Share and Follow

The governor voiced his agreement with a recent bill filed by a Senate Republican in an X post.

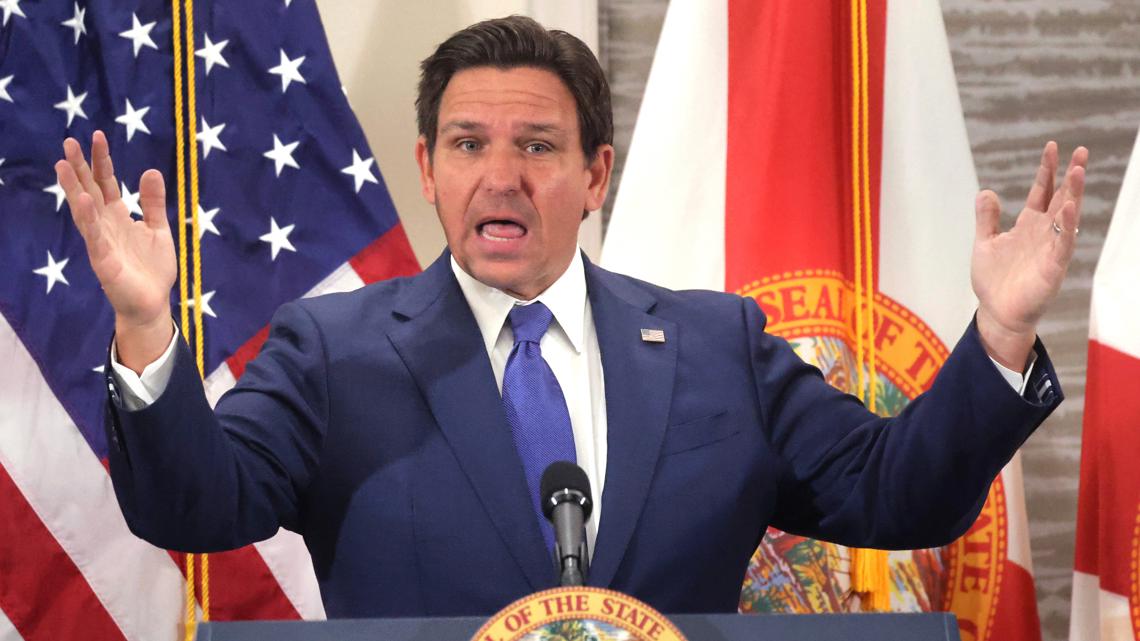

ST. PETERSBURG, Fla. — Florida Gov. Ron DeSantis is pushing for the Sunshine State to abolish property taxes after a Senate Republican filed a bill “relating to the study on the elimination of property taxes” earlier this month.

In an X post on Feb. 13, the governor said that a constitutional amendment would need to be implemented to eliminate property taxes in Florida. That amendment would need 60% of voters to approve it.

“We should get the boldest amendment on the ballot that has a chance of getting that 60%,” DeSantis stated in the post. “I agree that taxing land/property is the more oppressive and ineffective form of taxation.”

Suppose the legislature passes a bill that meets what DeSantis is proposing. For example, if SB 852 passes as is, a study will be launched to establish a framework for eliminating property taxes, replacing property tax revenues through budget reductions and sales-based consumption taxes and locally determined consumption taxes authorized by the legislature.

The study will include the following if passed:

- An analysis of the potential impact of eliminating property taxes on public services, including education, infrastructure and emergency services.

- An assessment of potential housing market fluctuations, including changes in homeownership rates and property values.

- An evaluation of whether a shift to consumption-based taxes would help make Florida more attractive to businesses compared to other states.

- An analysis of the potential impact of eliminating property taxes on overall economic stability, consumer behavior, and long-term economic growth.

By the study’s end, the office will send a report detailing their findings to the President of the Senate and the Speaker of the House of Representatives, according to the bill.

A report from the News Service of Florida says property taxes have played a major role in funding schools and local governments in the Sunshine State.

The News Service of Florida contributed to the reporting in this article.