Share and Follow

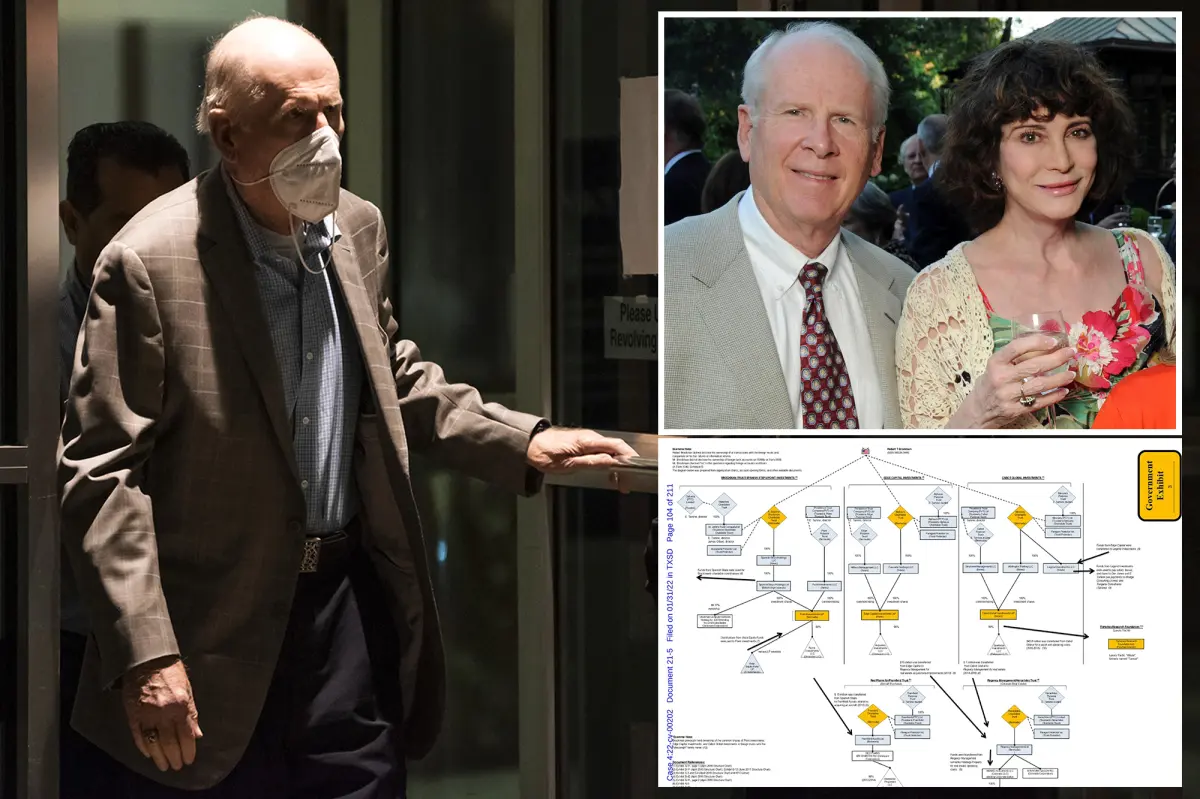

Robert Brockman, a billionaire and software mogul, orchestrated a colossal tax evasion scheme against the IRS, and now his descendants are bearing the consequences.

The late executive from Texas left behind an estate that has consented to a $750 million payment to resolve what federal prosecutors have deemed the most significant individual tax-fraud case in American history. This agreement was recently sanctioned by the US Tax Court.

The Wall Street Journal was the first to reveal details of this settlement.

This substantial financial settlement concludes a prolonged legal battle fueled by accusations that Brockman concealed over $2 billion in income from the IRS. He allegedly achieved this through an intricate network of offshore shell entities and clandestine bank accounts.

According to the settlement terms, Brockman’s estate is obligated to pay $456 million in owed taxes and an additional $294 million in penalties for tax years ranging from 2004 to 2018, as documented in the court filings.

The IRS initially sought much more — roughly $1.4 billion, including interest. Excluding interest, the agency was pushing for $993 million in back taxes and penalties.

It remains unclear how much interest, if any, Brockman’s heirs will ultimately be required to pay, according to The Journal.

Brockman, a Houston-based automotive software mogul, was indicted by federal prosecutors in October 2020 on a 39-count indictment that accused him of orchestrating a decades-long tax-evasion scheme.

Prosecutors alleged Brockman used a labyrinth of offshore entities in Bermuda and Nevis, along with secret bank accounts in Bermuda and Switzerland, to conceal income generated largely from private-equity investments.

Much of the hidden money stemmed from Brockman’s early backing of Vista Equity Partners, the private-equity powerhouse focused on enterprise software.

According to court filings, he employed encrypted servers, coded language and fishing-themed nicknames to communicate with associates managing his offshore empire — tactics prosecutors said were designed to evade detection by US authorities.

Brockman vehemently denied the allegations.

The criminal case took repeated twists as Brockman’s lawyers argued he was mentally unfit to stand trial due to dementia. Prosecutors countered that he was exaggerating his symptoms to avoid accountability.

A federal judge ruled in May 2022 that Brockman was competent to stand trial.

But the case never reached a jury. Brockman died in August 2022 at age 81 while still awaiting trial.

The government then pivoted to a civil case in US Tax Court, pursuing Brockman’s estate for unpaid taxes and penalties.

The civil matter continued quietly until this week’s settlement filing brought it to a close.

The Brockman case was deeply intertwined with another high-profile tax scandal, which involved Vista Equity Partners CEO Robert F. Smith.

Smith, who became a billionaire through Vista’s meteoric rise, admitted in 2020 that he failed to pay taxes on income linked to Brockman’s offshore structure.

Smith made a non-prosecution deal with the Justice Department in which he agreed to pay $139 million in back taxes and penalties and to cooperate with prosecutors investigating Brockman.

They alleged Brockman had been a critical early financial backer of Vista, funneling more than $1 billion into the firm through offshore vehicles.

Brockman’s longtime Houston tax lawyer, who allegedly advised both Brockman and Smith, died by suicide on the eve of his own criminal trial.

Despite his vast wealth, Brockman cultivated a reputation for extreme frugality.

Former associates told investigators that he stayed in budget hotels and ate frozen dinners in his room while visiting company offices.

He was also known for harboring deep distrust of the federal government — particularly the IRS — which he reportedly described to associates as corrupt and unfairly hostile to taxpayers.

The Post has sought comment from Brockman’s estate.