Share and Follow

CHICAGO (WLS) — There’s a new effort to address disparities in how car insurance rates are determined and prevent insurance companies from using socio-economic data like credit scores, zip codes and age to charge higher rates.

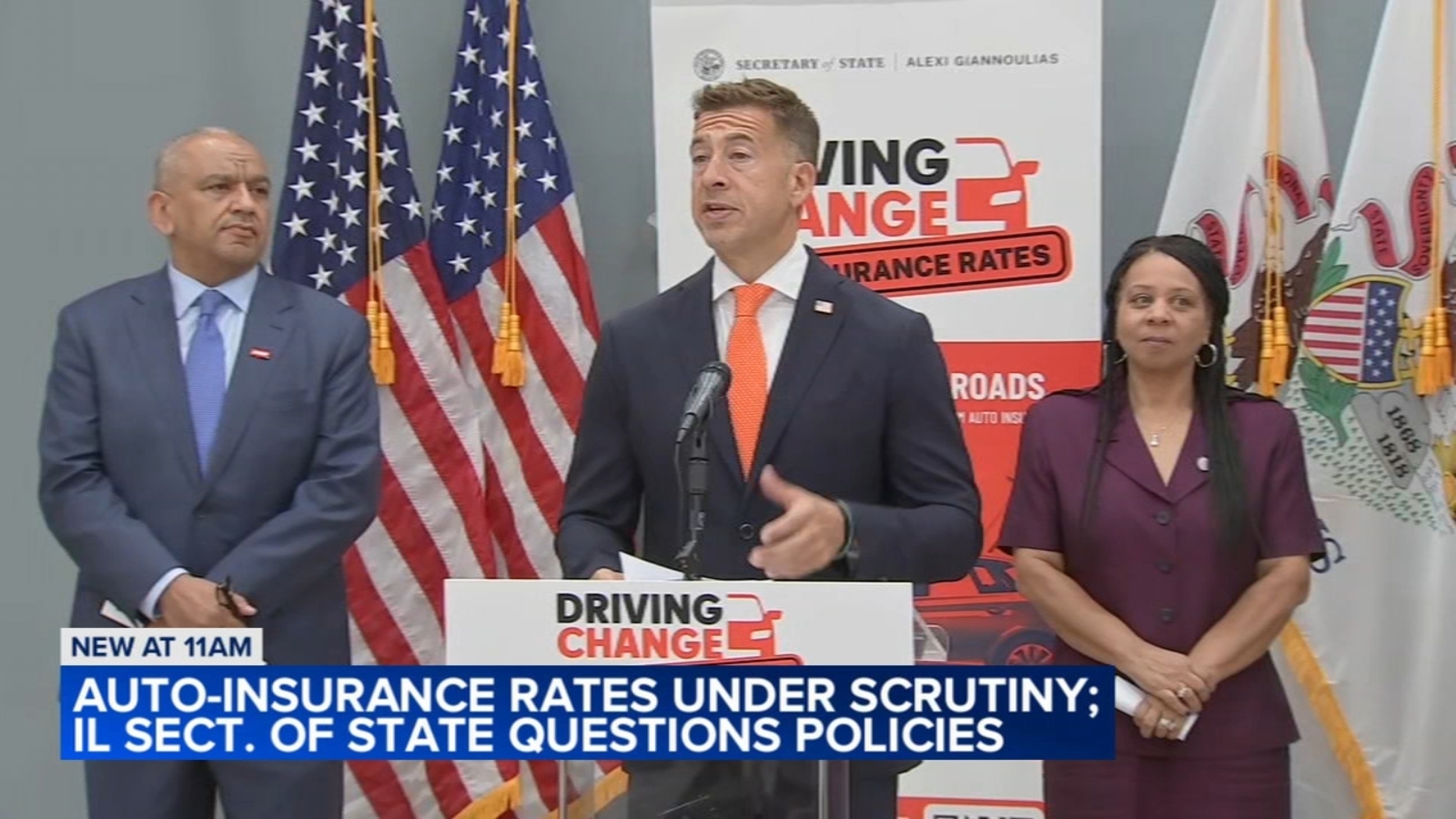

It’s all a part of the Secretary of State’s new advocacy campaign called “driving change.”

ABC7 Chicago is now streaming 24/7. Click here to watch

The new campaign launched Wednesday with the support of AARP Illinois and some state lawmakers.

Their goal is to stop what supporters call unfair and discriminatory rate making practices.

They say insurance companies often use factors to come up with rates that have nothing to do with your driving record like credit scores, address and age.

State law requires every vehicle owner to have auto insurance.

Supporters say although older drivers in illinois are the safest drivers, their car insurance rates don’t reflect that.

Advocates of the new effort say reforms will create equality and transparency for auto insurance premiums.

And this will have a positive impact on the number of un-insured drivers by making car insurance more affordable.

“So if the purpose of auto insurance is to protect the eight-and-a-half million Illinois motorists it only makes sense that their driving records, that their driving records serve as the primary record for setting their rates.” Illinois Secretary of State Alexi Giannoulias said.

The new campaign comes as State Farm announced earlier this month that it would raise homeowners insurance rates by more than 27 percent, prompting Illinois Governor JB Pritzker to call on the legislature to find a solution.

The Illinois Secretary of State is also launching a new website so people can learn more about the auto insurance issue and share their stories.

A series of town halls are also planned around the state in the next few weeks.

State Farm issued a statement saying, “State Farm recently announced auto insurance rates in Illinois will decrease an average of 5.7%, with some customers seeing reductions in premiums of up to 15%. This decision was driven by trends projecting lower claims costs.

“To better understand the factors used by the auto insurance industry in rate making and underwriting we recommend you contact trade organizations like NAMIC, APCIA, III, and IIA.”

Copyright © 2025 WLS-TV. All Rights Reserved.