Share and Follow

The billionaire heir of the luxury design house Hermès reportedly no longer possesses his €14 billion (£12.1 billion) shares in the brand, as it has come to light, though it’s not immediately known why or where the money has been allocated.

Nicolas Puech, 82, captured attention in 2023 when he revealed that he was bequeathing his fortune to his former gardener, making the worker the rightful heir to the billionaire’s wealth.

The intrigue deepened last year when Puech, a fifth-generation descendant of the house’s founder, Thierry Hermes, supposedly failed on a commitment to sell shares to the Qatari sheikh.

At the time, the complaint, filed in the District of Columbia by a company representing the Qatari leader, Honor America Capital, and seen by the New York Times, accused Puech of breaching his contract with them to sell shares.

The lawsuit, filed last March, stated that Puech holds a five per cent stake in the French luxury retail giant, and that he agreed to sell more than six million shares, trading at $270.89 each, to the Qatari royal family.

Now, in the latest twist, Hermès International SCA said it believes that Puech no longer possesses any shares in the luxury fashion house and hasn’t done for some time, leading them to take legal action.

Executive chairman at Hermès, Axel Dumas, told Bloomberg via Business of Fashion, ‘I’ve had the certainty for a long time that Nicolas Puech no longer holds his shares’, adding, ‘This is why we’ve started legal proceedings.’

The legal battle is reportedly facing further complications because Puech’s former wealth manager died last week. Dumas said he believes the shares cannot be recovered.

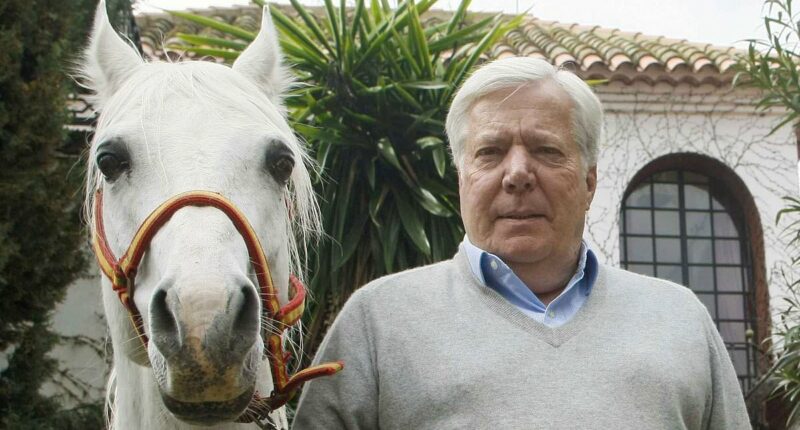

Nicolas Puech (pictured), heir of the Hermes family, reportedly no longer holds his €14 billion ($16.2 billion) shares in the brand

Lawyers for Puech and Freymond couldn’t be reached for immediate comment by Business of Fashion.

Hermès has dealt with the issue of Puech’s shares for some time. Over ten years ago, the brand fought an advance from rival Bernard Arnault, chairman and CEO of LVMH, the world’s largest luxury goods company.

Even during the 2014 agreement where the brand recoiled Arnault’s stake, the future of Puech’s shares still remained unclarified.

The plot thickened in 2023 when the heir told courts in Switzerland, where he lives, that his shares had vanished while they were being handled by his former wealth manager, Eric Freymond, who died last week.

That same year, he hit headlines again for reportedly attempting to leave a substantial portion of his vast wealth to his longtime gardener and handyman – though the plan never materialised.

Puech moved to adopt his former greenskeeper, according to sources cited by Swiss publication Tribune de Genève at the time.

The Hermes scion, who does not have kids and is not married, is said to have referred to his former employee – reportedly from a ‘modest Moroccan family’ – and his wife as his ‘children’.

The gardener was poised to inherit significant assets from his former employer, including properties in his native Morocco, as well as Puech’s retreat in Montreux, Switzerland.

The heir allegedly once promised shares to Sheikh Tamim bin Hamad Al Thani, the Emir of the State of Qatar (pictured)

Luxury French fashion house Hèrmes is celebrated for its silk scarves (pictured) and beloved Birkin bag

Hèrmes Executive Chairman, Axel Dumas (pictured), said that believes the shares cannot be recovered

However, the plan fell through after Puech told a Swiss court he does not actually have much of a fortune left to hand out.

The attempt to adopt his greenskeeper came off the back of suspected family tensions, which arose in part due to a rival takeover of a significant stake in Hermès shares.

Earlier this year, the brand was entangled in fresh courtroom drama after Puech allegedly defaulted on a promise to sell shares to the Qatari sheikh.

He was slapped with a lawsuit on behalf of Sheikh Tamim bin Hamad Al Thani, the Emir of the State of Qatar.

The lawsuit, filed in March, stated that Puech holds a five percent stake in the French luxury retail giant, and he agreed to sell more than six million shares, trading at $270.89 each, to the Qatari royal family.

It appealed to a judge to order him to honor the sale and pay $1.3 million in damages for ‘lost profits, opportunity costs, and reputational harm.’

Puech is accused of delaying the sale twice. Puech’s lawyer said his client was not involved in the deal and was not aware of it until reading about it in the press, according to Bloomberg.

The Hermes heir also previously told courts in Switzerland, where he lives, that his shares had vanished while they were being handled by a wealth manager.

If Puech was to maintain his stake, he would be the single and largest investor in the high fashion label

Letters filed with the lawsuit detail how the deal was discussed over several months and signed off on February 10.

Hermes was worth $300 billion in mid-February, after share prices rocketed more than 200 percent over the last five years, making a five percent stake incredibly valuable.

Puech had in 2011 pledged to bestow his fortune upon the Isocrates Foundation – a philanthropic organization he founded which provides grants to ‘support the fundamental role civil society organizations play in safeguarding and stimulating public debate’.

According to its website, the foundation ‘funds and supports public interest journalism and media organizations committed to strengthening the field of investigative journalism’.

Should Puech still hold his stake, he would be the single and largest investor in the brand responsible for the beloved Birkin bag.