Share and Follow

For those looking to buy a home, it might be wise to time the market to get the best deal possible.

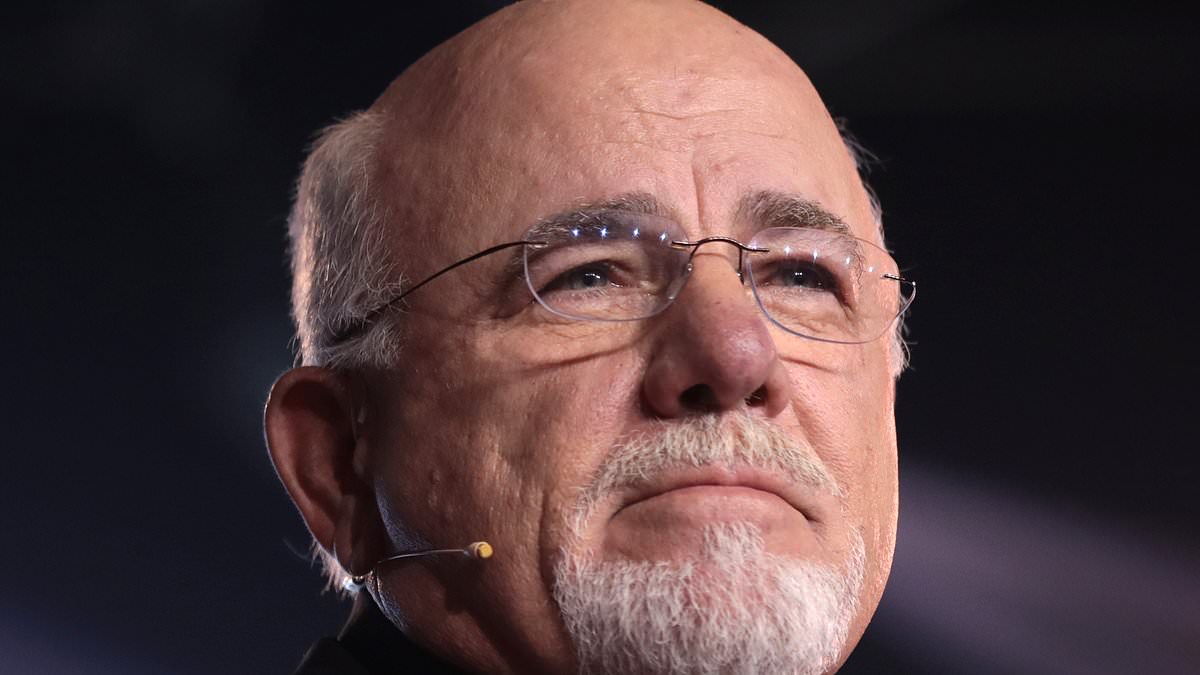

Dave Ramsey, a specialist in personal finance, recently advised his audience that there are specific months of the year that are more advantageous than others when making a purchase.

‘Ideally, it is beneficial to purchase a house during the months when prices are at their lowest and there is a high inventory available. Traditionally, this occurs in August or September,’ he shared in a blog post on Ramsey Solutions, the organization he established to assist individuals in becoming debt-free.

He explained that home prices tend to drop after the summer rush and into fall, since fewer buyers are on the market and inventory is still high.

‘On the flip side, the worst time to buy a house is typically the late spring and early summer (May through July),’ Ramsey wrote.

‘That’s because tons of people are in the market to buy a home—which means you’ll face more competition.’

Ramsey pointed out that September would have been the optimal month to buy a home because the median home price decreased by almost five percent to $406,700 from the peak of $426,900 in June 2024.

However, if you’re looking for the absolute lowest price, winter is the best time to go house hunting, according to Ramsey.

Dave Ramsey told his audience that the fall is the best time to buy a home if you want a nice mix between strong inventory and low prices. However, winter is the best time to buy if you want the absolute lowest price for a home

There is a drawback to this though, as there’s often a far thinner stock of available homes to choose from in the winter, especially right after the holidays.

When there are fewer homes, competition between buyers is more vigorous and you could end up losing out. Or you could be in a better position to negotiate with the seller.

‘The number of homes for sale saw its greatest drop from November to December—losing 140,000 homes from the market,’ Ramsey wrote.

‘Still, less demand for homes could give you some bargaining power when it comes time to make an offer on a house.’

February 2024 was the cheapest month to buy a home last year, with the median price coming in at $383,800.

Ramsey stressed that for any of this to matter, a buyer has to first have healthy finances.

‘No one can predict real estate trends with 100 percent accuracy. So never let what month it is make or break your home-buying decision—only your financial situation can truly determine the right time for you,’ Ramsey wrote.

According to Ramsey, you’re only ready to buy a home when you have no debt and an emergency fund with enough money to 3 to 6 months worth of your typical expenses.

Ramsey’s advice comes at a particularly fraught time in the the US housing market, when both interest rates and prices are elevated

Additionally, Ramsey said your monthly home payment shouldn’t be more than 25 percent of your take-home pay.

That includes the principal and interest of your mortgage, as well as other costs like property taxes, homeowners insurance, private mortgage insurance and homeowners association fees.

Ramsey said buyers also ought to be able to handle the unexpected costs of owning a home, especially maintenance since there’s no landlord there to fix problems.

Ramsey’s advice comes at a particularly fraught time in the the US housing market, when both interest rates and prices are elevated.

As of February 6, the average 30-year fixed mortgage rate is at 6.89 percent, a far cry from the early days of the pandemic when the Federal Reserve was keeping rates around 2 to 3 percent.

The most recent data available on prices came in December, when the National Association of Realtors said the median home was $404,400, up 6 percent from a year earlier.

For that house, you’d need to save more than $80,000 for the typical 20 percent down payment Ramsey recommends, which is far more than what most Americans earn in a year.

The average monthly mortgage payment in June 2024 was $2,209, which is nearly half of what the median American earns in a month.

That’s quite off from Ramsey’s rule for your home payment not to eat up more than 25 percent of your take-home pay.