Share and Follow

Last week, an unusual event took place on the New York Stock Exchange. Brera Holdings, a company that holds interests in several football clubs, disclosed plans to purchase cryptocurrency tokens.

This announcement piqued considerable interest, causing the company’s stock to surge by nearly 600 percent in a single day, although it later stabilized at a 225 percent gain.

What makes this situation particularly intriguing is that the company does not hold shares in renowned football giants like Liverpool or Real Madrid. Instead, they have investments in Brera Ilch, a club that placed last in the Mongolian League, and other teams from North Macedonia and Mozambique.

J K Galbraith, the influential economist who chronicled the Great Crash of 1929, coined a term for such obviously hyperactive speculation: the ‘bezzle’.

The bezzle occurs when markets become so overheated that even serious and respectable individuals – Brera is backed by Emirati investors and Wall Street tech sage Cathie Wood – somehow convince themselves that the only way is up.

I wish Brera well, but the truth is there is mounting and deeply troubling evidence that the financial world is entering dangerous territory.

We are very possibly heading for a historic crash, one that could presage all manner of impoverishment, ruined careers, decimated retirement prospects, social unrest – and worse.

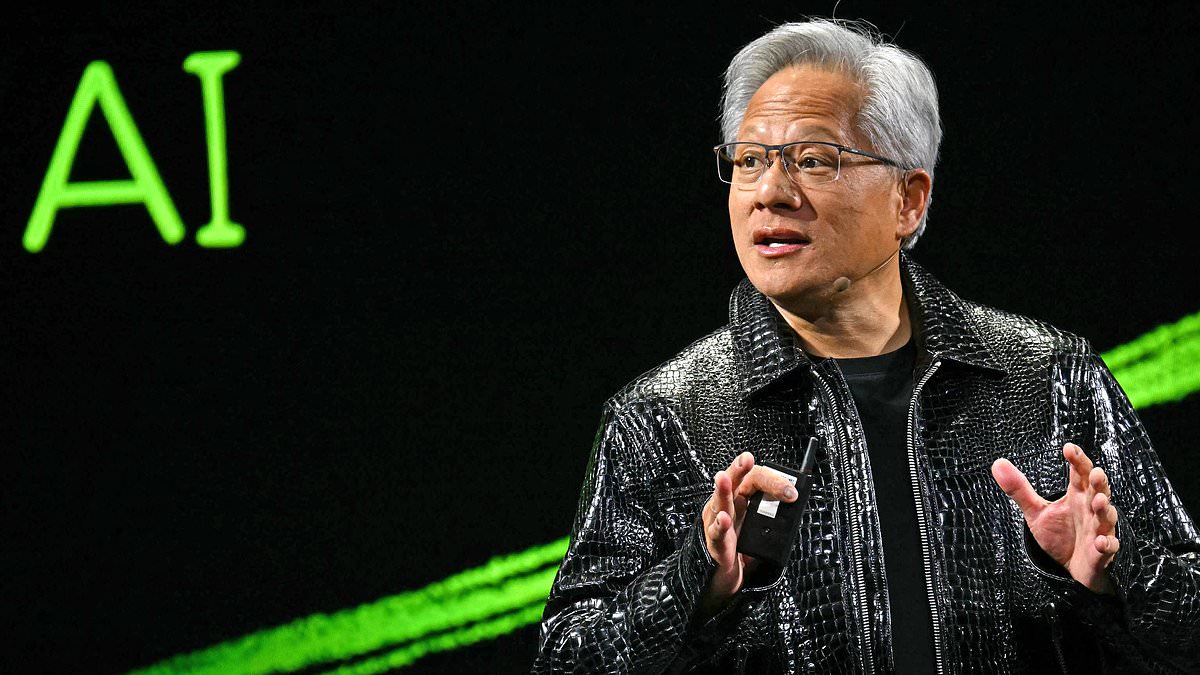

The decision this week by smart-chip maker Nvidia, currently the largest corporation in the world, to plough $100 billion into OpenAI is just one mind-boggling symbol of these ultra-frothy times.

That gargantuan sum is more than the entire value of Unilever, which still makes vast sales in everything from Dove soap to Marmite, or of the oil giant BP. It even eclipses the $72 billion so far invested in OpenAI throughout its ten-year history.

Nvidia CEO Jensen Huang. The smart-chip maker this week decided to plough $100 billion into OpenAI

Yes, AI models such as OpenAI’s ChatGPT may one day change the world – and perhaps are already doing so. But they also require enormous quantities of electricity – the capacity, globally speaking, of ten new nuclear reactors. This may take a decade or more to go live.

The Nvidia-OpenAI transaction may herald a brave new world of technological abundance and increased hyper-productivity, but it is the kind of outsized deal that is only ever possible when markets are at their zenith.

And that seems beyond doubt. Almost all the world’s stock market indexes – from the Dow Jones, Nasdaq and S&P 500 in New York to the Nikkei in Japan and even Britain’s FTSE 100 and FTSE 250 – are at or close to all-time peaks.

This week, the gold price hit a fresh record high of $3,791 per ounce, having surged 44 per cent this year alone.

Even the cryptocurrency Bitcoin, which has no intrinsic value, stands just below its all-time high of $124,000 per ‘coin’, set earlier this year.

Bitcoin’s critics insist it is a totem of speculative mania, while the world’s greatest living investor, Warren Buffett, infamously called it ‘rat poison squared’.

A characteristic of all bubbles – or, to take the phrase of former US Federal Reserve chairman Alan Greenspan, ‘irrational exuberance’ – is that people ignore the warning signs. And I am losing count of those.

Barely a day passes without some fresh headline warning of the surging price of government debt here and around the world. This month, the long-term yields on UK government bonds (the return investors receive to buy government debt) rose to their highest since 1998.

British payroll numbers have plummeted by 178,000 since Rachel Reeves’s £40 billion tax-grabbing Budget last October

The markets can’t be fooled for ever, and they are beginning to show deep concern about our country’s long-term prospects and the Labour Government’s ability to afford its spending.

British government debt now stands at close to 100 per cent of GDP – the highest level ever in peacetime.

But we are far from an outlier. The situation is even worse in France, where it hit 114 per cent earlier this year. And even in the mighty United States, government debt is heading towards 140 per cent of GDP, following Donald Trump’s ‘Big Beautiful Bill’ with its tax cuts and modest spending reductions.

Last week, top International Monetary Fund official Vitor Gaspar warned that global debt levels have now hit 235 per cent of world output, with public – that is, government – debt the main driver.

And the private debt markets, where companies raise money, look scarcely any better. Just this week, American car lender Tricolor Holdings and car-parts supplier First Brands Group both sought emergency finance to avoid bankruptcy.

Rising unemployment is a classic sign of an impending recession, and here the figures are equally bleak. British payroll numbers – that is, people in jobs – have plummeted by 178,000 since Rachel Reeves’s £40billion tax-grabbing, growth-destroying budget last October.

Across the Atlantic, last week the Federal Reserve used typically cautious language when it cited ‘downside risks to employment’ as it cut interest rates.

The costs of Donald Trump’s tariff mayhem also are soaring. Tariffs are a tax on consumers as much as anything, as most importers pass on the cost to their customers. Trump’s tariffs have seen an extra $350billion collected from importers, more than double the amount expected.

But that far surpasses the benefit of the President’s tax cuts to corporate Americans.

I should point out that tariff wars were a crucial cause of the Great Depression during the 1930s.

Then, worldwide GDP collapsed by 30 per cent, tens or perhaps hundreds of millions were left jobless around the world, and fascist and communist movements were emboldened, leading to the horrors of the Second World War. The contemporary peril ought to be obvious.

As a financial writer of more than five decades’ standing, I have almost never felt so worried for the prosperity of our nation and that of the world.

Virtually every decade in my professional lifetime has seen a financial crash and, despite the markets’ ‘Tariff Tantrum’ earlier this year (where they suffered a sharp fall and soon corrected), or the Covid crash of 2020 (again swiftly recovered), we have not seen a true recession since 2008-2009. Another is long overdue.

Now the marathon bull-run could soon be over. And, here, the gold price is a useful bellwether. Historically, private investors, central banks and asset managers turn to gold, which offers no dividends or interest, when they are fearful and searching for a safe harbour for their assets.

No one ever knows precisely what will trigger a financial implosion. The ‘Black Monday’ crash of 1987 was sparked by, of all things, a complicated and technical dispute between the US and Germany over interest rates.

Modern monetary crises are the equivalent of flash floods. Financial markets are driven by computer algorithms, now ironically empowered by AI, which magnify panic-selling.

Once that hideous process begins, no amount of intervention by monetary authorities can stop the tide.

Computer-driven trading, combined with the herd instinct of millions or billions of ordinary investors, can lead to an unstoppable tsunami. The world economy and markets are teetering on a precipice. But lamentably few politicians, officials and financial players recognise the risks for what they are.

When at last they wake up, it could all be too late.