Share and Follow

Introduction: HSBC pulls new mortgage deals after flood of demand

Good morning and welcome to our rolling coverage of business, the financial markets and the world economy.

The turbulence in Britain’s mortgage market has escalated after HSBC temporarily withdrew all its loans with only a few hours’ notice, last night.

HSBC has removed all its residential and buy-to-let products for new customers, with deals becoming available again on Monday. Products and rates for existing customers were still available, though.

An HSBC spokesperson said:

“To ensure that we can stay within our operational capacity and meet our customer service commitments, we occasionally need to limit the amount of new business we can take each day.

“Our broker products will be available again on Monday, June 12.”

But deals are likely to return at higher rates on Monday.

It is the first time that HSBC, which accounts for almost a quarter of the home loans market, has withdrawn from the mortgage market since the aftermath of September’s disastrous mini-budget under Liz Truss’s government.

HSBC originally set a 5pm deadline for securing new deals yesterday, but after experiencing “significant demand”, at 3.45pm it pulled all the remaining deals immediately, as George Nixon of The Times explains:

A few scenes (and angry brokers) in mortgage land today as HSBC sends out first an email saying it will pull *all* mortgage deals from sale due to “significant demand” at 5pm, then another at 3.45pm saying it’ll now do it immediately. Not back on-sale til Monday.

— George Nixon (@George_Nixon97) June 8, 2023

Nationwide also due to increase fixed-rates by up to 0.25% tomorrow too. (But cut trackers)

It’s likely to put a dent in product availability, which bounced back today from 4,597 to 4,831 deals.

Average two-year rate up again to 5.82% today, average five-year fix up to 5.49%

— George Nixon (@George_Nixon97) June 8, 2023

Nationwide Building Society, the country’s second-largest lender, has already pushed up borrowing costs too – increasing its fixed-rate mortgage deals by up to 0.25 percentage points.

Among Nationwide’s changes, it said two, three and five-year fixed-rate deals for people with a 5% deposit will increase by between 0.01 and 0.20 percentage points, with rates starting from 4.69%.

Both lenders acted following the rapid rise in mortgage rates over the past few weeks.

Those moves are being driven by concerns that the Bank of England will continue to raise interest rates, after UK inflation remained stubbornly high in April.

Hundreds more home loan deals have been pulled by banks and building societies over the last week, while rates on new fixed mortgage deals are continuing to rise.

Also coming up today

Britain’s windfall tax on oil and gas producers is being scaled back, the government has just announced, as it tries to boost investment in the North Sea.

Currently 75%, the levy will be cut to 40% if prices consistently return to normal levels for a sustained period, but still remain in place until 2028.

The Treasury says:

This forms part of the Government’s strategy to support households with energy bills whilst providing certainty to investors to secure the long-term future of domestic energy production

The Energy Profits Levy has raised around £2.8 billion to date, helping the Government pay just under half the typical household energy bill last winter.

City investors are watching whether Vodafone and the owner of Three network, CK Hutchison, will announce a long-anticipated merger today.

The agenda

-

9am BST: Italian industrial production data for April

-

11.30am BST: Bank of Russia sets interest rates

-

1pm BST: Bank of Russia holds press conference

Key events

High street sales turn negative for first time in more than two years

The UK’s cost of living crisis has driven down sales on the high streets, which turned negative for the first time in more than two years

Total like-for-like retail sales, combining in-store and online, fell by 1.5% overall compared with last May, according to business advisory firm BDO’s latest High Street Sales Tracker.

Online sales fell by 3.3%, one of the lowest results recorded outside of the pandemic, while in-store sales rose by just 1% across the month.

Given the high inflation rates, these figures suggest significant drops in volumes, explains Sophie Michael, head of retail and wholesale at BDO LLP, who called the results “extremely discouraging”.

Miichael adds:

“With three bank holidays last month and the fact that footfall has increased compared to this time last year, these results highlight the huge pressure on the consumer purse.

“The drop in online sales is also stark, recording the worst online sales results on record with the exception of the months impacted by the Covid-19 pandemic.”

The homewares sector recorded a “very poor” total fall of 9.2% in May – as shoppers shunned expensive items such as furniture and electronics. Fashion sales fell 1.5%.

Tesco reported to CMA over pricing of Clubcard offers

Sarah Butler

The consumer group Which? has reported Tesco to the UK’s competition watchdog over the supermarket’s failure to provide detailed pricing information on its loyalty card offers.

The group said the UK’s largest retailer had not clearly explained the unit price of deals for its Clubcard holders – such as the price per 100g or 100ml – so that shoppers could easily compare value for money between different sized packages, bottles, brands and retailers.

It said the lack of unit pricing could be a “misleading practice” under consumer protection regulations because it could make it difficult for shoppers to determine which was the cheapest product.

In one example, Which? found a 700g bottle of Heinz tomato ketchup in Tesco for which the label showed the standard price to be £3.90, or 55.7p per 100g. A prominent Clubcard label showed the same size bottle on offer at £3.50, but the unit price, which would be 50p per 100g, was not given.

At the same time a 910g bottle of the same ketchup on the shelf below was priced at £3.99, or 43.8p per 100g, for all shoppers, making it the cheapest option per 100g. Which? argued many shoppers would wrongly assume the Clubcard option was the best deal available.

UK house prices set to slide 10%, Moody’s warns

Rating agency Moody’s has added to the dilemma facing UK housebuyers, by predicting prices will fall 10% over the next two years.

Moody’s believes that persistently high inflation and the recent spike in lending rates will trigger a correction in the UK housing market.

In a report issued last night, Moody’s say:

The combination of less affordable mortgages and high inflation putting a dent in incomes will trigger a correction in the UK housing market.

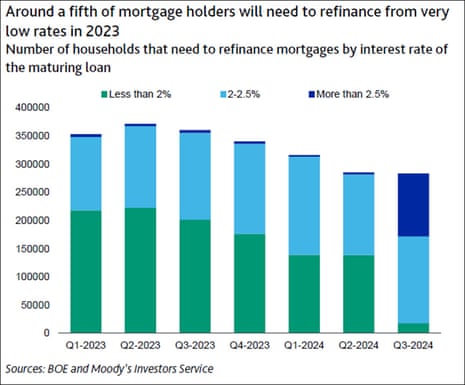

The relatively large share of short-dated or variable-rate mortgages exposes the existing stock to tightening monetary policy. Strong fundamentals such as a robust labour market, tight underwriting standards and housing supply shortages will prevent more severe credit implications.

Moody’s warns that the correction in UK house prices will be more pronounced than in many other advanced economies.

That’s because the UK has a high proportion of variable or short-term fixed mortgages, compared to other countries such as Germany, the US or France where mortgages have longer maturities.

Buy-to-let landlords, who hold 8% of the UK private housing stock, will also influence house prices if a large number choose to sell.

Moody’s say:

Read Related Also: Danny Masterson in ‘administrative segregation’ in jail

To be eligible to refinance, landlords must comply with regulatory requirements to ensure rental income is sufficient to support mortgage payment costs. Landlords can pass on these costs to tenants, but for an average mortgage, this would mean raising rents by close to 20%, according to BOE estimates. Rents are currently increasing by around 5%.

There is anecdotal evidence that landlords are choosing to sell properties instead, putting additional downward pressure on house prices.

El-Erian: Inflation is still too high, causing mortgage turbulence

The turbulence in the UK mortgage market is being driven by high inflation, and expectations that the Bank of England will continue to raise interest rates to fight it.

So explains Mohamed El-Erian, chief economic adviser at Allianz and President of Queens’ College, Cambridge.

He told Radio 4’s Today programme:

People expect that the cost of mortgages will go up. And if you are someone who’s going to get a mortgage, you will accelerate the demand for getting that mortgage. Why pay more tomorrow, when you can pay less today?

And if you’re HSBC, you’ve seen lots of people turn up wanting mortgages and you worry about two things. One is will I make money on those mortgages? And two, can I operationally handle these.

HSBC made the judgement that its sustainability, the ability to do business under these conditions, is threatened so it took a very dramatic move.

And all this comes down to a simple fact. Inflation is still too high. And people expect the Bank of England to increase interest rates more.

UK inflation rose by 8.7% in the year to April, four times over the BoE’s 2% target.

City traders expect interest rates will rise again this month, to 4.75%, and could hit 5.5% by the end of this year.

These expectations are pushing up the yield, or interest, on short-term government bonds, which are used to price fixed-term mortgages.

With the recent leg up, the yield on 2-year US government #bonds is nearing 4.60% — some 80 basis points above the low levels of March, April, and early May but short of the 5.07% that prevailed just before the banking tremors.

This comes ahead of two significant events next… pic.twitter.com/PQQnEwKnsM— Mohamed A. El-Erian (@elerianm) June 8, 2023

Mortgage turbulence: what the brokers say

UK mortgage brokers were startled by the speed at which HSBC pulled its mortgage offers for new customers yesterday.

Paul Neal, mortgages & equity release advisor at Missing Element Mortgage Services, says the move came without warning:

Yet again we find ourselves with another lender dropping out of the market until they release new products. This time with no warning.

How are we supposed to give our clients best value when a lender pulls rates with zero notice? This just highlights the importance of a minimum withdrawal period.

Ashley Thomas, director at Magni Finance, says there was a flood of demand after HSBC announced its move yesterday (which is why HSBC ended up pulling deals even earlier than planned):

Unsurprisingly, everyone has tried logging into the system following the announcement. I have been in a queue for a long time and, once I got past the initial wait, I have had several errors/issues.

It is very unfair on clients and brokers with the short notice being given. We have had the same issues before with HSBC when they gave less than a day’s notice.

Katy Eatenton, mortgage & protection specialist at Lifetime Wealth Management, fears other lenders could follow HSBC’s lead:

HSBC is another lender making changes with little notice, making it nearly impossible for brokers to service clients properly. And then to add insult to injury, they pulled them with immediate effect at 3.50pm.….

I’m praying other lenders don’t follow suit. We need to get an industry minimum notice period sooner rather than later, as the status quo simply doesn’t work for consumers.

Introduction: HSBC pulls new mortgage deals after flood of demand

Good morning and welcome to our rolling coverage of business, the financial markets and the world economy.

The turbulence in Britain’s mortgage market has escalated after HSBC temporarily withdrew all its loans with only a few hours’ notice, last night.

HSBC has removed all its residential and buy-to-let products for new customers, with deals becoming available again on Monday. Products and rates for existing customers were still available, though.

An HSBC spokesperson said:

“To ensure that we can stay within our operational capacity and meet our customer service commitments, we occasionally need to limit the amount of new business we can take each day.

“Our broker products will be available again on Monday, June 12.”

But deals are likely to return at higher rates on Monday.

It is the first time that HSBC, which accounts for almost a quarter of the home loans market, has withdrawn from the mortgage market since the aftermath of September’s disastrous mini-budget under Liz Truss’s government.

HSBC originally set a 5pm deadline for securing new deals yesterday, but after experiencing “significant demand”, at 3.45pm it pulled all the remaining deals immediately, as George Nixon of The Times explains:

A few scenes (and angry brokers) in mortgage land today as HSBC sends out first an email saying it will pull *all* mortgage deals from sale due to “significant demand” at 5pm, then another at 3.45pm saying it’ll now do it immediately. Not back on-sale til Monday.

— George Nixon (@George_Nixon97) June 8, 2023

Nationwide also due to increase fixed-rates by up to 0.25% tomorrow too. (But cut trackers)

It’s likely to put a dent in product availability, which bounced back today from 4,597 to 4,831 deals.

Average two-year rate up again to 5.82% today, average five-year fix up to 5.49%

— George Nixon (@George_Nixon97) June 8, 2023

Nationwide Building Society, the country’s second-largest lender, has already pushed up borrowing costs too – increasing its fixed-rate mortgage deals by up to 0.25 percentage points.

Among Nationwide’s changes, it said two, three and five-year fixed-rate deals for people with a 5% deposit will increase by between 0.01 and 0.20 percentage points, with rates starting from 4.69%.

Both lenders acted following the rapid rise in mortgage rates over the past few weeks.

Those moves are being driven by concerns that the Bank of England will continue to raise interest rates, after UK inflation remained stubbornly high in April.

Hundreds more home loan deals have been pulled by banks and building societies over the last week, while rates on new fixed mortgage deals are continuing to rise.

Also coming up today

Britain’s windfall tax on oil and gas producers is being scaled back, the government has just announced, as it tries to boost investment in the North Sea.

Currently 75%, the levy will be cut to 40% if prices consistently return to normal levels for a sustained period, but still remain in place until 2028.

The Treasury says:

This forms part of the Government’s strategy to support households with energy bills whilst providing certainty to investors to secure the long-term future of domestic energy production

The Energy Profits Levy has raised around £2.8 billion to date, helping the Government pay just under half the typical household energy bill last winter.

City investors are watching whether Vodafone and the owner of Three network, CK Hutchison, will announce a long-anticipated merger today.

The agenda

-

9am BST: Italian industrial production data for April

-

11.30am BST: Bank of Russia sets interest rates

-

1pm BST: Bank of Russia holds press conference