Share and Follow

Despite a government shutdown affecting over a million federal workers, a government agency founded by Democrats is continuing to hire staff.

The Consumer Financial Protection Bureau (CFPB) circulated an internal email on October 1, coinciding with the start of the shutdown, announcing job openings for attorney-advisors in its Office of Litigation’s legal division.

This hiring is possible due to a unique funding structure: the CFPB is financed by the Federal Reserve Bank rather than direct congressional appropriations.

The hiring initiative, initially reported by American Banker, adds to the challenges facing the agency, which recently dealt with a costly racial discrimination lawsuit and a significant data breach in 2023.

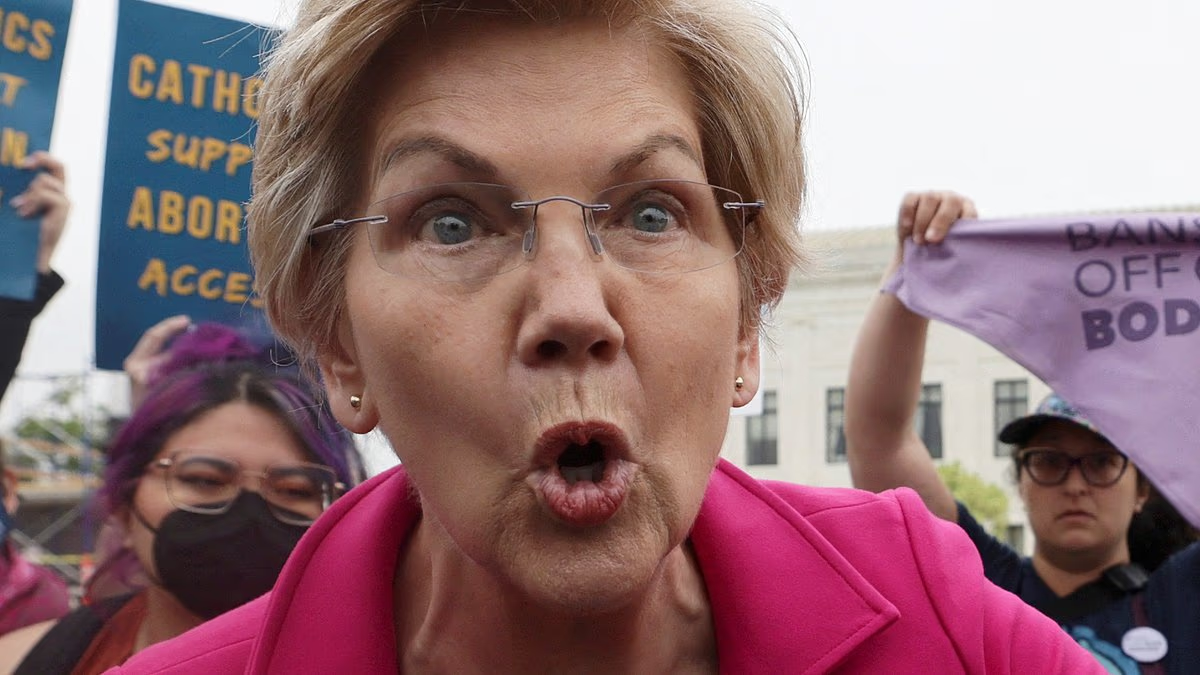

The CFPB was established under the guidance of Democrat Elizabeth Warren. The senator, who has been the subject of past political jabs by Donald Trump regarding her Native American ancestry claims, remains a vocal advocate for the agency despite its controversies.

Democrats and Republicans have blamed each other for the government shutdown, which is entering its third week and has left roughly 750,000 furloughed. Tens of thousands more have been forced to work without pay.

President Trump has said the funding feud will lead to permanent job losses and trolled critics by posting a computer-generated image of one of his key aides dressed as the grim reaper.

Democrats have refused to approve the proposed spending plan unless Republicans restore healthcare funding that was slashed over the summer. Republicans have said Democrats are to blame because nearly every Republican senator has already voted in favor of the spending plan.

Senator Elizabeth Warren was key to establishing the Consumer Financial Protection Bureau

The CFPB sent an internal email on the first day of the government shutdown saying the agency had job openings for attorney-advisors

The CFPB was created as a part of the Dodd-Frank regulatory reform passed by a Democrat-controlled Congress in 2010 under President Barack Obama. It was created to protect consumers in the financial marketplace by enforcing federal consumer financial laws and supervising financial institutions.

Senator Warren conceived the idea for the agency and she served as a special advisor to help set it up.

The agency’s funding structure, which is relatively unusual for federal agencies, means its bureaucrats have greater autonomy from elected officials.

Kentucky congressman Andy Barr said the CFPB’s apparent insulation from the shutdown is ‘exhibit A for why Congress must pass the TABS Act.’

TABS is short for Taking Account of Bureaucrats’ Spending. Barr proposed the bill, and it would subject the CFPB to traditional congressional appropriation.

Critics of the CFPB, which include President Donald Trump, have said the agency makes it unnecessarily difficult for community banks to operate because they face disproportionate compliance and legal costs.

During his first term, Trump said: ‘Dodd-Frank has made it impossible for bankers to function. It makes it very hard for bankers to loan money for people to create jobs, for people with businesses to create jobs. And that has to stop.’

The president pledged to dismantle the Dodd-Frank Act, which would likely lead to the CFPB’s demise, during his first term. That did not happen, but it remains something on the agenda for his current term.

The CFPB has faced a number of controversies in recent years. In 2024 it settled a racial discrimination lawsuit filed by former employees for $6 million. In 2023 a digital breach of the agency exposed the data of 256,000 consumers.

The shutdown is entering its third week as senators have been unable to pass a spending bill despite convening at the Capitol building (pictured) eight times to vote on it so far

In his first term President Trump said: ‘Dodd-Frank has made it impossible for bankers to function’

Construction of the CFPB headquarters in Washington DC, which was completed in January 2019, exceeded its budgeted cost by $125million.

Russell Vought, Director of the United States Office of Management and Budget, posted on X shortly after his appointment by Trump: ‘The CFPB has been a woke and weaponized agency against disfavored industries and individuals for a long time. This must end.’

He was then placed as the acting director of the agency and attempted to hollow it out by denying its funding request for the next quarter and removing up to 90 percent of the CFPB’s staff, but the National Treasury Employees Union sued in February to stop the removals.

The move was successful until the Trump administration appealed the case to the DC Circuit. In August the court vacated an earlier injunction, allowing firing to proceed at the agency.

The CFPB has lost 500 employees, including 90 enforcement attorneys, since Vought’s takeover. The email announcing openings at the agency is bizarre in the context of those layoffs and the wider government shutdown.

But John Berlau, director of finance policy at a think tank called the Competitive Enterprise Institute, told WorldNetDaily that the CFPB has been headed in a more positive direction with Vought at the helm.

He said the agency has been ‘trimming waste and fraud’ and that ‘it has also been dropping enforcement actions that would choke out business.’

The Daily Mail approached the Consumer Financial Protection Bureau for comment.