation will see monetary policy tightening even further, increasing the risk of unwelcome side effects among other potential headwinds.”

Introduction: Mortgage fears and London Tech Week

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

UK borrowers face further interest rate hikes this year as the fight against inflation continues.

A Bank of England policymaker is warning this morning that the UK central bank may need to make “further increases” to borrowing costs as it tries to ease the cost of living crisis.

Jonathan Haskel, a member of the Bank’s Monetary Policy Committee, suggests that more than one increase in interest rates may be needed.

Writing in The Scotsman today, Haskel says the BoE mustn’t allow inflation to become ‘embedded’ in the economy, saying:

We are monitoring indicators of inflation momentum and persistence closely.

My own view is that it’s important we continue to lean against the risks of inflation momentum, and therefore that further increases in interest rates cannot be ruled out.

As difficult as our current circumstances are, embedded inflation would be worse.

Expectations of higher interest rates has caused turbulence in the mortgage market in recent weeks.

Ian Stuart, CEO of HSBC UK Bank, told Radio 4’s Today programme that inflation is looking sticky, and probably won’t fall “quite as fast” as hoped.

That means that borrowing costs are unlikely to start falling again soon.

Stuart explains:

Well, I don’t have a crystal ball. But…. inflation is not falling as quickly as a lot of people have predicted.

So as long as that is the case, then our house view is that rates will probably increase a little bit more and will probably stay a little bit higher for longer.

Bank of England base rate is currently 4.5%, the highest level since 2008.

The money markets are anticipating that rates could hit 5.5% by the end of the year, meaning people who must remortgage their loans face higher repayment costs.

Stuart says:

So, not the mortgage news we’d be looking for.

He doesn’t believe rates will fall back to 1%, and warns that rates won’t start to fall until inflation is much lower than it is today (it was 8.7% in April).

Mortgage rates in UK have jumped sharply in recent weeks due to sticky inflation.The market expects BOE to increase the rate to 5-5.5%. The current rate is 4.5%. How far mortgage rate will go up if the benchmark rate has to increase to 5.5%? Ticking timebomb in UK property market pic.twitter.com/Qb4GgdGtaw

— Winston (@WKyaw7) June 5, 2023

Stuart explained that HSBC was forced to ‘put a pause on business’ coming in from brokers last Thursday, due to a supply and demand issue as people tried to secure mortgages.

The Nationwide Building Society raised its mortgage rates last week, adding to the pressure on the market.

New analysis suggests that around 2.6 million households with a mortgage could have to pay thousands of pounds more in repayments next year.

The Times reports today:

City figures said the mortgage market was going through a “complete reset” and that only a third of borrowers who are on cheap fixed-term deals had come off them so far.

Analysis by Capital Economics found that a third of such households, equivalent to 3.2 million, are paying interest rates of 3 per cent or more. By the end of next year that will have risen to 5.8 million as the impact of higher interest rates passes through to the market.

Also coming up today

London’s Queen Elizabeth II Centre is hosting London Tech Week, the 10th gathering of the UK’s largest technology event.

PM Rishi Sunak, chancellor Jeremy Hunt and Secretary of State for Science, Innovation and Technology Chloe Smith are attending, as Britain pitches itself as a tech superpower and “the best place in the world to invest”.

Asia Pacific (APAC) investors with over £100bn of funds will be there, the government reports, and could put money into fintech, clean tech, life sciences and Artificial Intelligence firms.

An ‘elevator pitch’ will be run at the London Eye, where 25 tech firms will have 30 minutes to pitch their latest innovations to investors before their pods circle back to the ground…..

The agenda

-

Morning: London Tech Week panel discussion with Secretary of State for Science, Innovation and Technology Chloe Smith chancellor Jeremy Hunt, and HSBC and SVB UK.

-

9am BST: Prime minister Rishi Sunak gives keynote address to open London Tech Week

-

9am BST: China’s new yuan loan for May

-

1pm BST: India’s industrial production data for April

-

3pm BST: Bank of England policymaker Catherine Mann gives a webinar

-

4pm BST: US inflation expectations for