Share and Follow

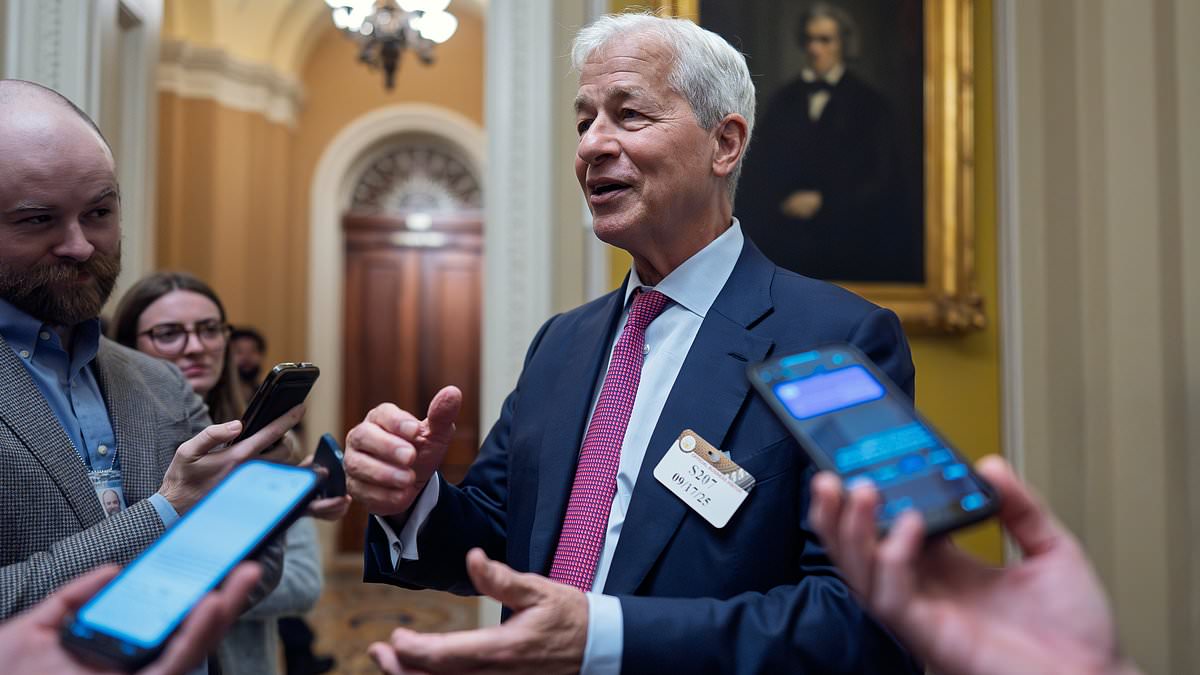

Jamie Dimon, the steady-handed chief executive of JPMorgan Chase, is sounding the alarm on America’s economic outlook.

The world’s most powerful banker fears the US might slide into a recession in 2026, even as the economy currently hums along.

‘I hope for the best and plan for the worst,’ he told Bloomberg on Tuesday. ‘You don’t wish it, because you know certain people get hurt.’

Investors watch Dimon closely. Known for blunt analysis and JPMorgan’s rigorous stress tests, his insights carry weight across industries.

At the moment, the US economy is far from entering a technical recession. According to standard definition, the country would need to experience two consecutive quarters of declining economic growth along with a slowdown in job numbers.

In July, the US economy expanded by 3.8 percent. Additionally, retail sales saw an increase of 0.6 percent, which surpassed Wall Street’s prediction of a mere 0.2 percent.

Despite the solid economic numbers, Dimon is worried about weakening jobs numbers, stubborn inflation, the impact of AI, and trade wars.

The greatest challenge for America might be the job market’s performance. In August, employers added an estimated 22,000 positions, falling short of Wall Street’s expectation of 75,000 jobs.

Jamie Dimon, JPMorgan’s top boss, said he is worried the US might slip into recession in 2026

Meanwhile, economists said federal data likely overestimated last year’s jobs growth by nearly a million positions.

‘I am a little more nervous about inflation not coming down like people expect,’ Dimon added.

After price increases dropped down to just 2.3 per cent in April, they’ve steadily ticked up as Donald Trump has introduced tariffs to the economy.

The last reading measured inflation in grocery stores, at the gas pump, in clothing shops, and on car dealership lots at 2.9 per cent.

Dimon also criticized the economic impact of government shutdowns.

Lawmakers have decided to suspend government operations while fighting over plans to fund government spending.

That has shuttered taxpayer-funded statistics departments that investors rely on, nixing this month’s jobs and inflation reports.

‘Look, I don’t like shutdowns. I think it’s just a bad idea,’ Dimon said. ‘I don’t care what the Democrats or Republicans say, it’s a bad idea.’

Big name investors are worried that recent wobbles in the jobs market could lead to a downturn for the US economy

Still, the stock market has been trading at record highs – the tech heavy Nasdaq traded a full percent in the green on Wednesday

This isn’t the first time Dimon has sounded the alarm about America’s financial standing.

In January, Dimon said he was approaching the stock market with caution, as he predicted volatility in major stocks.

Last month, he doubled down on his worries, saying the shrinking jobs numbers were proof that ‘the economy is weakening’.

‘Whether it’s on the way to recession or just weakening, I don’t know,’ he told CNBC.

He isn’t alone. Major investors like Ray Dalio, Paul Tudor Jones, and Mark Zandi — men who have predicted major economic downturns and can look under the hood of the American economy — have voiced concern about a looming downturn.

But, so far, Wall Street doesn’t seem to care.

The three main stock indexes — the Dow Jones Industrial, S&P 500, and tech-heavy Nasdaq — have all been trading at record highs for the past month.

The Nasdaq is up a full per cent at the end of the day on Wednesday.