Share and Follow

CHICAGO (WLS) — On Monday night, the Cook County Assessor’s Office hosted one of three workshops scheduled this week in neighborhoods heavily burdened by rising property taxes.

Despite the personalized assistance offered at these sessions, many residents are finding this year’s tax bills overwhelming and unaffordable.

ABC7 Chicago is now streaming 24/7. Click here to watch

Michael Strode, a resident of West Garfield Park, expressed his frustration, stating, “I haven’t made any changes to my home, yet my taxes have increased by 400%.”

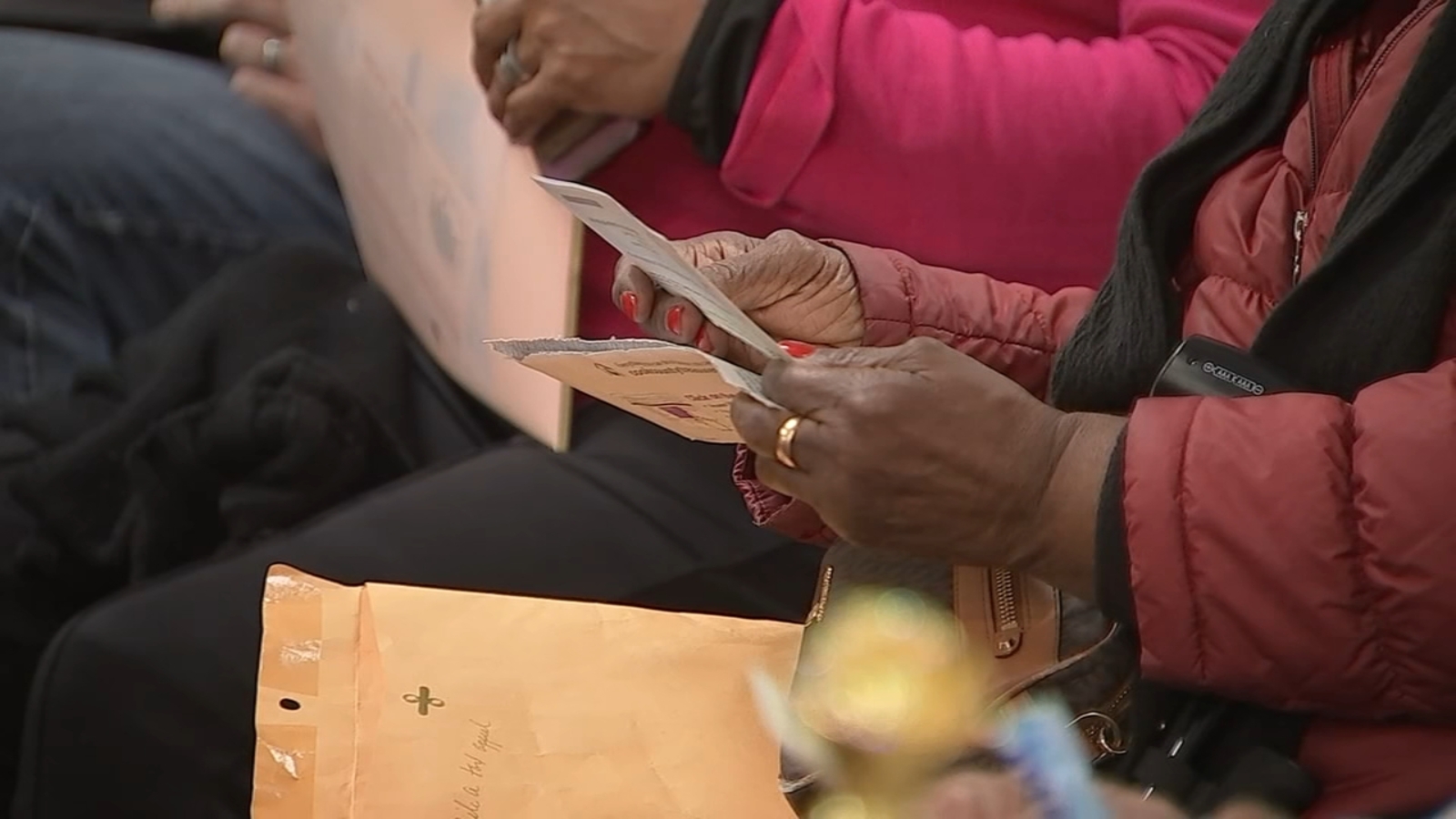

The basement of West Garfield Park’s New Mt. Pilgrim Missionary Baptist Church was filled with locals clutching their second installment property tax bills. They were eager for explanations and solutions to the dramatic increases they faced.

Another West Garfield Park resident, Selestine Washington, shared her concerns, saying, “They sent me a $2,500 bill, and soon I’ll be receiving another one.”

SEE ALSO | Cook County Board of Review reopening tax appeals for 24 townships after dramatic bill increases

Monday night’s event was, in equal parts, an informational session hosted by the Cook County Assessor’s Office and a community rally.

On the one hand, county employees worked with residents to see if they might be missing out on any qualifying property tax exemptions. On the other, religious leaders and city council members representing the neighborhoods hardest hit by the latest reassessment rallied the crowd of angry homeowners.

“We need the same treatment that they have up north here on the West Side of Chicago,” said 28th Ward Ald. Jason Ervin. “This is an error that has been perpetrated on us by the assessor’s office.”

The Cook County Treasurer’s Office estimates the average residential bill in the city of Chicago increased by more than 16% this year. A slump in commercial real estate downtown is being blamed for the increases. But three of Chicago’s poorest neighborhoods are seeing spikes that are hard to imagine.

In West Garfield Park, bills soared 133%. North Lawndale saw a 99% spike. And in Englewood, taxes climbed more than 80%.

“We’re here to help people fight back. We’ve got to make noise,” said Rev. Marshall Hatch with New Mt. Pilgrim Missionary Baptist Church. “We need, really, those taxes to be frozen in last year’s rate until we can figure out how to make this system fair and make this system make sense.”

READ MORE | Chicago residents worry over Cook County property tax increases as payment due soon

Cook County Assessor Fritz Kaegi faced many angry questions even as he tried to pass the blame onto others for the current predicament.

“There is a system of appeals, where reductions are being made and pushed onto us,” Kaegi said.

Michael Strode said, in response, “I’m in the hood. I don’t have the money to purchase a tax attorney to keep on retainer to get my property lower.”

Cook County property tax bills are due Dec. 15. Those unable to pay on time will be able to sign up for a payment plan with the Cook County Treasurer’s Office starting on Dec. 16.