Share and Follow

Many consumers in Southern California have been receiving unnecessary notices claiming that their credit is in danger—or not good at all.

“What the heck? Here I am, a former speaker and government official for many years. What happened? I have an 850 credit score. What is this about?” said former California Assembly Speaker Robert Hertzberg in an interview with local affiliate KTLA reporter David Lazarus.

“They’re saying that you have a problem with one of your credit agencies. That is a lie. That’s a deceptive practice,” Hertzberg added.

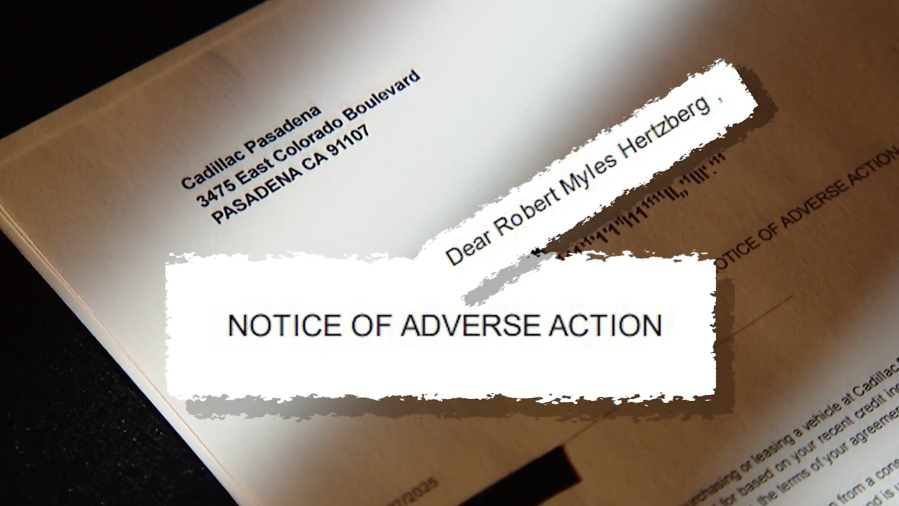

Ironically, Hertzberg found himself the target of the same type of concerning business practice he once sought to regulate through legislation. Specifically, he received a letter—ostensibly from Cadillac Pasadena—informing him that his creditworthiness was in peril after leasing an Escalade electric vehicle.

It’s a letter many consumers have received after doing business with an auto dealer. And it can contain a frightening message: “This letter is being sent to you because you were either denied credit or offered credit on terms different from what you applied for, based on your recent credit inquiry for a vehicle.”

“The reality is nothing bad happened,” Hertzberg said. “There were no changes. There were no denials.”

Consumer advocate Rosemary Shahan says these letters are often sent out unnecessarily.

“Very often, the letters are sent when they’re not really necessary, and they cause a lot of confusion—especially if you got the terms you were asking for and were approved for credit,” Shahan said.

So what’s going on here? Federal law requires that consumers be notified any time they’re denied credit or receive different loan terms. This is called a “notice of adverse action.”

Auto dealers are among the businesses that send out most of these notices. Thousands of dealers nationwide—including many in California—use a Michigan company called 700Credit to handle the letters, including the one Hertzberg received.

“Well, it’s up to the dealer what their adverse action policies are,” said 700Credit Managing Director Ken Hill. He explained that the company offers different templates of compliance letters to car dealers, allowing them to choose the one their legal teams prefer.

700Credit then handles mailing the notices of adverse action to customers. “Dealers’ policies vary based on their interpretation of the regulation,” Hill said. “You know, some dealers send adverse actions to everybody who applies.”

Cadillac Pasadena said in a statement that it doesn’t do that. However, it noted that if a customer has a freeze on their credit files to protect against identity theft, an adverse action letter from 700Credit is appropriate.

Hertzberg admitted that, like many privacy-minded individuals, he has a credit freeze in place. But he says no one at the dealership instructed him to lift the freeze when he leased the Escalade.

Questionable criteria for triggering notices of adverse action is one issue—but the more serious concern is consumers being misled. Many are told in these letters that their credit is in jeopardy when it’s not.

“I would agree. Sometimes they can read scary,” Hill said.

So what happens now? As it turns out, Simi Valley resident Hertzberg knows some influential people in Sacramento. He says he’s been in touch with regulators, lawmakers, and the state attorney general’s office.

A simple solution, he suggests, would be a rule requiring that notices of adverse action be written in plain English—and only sent to people who truly have credit issues. That’s what Hertzberg says he intends to pursue.