Share and Follow

Alaska, a state I’ve long described as America’s hidden gem, has often been treated by the federal government as if it were the world’s largest natural reserve. This has been particularly true up until January 2025, as policymakers, largely influenced by Democrats and environmental advocates, have enforced strict regulations on development, extraction, mining, and drilling, seemingly ignoring the voices of those who actually reside in these areas.

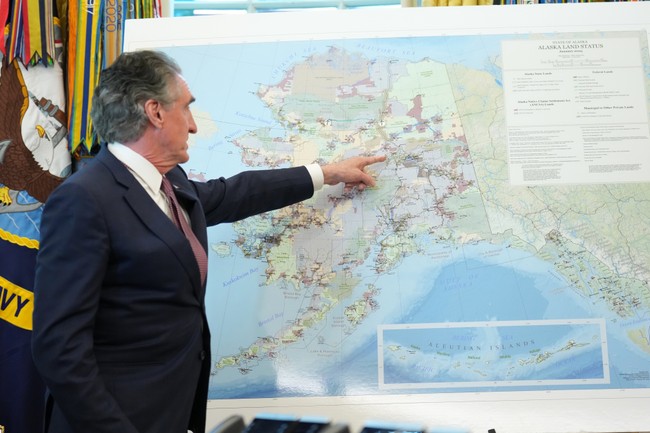

However, the tide has turned. Alaska is now embracing economic opportunities, and the discovery of new survey results in the Pebble deposits has further unlocked America’s potential wealth.

Historically, we have imported many of these metals and minerals from countries like China and Russia. The estimated value of these newfound resources in Alaska is nothing short of extraordinary.

The increasing geopolitical tensions cannot be ignored as they add another layer of complexity to this situation.

Under the longer-life expansion scenarios extending operations toward a century, those public revenues were projected to rise to roughly $22 billion for Alaska, $4 billion for local government, and about $19 billion for the federal treasury, reflecting the magnitude of the deposit’s contribution at both state and national levels.

Since then, rising metal prices and new critical mineral designations have reshaped the context for evaluating the deposit.

In its most recent update, the USGS expanded the federal critical minerals list to reflect updated assessments of supply risk and economic exposure, increasing the total number of designated minerals from 50 to 60 and adding several widely used industrial and energy transition metals.

These are, in many cases, metals and minerals we have been getting from other sources, including China and Russia. And the dollar value of these deposits are, to put it mildly, impressive.

Collectively valued at approximately $591 billion based on 2025 prices for the contained resource from all categories, this valuation represents a nearly 50% increase from the estimated $393 billion valuation from 2023 metal prices.

Based on contained metal and current pricing, copper accounts for the largest share of Pebble’s critical mineral value, at an estimated $431 billion, followed by molybdenum at approximately $120 billion.

Silver contributes another $27 billion, while rhenium – one of the rarest elements in commercial production – adds roughly $13 billion, reflecting its critical role in high-performance aerospace applications.

When the gold also found at Pebble is added in, the total in-ground value rises to $904 billion – nearly a trillion dollars and a 64% increase from the $552 billion valuation at 2023 prices – reflecting both the surge in gold prices and the broader repricing of strategic metals amid tightening global supply and rising geopolitical risk.

The rising geopolitical risk is the elephant in the room.